Bitcoin mining firms proceed struggling to outlive the continued bear market. Desires of outperforming bitcoin as a public mining firm are lengthy gone. Bankruptcies and lawsuits make routine headlines. And even Wall Road analysts that had been as soon as bullish on bitcoin mining funding alternatives now say they’re “pulling the plug” till the market improves. However precisely how unhealthy is the present bear market?

It’s at all times darkest earlier than daybreak, because the adage says. And in comparison with earlier bear markets, the mining business seems a lot nearer to the top of a turbulent market part than the start of it. This text explores a bunch of knowledge units from the present and former bear markets to contextualize the state of the business and the way the mining sector is faring. From {hardware} lifecycles and miner balances, to hash fee development and hash worth declines, all of those knowledge inform a novel story about one in all Bitcoin’s most vital financial sectors.

Mining Income Is Evaporating

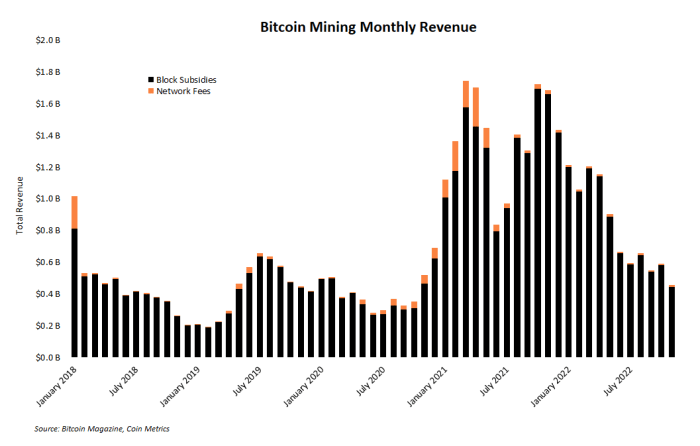

When bitcoin’s worth drops, it’s not stunning that dollar-denominated mining income additionally drops. But it surely has – lots. Roughly 900 BTC are nonetheless mined day by day and shall be till the following halving in 2024. However the fiat worth for these bitcoin has plummeted this 12 months, which means miners have far fewer {dollars} for bills like electrical energy, upkeep and the servicing of loans.

Because the chart under demonstrates, in November, your complete bitcoin mining business earned lower than $500 million from processing transactions and issuing new cash. The bar chart under exhibits this month-to-month income in comparison with the previous 5 years. November mining income marks a two-year low for month-to-month earnings.

Potential Hash Charge Uptrend Reversal

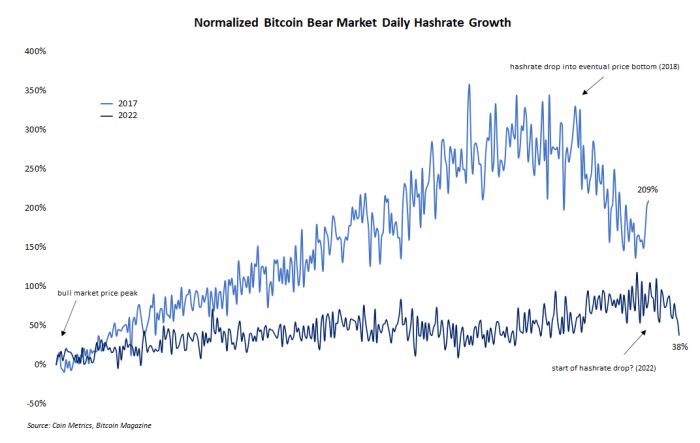

Evaluating the present bear market to the earlier one in 2018 affords some fascinating insights into how the mining business has modified and the way it has remained the identical. One such comparability is hash fee development throughout downward worth traits. It’s not unusual to see hash fee develop throughout bear markets. The annotated line chart under exhibits normalized hash fee development in the course of the 2018 and 2022 bear markets from bitcoin’s worth peak to the drawdowns’ historical past (or present) lows.

However one factor that’s clearly lacking from the above chart is a correction in hash fee development in the course of the later interval of the bearish part. In 2018, for instance, the expansion development clearly modified course and dropped because the market ultimately discovered a low for bitcoin’s worth. However within the present market, hash fee has solely grown. Maybe a slight drop in hash fee by means of late November indicators a development change, however the query continues to be open.

Collapse Of Public Mining Corporations

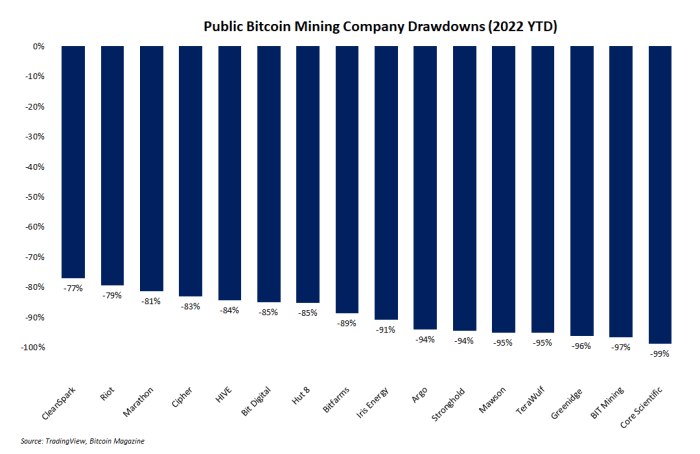

Maybe probably the most brutal bitcoin mining chart of all exhibits the drawdowns of publicly-traded mining firms this 12 months. It’s no secret that the previous 12 months has been brutal for bitcoin, different cryptocurrencies, and the worldwide financial system normally. However mining firms specifically have been clobbered. Over half of those firms have seen their share costs fall over 90% since January. Solely two — CleanSpark and Riot Blockchain — haven’t dropped greater than 80%.

Mining firms normally are sometimes thought-about to be a high-beta funding in bitcoin, which means when bitcoin goes up, mining inventory costs go up extra. However this market dynamic cuts each methods, and when bitcoin falls, the draw back for mining shares is much more brutal. The bar chart under exhibits the bloodbath these shares have endured.

The Rise And Fall Of Bitcoin Mining’s ‘AK-47’

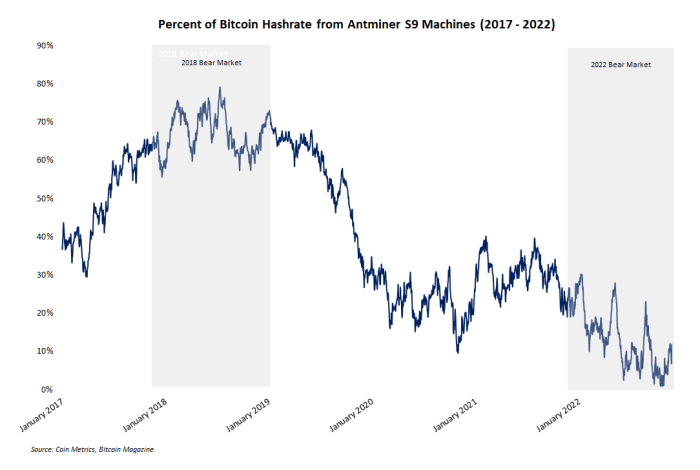

An underappreciated hallmark of the present bitcoin bear market is the precipitous decline in hash fee contributed by Bitmain’s Antminer S9 machines. This mannequin of mining machine is often known as the “AK-47” of mining due to its sturdiness and dependable efficiency. And at one level within the 2018 bear market, the S9 was king. Almost 80% of Bitcoin’s complete hash fee got here from this Bitmain mannequin in the course of the depths of the earlier bear market.

However the present bear market tells a totally completely different story. Due to new, extra environment friendly {hardware} and a vice-grip squeeze on mining revenue margins, the share of hash fee from S9s dropped under 2% in early November. The annotated line chart under exhibits the rise and fall of this machine.

Miner Steadiness Retraces Its Promote Off

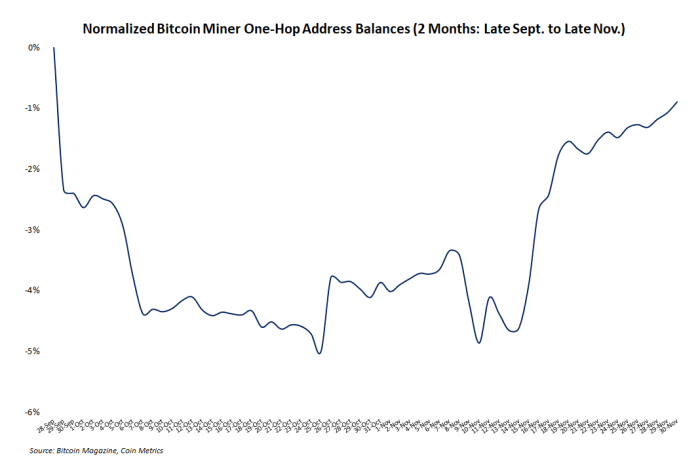

The previous few months have been disastrous for the “crypto” business as trade wars, bancrupt custodians and different types of monetary contagion swept the market. Many bitcoin buyers wish to assume their section of the business is usually insulated from the chaos of the remainder of “crypto,” however that is normally false. Within the case of miners, who’re notoriously unhealthy at timing the market, some panic was evident as handle balances and miner outflows appeared to drop and spike, respectively.

However this exercise was brief lived. The road chart under exhibits that miner handle balances have nearly absolutely retraced their drop from late September by means of October. Briefly, miners seem like again in HODL mode, impervious to exogenous market occasions. Whether or not the bear market is over or not is unknown. However miners appear to be accumulating greater than promoting.

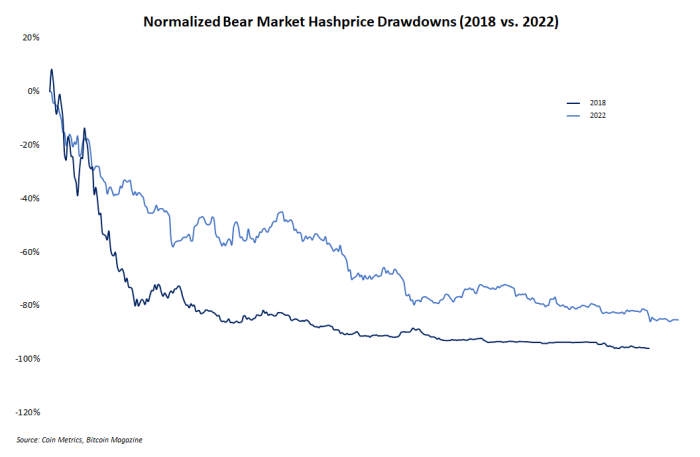

Hash Value Drop Immediately Vs. 2018

Hash worth is without doubt one of the hottest financial metrics for miners to trace, although few folks exterior of the mining sector perceive it. Briefly, this metric represents the dollar-denominated income anticipated to be earned per marginal unit of hash fee. And like every part else within the bear market, hash worth has fallen considerably. However its decline will not be uncommon, particularly when it is in comparison with the hash worth decline in 2018.

Proven within the chart under are normalized hash worth drawdowns from 2018 and 2022. Readers will discover the pretty related slope and dimension of the drawdowns. 2018 was barely steeper. 2022 so far has been shallower however longer. However each had been and are brutal for fledgling mining operations.

The Subsequent Part Of Mining

Increase and bust cycles are a pure collection of occasions for any correctly functioning market. The bitcoin mining sector is not any exception. For the previous 12 months, mining has seen its weaker, unprepared operators weeded out because the excesses from the bull market are delivered to account. Now, within the depths of a bearish interval, the true builders can proceed to broaden their operations and construct a strong basis for the following part of euphoric bullishness.

This can be a visitor submit by Zack Voell. Opinions expressed are fully their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.