Bitcoin is as soon as once more going through vital circumstances, with the worth retesting the vary lows close to $110,000 following a risky and unsure weekend. After Friday’s huge crash, which worn out billions in leveraged positions, bulls are struggling to regain management and set up a secure restoration. The broader market stays cautious, as merchants weigh whether or not the present stage can maintain or if one other wave of promoting may push costs decrease.

Regardless of the stress, some analysts see potential indicators of resilience if Bitcoin can keep help on this zone. In line with prime analyst Maartunn, latest on-chain exercise reveals an essential shift in market habits. Over the past 24 hours, Brief-Time period Holders (STHs) have despatched 46,524 BTC to exchanges, signaling energetic repositioning after the most recent downturn.

Such habits typically marks a short-term reset, permitting the market to soak up profit-taking and capitulation concurrently. As Bitcoin hovers round key help, holding this vary may decide whether or not the market is getting ready for stabilization or one other leg down.

Bitcoin Enters New Part As Market Seeks Path

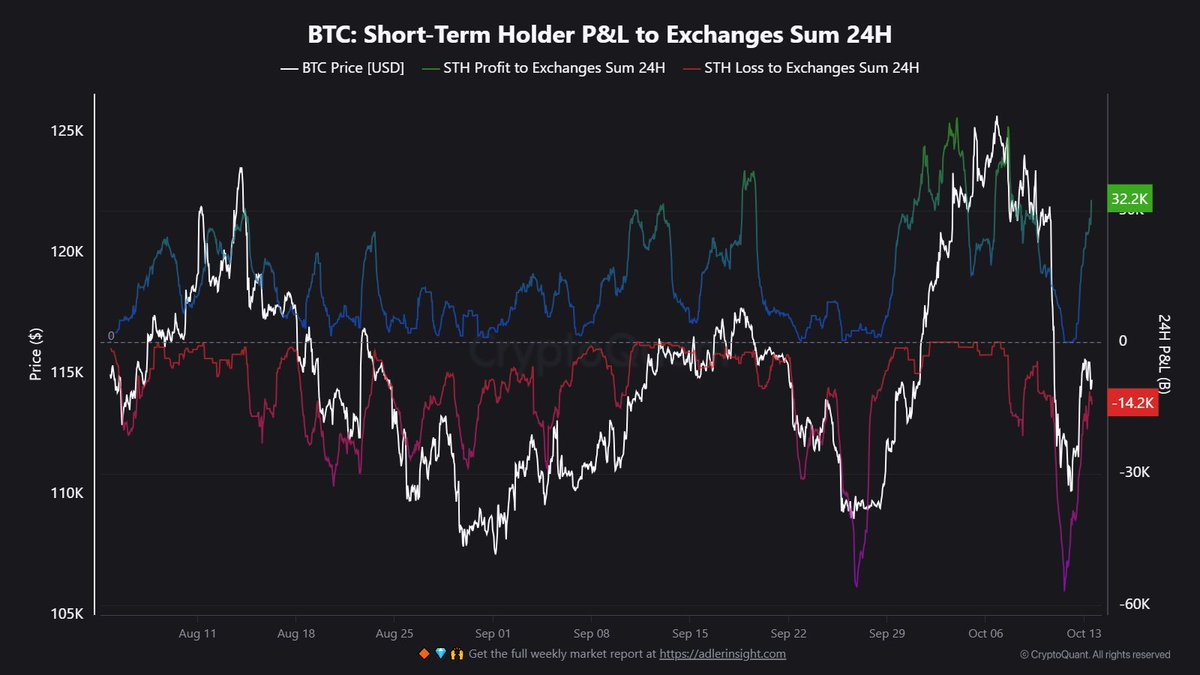

In line with Maartunn, the most recent on-chain information reveals a vital rebalancing section amongst Brief-Time period Holders (STHs) following the latest market crash. Up to now 24 hours, these buyers despatched 46,524 BTC to exchanges, marking one of many largest actions in latest weeks. Of that whole, 32,279 BTC have been despatched in revenue, whereas 14,245 BTC have been moved at a loss. This sample displays a market dynamic by which some buyers are locking in positive factors after the most recent restoration try, whereas others are slicing losses to cut back publicity amid uncertainty.

Maartunn notes that such exercise is typical within the aftermath of sharp corrections. It typically indicators the method of cleaning extra leverage and emotional buying and selling — a necessary step towards restoring equilibrium out there. This sort of rebalancing section normally precedes the formation of a short-term or mid-term backside, as promoting stress from each profit-takers and panic sellers will get absorbed by stronger fingers.

The approaching days will probably be decisive in figuring out whether or not Bitcoin can stabilize close to the $110,000–$112,000 vary and construct the inspiration for a restoration. If the worth holds, it may point out that the market has discovered a sustainable flooring, paving the best way for renewed accumulation and confidence amongst buyers. Nevertheless, a breakdown beneath this zone may reignite concern and result in one other spherical of liquidations.

Bitcoin Checks Key Help as Momentum Weakens

Bitcoin is presently buying and selling close to $110,800, testing a vital help zone after failing to carry above the $115,000–$116,000 resistance vary. The 12-hour chart reveals that BTC continues to wrestle with downward stress following final week’s crash, as market sentiment stays fragile and volatility persists.

The rejection from the $117,500 stage — a serious provide zone that has capped rallies since early September — triggered renewed promoting, pushing the worth again beneath the 50-day (blue) and 100-day (inexperienced) transferring averages. This breakdown highlights weakening short-term momentum, with the 200-day MA (purple) now positioned close to $111,000, appearing because the final important line of protection for bulls.

If Bitcoin closes decisively beneath this stage, it may sign a deeper correction towards $107,000–$108,000, an space of earlier accumulation. However, sustaining help right here may set the stage for a rebound try towards $114,000–$115,000, the place the following resistance cluster sits.

The chart displays a neutral-to-bearish construction, with bulls needing a robust push to reclaim misplaced floor. The approaching periods will probably be essential, as sustained weak point beneath transferring averages may lengthen the consolidation section — whereas a bounce from present ranges may affirm short-term stabilization earlier than any broader restoration.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.