Shark Tank star Kevin O’Leary and billionaire hedge fund supervisor Invoice Ackman have been slammed for stating that they consider Sam Bankman-Fried (SBF) was telling the reality that he “didn’t knowingly commingle funds.” The previous CEO of the collapsed crypto alternate FTX additionally stated he “wasn’t working Alameda,” so he “didn’t know precisely what was happening.”

Kevin O’Leary, Invoice Ackman Defend Sam Bankman-Fried

Shark Tank star Kevin O’Leary, aka Mr. Great, and billionaire hedge fund supervisor Invoice Ackman had been slammed Thursday after they stated they consider former FTX CEO Sam Bankman-Fried (SBF) was telling the reality throughout an interview at The New York Instances’ Dealbook Summit, aired Wednesday night. Crypto alternate FTX collapsed and filed for chapter on Nov. 11. An estimated a million clients and traders misplaced billions of {dollars} within the alternate meltdown.

Bankman-Fried stated through the interview that he “didn’t knowingly commingle funds.” He additionally shifted blame to Alameda Analysis, stating: “I wasn’t working Alameda … I didn’t know precisely what was happening.”

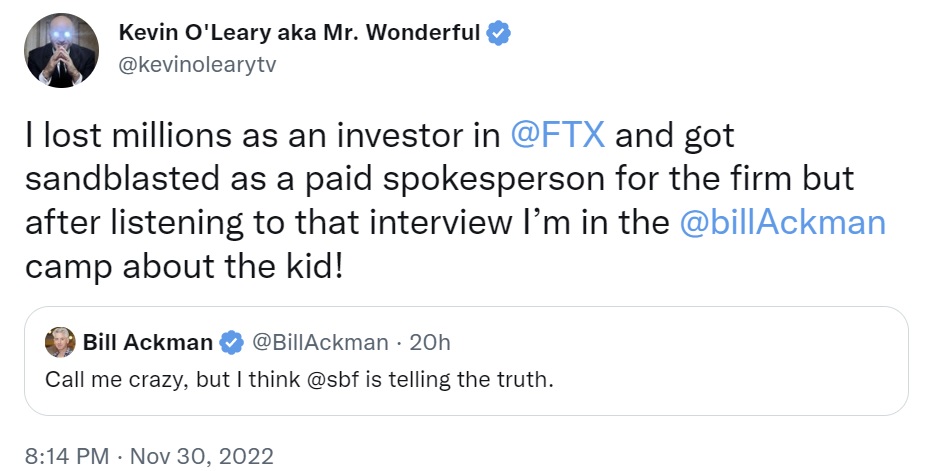

Whereas most individuals within the crypto group don’t consider Bankman-Fried’s story, at the very least two outstanding individuals spoke up in favor of the previous FTX CEO. Ackman, the CEO and portfolio supervisor of Pershing Sq. Capital Administration, tweeted after the interview: “Name me loopy, however I feel SBF is telling the reality.”

O’Leary shortly concurred, tweeting that he misplaced tens of millions as an investor in FTX and received sandblasted as a paid spokesperson for the crypto alternate. Nonetheless, he burdened that after listening to the interview, he agrees with Ackman “concerning the child.”

Many individuals disagreed with O’Leary and Ackman. Some referred to as them “morons,” “idiots,” and “scammers.” One wrote: “I’m a bit confused why individuals have this view on SBF because the actually sensible child that screwed up. He’s virtually 31, which implies he’s a grown man. This isn’t a 23-year-old contemporary grad making a buying and selling error on the desk. The narrative round this story shouldn’t actually be that.”

“I think about that if I used to be a public spokesperson for what turned out to be a Ponzi, I’d in all probability hope the chief received off with out legal fees as effectively (much less doubtless legal fees could be introduced in opposition to me). Simply saying, have a look at the incentives,” one other commented.

A 3rd opined: “Suppose I perceive now. All of those statements are a type of authorized safety and that interview was crafted in a really deliberate method. Higher to be a spokesperson for one thing that failed than one thing that dedicated mass fraud. Blatantly apparent the latter is true.” A fourth stated: “You gave tens of millions to a fraudster who didn’t know the very first thing about working an alternate or a hedge fund or the way to defend investor belongings and who doubtless absconded together with your cash as a result of full incompetence however positive he’s harmless.”

Following the collapse of FTX, O’Leary stated that he would assist Bankman-Fried once more if he has one other enterprise, noting that SBF is among the greatest merchants within the crypto house. Mr. Great additionally just lately revealed that he and Bankman-Fried virtually raised $8 billion to rescue FTX earlier than it collapsed.

What do you concentrate on Kevin O’Leary and Invoice Ackman believing that SBF didn’t know what he was doing when he commingled funds? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any harm or loss precipitated or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.