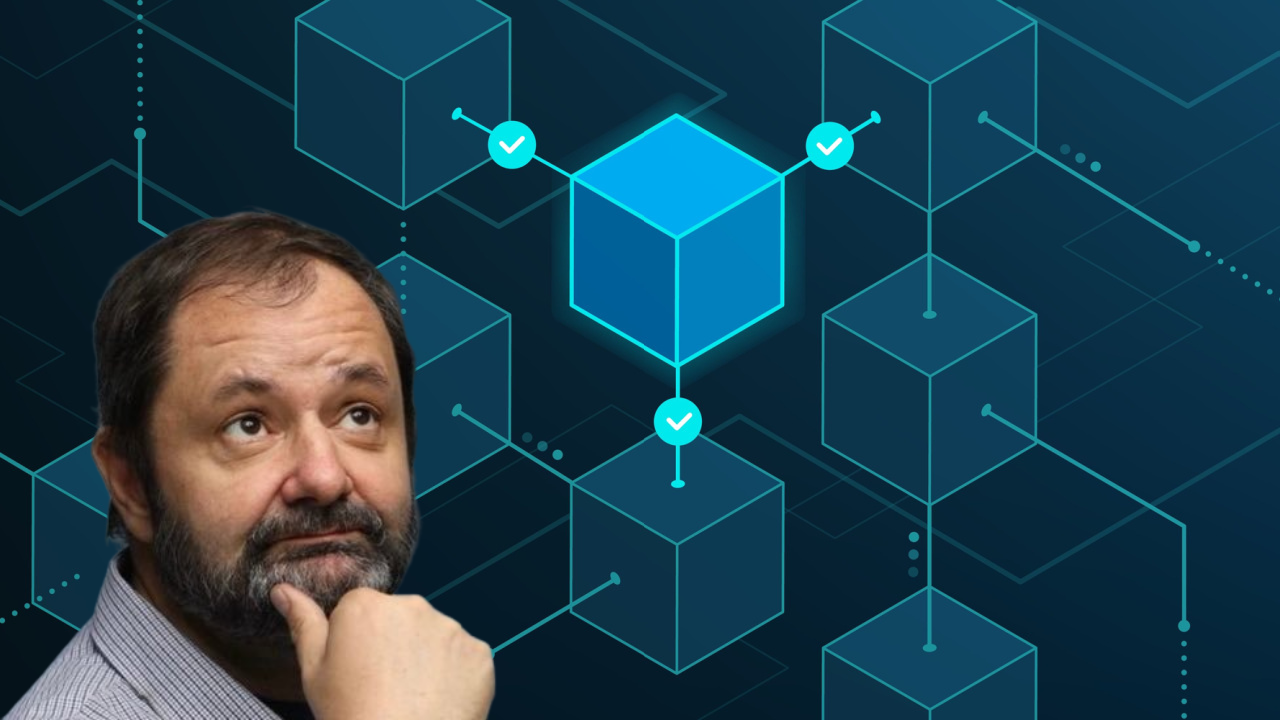

Whereas many crypto exchanges have seemingly embraced the usage of proof-of-reserves (PoR) to showcase their transparency and reassure nervous customers, crypto analyst Martin Hiesboeck insists such so-called proofs are inclined to manipulation or misrepresentation. He added that PoRs alone usually are not an appropriate technique of verifying an change’s reserves as a result of they don’t “account for liabilities and off-chain property in any respect.”

PoR Might Be ‘Deceptive and Misleading’

Following the collapse of FTX in November, belief in centralized exchanges ebbed, with many customers dashing to maneuver their property off of such platforms. This, in flip, sparked a rush by crypto exchanges to current or publish their proof-of-reserves (PoR).

Seen as an emergency response to the arrogance disaster created by FTX’s fall, PoR Merkle bushes have seemingly turn into the de-facto commonplace measure used to undertaking a crypto change’s transparency. Proponents of PoR assert that utilizing this audit technique reassures customers {that a} crypto change shouldn’t be misusing their funds.

Nevertheless, regardless of their obvious embrace by many within the crypto trade, presenting PoR audits alone could not show that an change shouldn’t be misusing consumer funds. It is usually alleged that some crypto exchanges are lending one another funds simply previous to an audit and returning these instantly after a PoR has been introduced.

To critics like Martin Hiesboeck, a crypto analyst and head of blockchain and crypto analysis on the multi-asset digital buying and selling platform Uphold, PoRs usually are not appropriate instruments for proving the standing of an change’s reserves as a result of they don’t “account for liabilities and off-chain property in any respect.” This based on Hiesboeck makes PoRs “at greatest incomplete, at worst deceptive and misleading.”

Commenting on why some within the crypto area have seemingly endorsed PoRs, Hiesboeck instructed Bitcoin.com Information:

“The Merkle Tree PoR has seen elevated adoption and curiosity previously few weeks because of shaken belief in centralized exchanges. CEXs [centralized exchanges] wanted a quick and public ’emergency response’ to revive public and person belief, and because of this the so-called Proof of Reserves technique grew to become so common and is at the moment touted as the easiest way to show an change’s transparency — at the very least on paper.”

However, Hiesboeck notes that PoRs have two points that make them inclined to manipulation or misrepresentation. One is what Hiesboeck describes because the inherent opaqueness of a Merkle Tree mannequin. This mannequin by design “permits for the verification of sure information with out divulging its contents.”

For centralized exchanges utilizing this mannequin, it means their respective auditors can publish a “reputable snapshot” of a crypto change platform’s reserves. Explaining why he finds this problematic, Hiesboeck stated:

Common onlookers haven’t any means to confirm the outcomes of PoRs nor assurance that funds weren’t moved from these addresses instantly after the audit. To resolve this concern, at the very least partially, there must be some form of a real-time unbiased reserve monitoring system to offer up-to-date data over time.

The exclusion of an change’s excellent liabilities in PoRs is one other concern making them a much less dependable manner of verifying or ascertaining a crypto change platform’s monetary well-being. Subsequently presenting or publishing a crypto change’s property with out additionally revealing its liabilities doesn’t present an correct image of the platform’s monetary well being, Hiesboeck argued.

“Many exchanges which have revealed PoRs don’t embrace such data, that means they’re non-transparent. Nor do they mirror any custodians’ off-chain property and the place these funds originated from,” he added.

Nonetheless, regardless of Hiesboeck and different critics’ arguments towards the usage of this mannequin, PoRs seem to have gained traction. As reported by Bitcoin.com Information, a number of giant crypto exchanges have introduced audits based mostly on the Merkle tree mannequin. Binance, one of many world’s largest crypto change platforms, lately revealed its PoR for bitcoin. The snapshot instructed that Binance’s BTC reserves had been barely greater than internet person balances.

In the meantime, when requested if there’s a higher various verification technique, Hiesboeck replied:

“The one various to a Merkle Tree PoR is a system that gives a mix of reserves and liabilities. It ought to embrace proof that the working entities are domiciled in the proper jurisdictions and that any attestation has been topic to evaluation by an exterior auditing agency.”

What are your ideas on this story? Tell us what you suppose within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Dr. Martin Hiesboeck, Twitter

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

_id_3946e2f2-d00c-4dcf-82a4-682125cda574_size900.jpg)