In numerous current interviews, the previous co-founder of FTX, Sam Bankman-Fried (SBF), defined that he “wasn’t operating Alameda” and he “didn’t know the scale of their place.” In a newer dialogue with The Block’s Frank Chaparro, SBF defined that auditors have been taking a look at FTX’s company financials, however the auditors have been “not taking a look at buyer positions and never taking a look at buyer threat.” This week, an FTX insider talking to Bitcoin.com Information underneath phrases of anonymity shared a doc that purportedly exhibits Alameda Analysis CEO Caroline Ellison’s private account was within the gap by $1.31 billion in Could 2022.

SBF Interviews Proceed to Spotlight a Huge Margin Place That Went Bitter

There’s been quite a lot of data shared by the previous FTX co-founder Sam Bankman-Fried (SBF) throughout his interviews, and plainly by some means, with out his data, a big margin account obtained uncontrolled. This has been blamed on “poorly-labeled accounting” practices and SBF mentioned he “f***ed up.”

“In a number of methods, frankly. By way of letting a margin place get too large, larger than I assumed it was. And never being thorough sufficient to catch that,” SBF informed New York Journal. The huge margin place, that took SBF off guard, has been referred to in lots of reviews about FTX and through SBF interviews.

“We should always not have allowed a margin place to get that large,” SBF harassed to New York Journal reporter Jen Wieczner. “It was too large. And it was too large, given the liquidity of the collateral,” SBF added. In one other assertion, SBF detailed that Alameda’s margin place was so large that it “was not going to be closable in a liquid approach as a way to make good on its obligations.”

“That place, looking back, looks as if it obtained considerably larger in the course of the yr,” SBF added. The FTX co-founder continued:

That made it go from a considerably dangerous place to a place that was approach too large to be manageable throughout a liquidity disaster, and that it could be significantly endangering the power to ship buyer funds.

Throughout SBF’s most up-to-date interview with The Block’s Frank Chaparro, the previous FTX CEO mentioned that regulators and auditors didn’t see any monetary holes as a result of buyer positions, and Alameda Analysis’s positions, weren’t included in FTX’s financials. SBF mentioned auditors checked out sure elements, however they have been “not taking a look at buyer positions and never taking a look at buyer threat.”

“This was successfully a buyer detrimental place, and many shoppers had detrimental positions open on FTX,” SBF informed Chaparro. “These weren’t a part of FTX’s property or liabilities, they have been buyer property and liabilities, and so FTX’s financials weren’t immediately impacted by this.” Chaparro’s interview additionally talks about how high executives have been “prolonged massive private traces of credit score.”

FTX Insider Doc Supposedly Reveals Caroline Ellison’s Margin Place Was a $1.3 Billion Gap

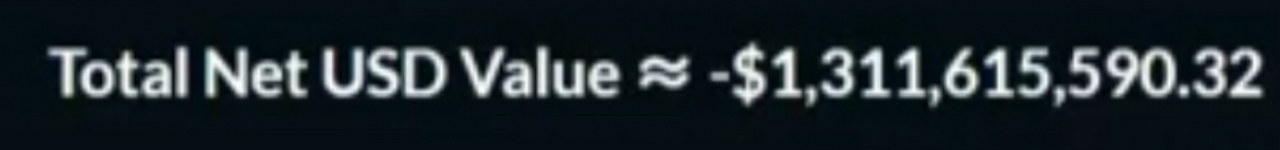

This week a doc was despatched to Bitcoin.com Information that allegedly exhibits Caroline Ellison’s steadiness on FTX seven months in the past in Could 2022. In accordance with the supply conversant in the matter, Ellison shared this knowledge amongst numerous FTX employees members when she was experiencing a technical glitch together with her private buying and selling account.

The doc exhibits Ellison ostensibly had a detrimental steadiness at the moment of round $1.31 billion in Could 2022. All FTX accounts present detrimental balances, if the consumer has a detrimental steadiness for particular causes resembling {that a} fee wasn’t settled or the consumer was in debt from margin positions. The documentation that’s allegedly tied to Ellison, exhibits an infinite steadiness that no extraordinary consumer would have, together with a detrimental amount of FTX fairness.

The doc our newsdesk considered signifies the consumer’s detrimental steadiness owed or held in a margin place, factors to an enormous quantity of FTT, megaserum (MSRM), locked megaserum (MSRM), locked serum (SRM), locked maps (MAPS), solana (SOL), ethereum (ETH), bitcoin (BTC), and tens of millions of {dollars} value of stablecoins. The consumer’s steadiness, allegedly tied to Alameda CEO Ellison, exhibits almost each account is within the detrimental to the tune of roughly $1.31 billion.

Chaparro notes across the 9:30 mark in his interview that Ellison talked about that FTX prolonged fairly a little bit of credit score to Alameda Analysis. “[Ellison] mentioned that you just knew, that Gary knew,” Chaparro pressed throughout his query, and he mentioned folks inside each companies knew about these traces of credit score. “I believe she’s seemingly right, that Alameda Analysis was successfully prolonged a considerable quantity of credit score by FTX and in the long run, that margin place grew to become underneath extreme stress and it blew out.”

A detrimental $1.31 billion margin place, just like the one disclosed to our newsdesk this week, is a really massive gap. Margin positions check with trades which can be made utilizing borrowed funds and normally, if the dealer is unable to keep up the minimal required margin, the place is liquidated as a way to repay the borrowed funds. The massive margin place shared in Could 2022, is across the similar timeframe the Terra LUNA fiasco occurred.

The insider that shared the doc purportedly tied to Ellison, requested “how can a buddy of SBF generate a debt” of that dimension “with no collateral?” There’s quite a lot of unanswered questions that circle again to Ellison and folks have been investigating the Alameda CEO for fairly a while. Ellison was reportedly noticed in New York this previous weekend with the FTX workplace canine referred to as ‘Gopher.’

What do you concentrate on the doc that supposedly exhibits Caroline Ellison had a detrimental $1.3 billion margin place in Could 2022? Tell us what you concentrate on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

_id_3946e2f2-d00c-4dcf-82a4-682125cda574_size900.jpg)