- Optimism (OP) underperformed as risk-off sentiment hit high-beta altcoins hardest.

- The buyback plan is delayed, small, and lacks quick provide discount.

- Technical breakdown beneath key averages has triggered robust sell-side momentum.

The Optimism (OP) token is falling even after token holders permitted a long-awaited buyback plan.

At first look, this appears counterintuitive, since buybacks are sometimes seen as bullish for token costs.

Nevertheless, the market response highlights the hole between long-term fundamentals and short-term buying and selling actuality.

OP is presently buying and selling round $0.27, down roughly 8.8% previously 24 hours.

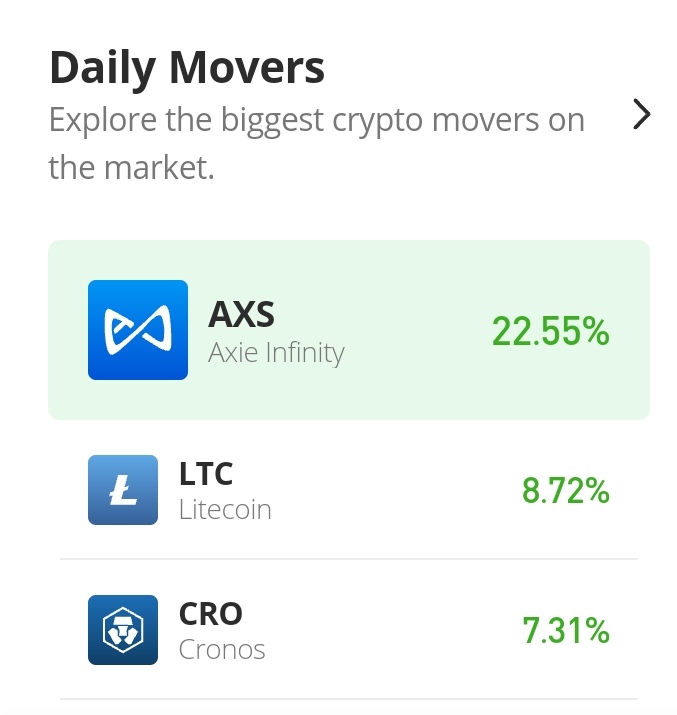

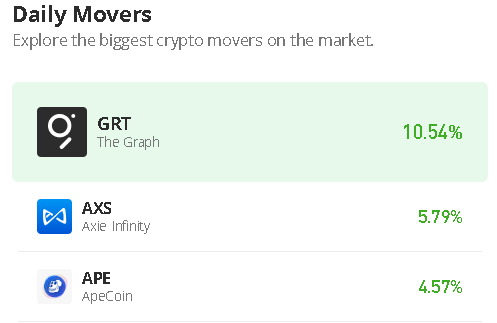

This decline is sharper than the broader crypto market’s 5.26% drop over the identical interval.

The underperformance alerts that OP is dealing with pressures past easy market noise.

Market-wide threat aversion is dragging down high-beta tokens

The crypto market is presently in a transparent risk-off part.

Traders are rotating away from speculative property and towards conventional secure havens.

Gold has surged to file highs, reflecting heightened international uncertainty.

On the similar time, Bitcoin has slid to round $85,000.

When Bitcoin weakens throughout risk-off intervals, altcoins sometimes fall tougher.

OP is taken into account a high-beta asset, which means it magnifies broader market strikes.

Consequently, even modest market stress interprets into outsized losses for OP.

The Concern and Greed Index sits at 38, firmly in “Concern” territory.

This means merchants are prioritising capital preservation over development alternatives.

In such circumstances, narratives like governance wins and future buybacks battle to achieve traction.

As an alternative, liquidity dries up and sellers dominate worth motion.

This macro backdrop units the stage for OP’s underperformance.

The buyback approval didn’t meet short-term market expectations

Whereas Optimism token holders have permitted a proposal to allocate 50% of Superchain sequencer income to OP buybacks, the market has reacted negatively slightly than positively, and the principle purpose is timing.

The buybacks are scheduled to start in February, not instantly. For brief-term merchants, delayed execution reduces the perceived affect.

The size of this system additionally disillusioned traders. Annual buybacks are estimated at round $8 million.

That determine represents roughly 1.5% of OP’s present market capitalisation.

Such a modest allocation is unlikely to offset sustained promoting stress. Moreover, the plan doesn’t embody token burns.

Repurchased tokens are despatched to the treasury, leaving future provide choices unsure.

On the similar time, token unlocks proceed so as to add provide to the market. This imbalance weakens the buyback narrative within the close to time period.

Reasonably than appearing as a worth ground, the announcement grew to become a “promote the information” occasion.

Conclusion: long-term promise, short-term stress

OP’s worth decline displays a convergence of macro, narrative, and technical elements.

Market-wide threat aversion has diminished demand for speculative altcoins.

The buyback plan, whereas structurally constructive, lacks quick affect.

The token lately broke beneath its 7-day and 30-day easy shifting averages, triggering algorithmic and momentum-based promoting.

The Shifting Common Convergence Divergence (MACD) indicator has additionally turned detrimental, pointing to accelerating draw back momentum.

The Relative Energy Index (RSI) stays close to 44, suggesting OP shouldn’t be but oversold, which means there’s little technical assist from discount hunters.

Collectively, these forces clarify why OP is falling regardless of constructive governance information.

Lengthy-term, tying token worth to Superchain income stays a significant shift.

Quick-term, nevertheless, merchants are targeted on survival slightly than future alignment.

The following main check, in line with analysts, might be whether or not OP can maintain the $0.2528 assist stage.

Upcoming macro information, notably US inflation metrics, might decide the subsequent transfer.

However till the market sentiment improves, OP is prone to stay beneath stress regardless of its bettering fundamentals.