Blockware Intelligence, the analysis arm of Blockware Options, has launched its 2023 forecast, which indicated, amongst different issues, that the bitcoin value backside might be in quickly.

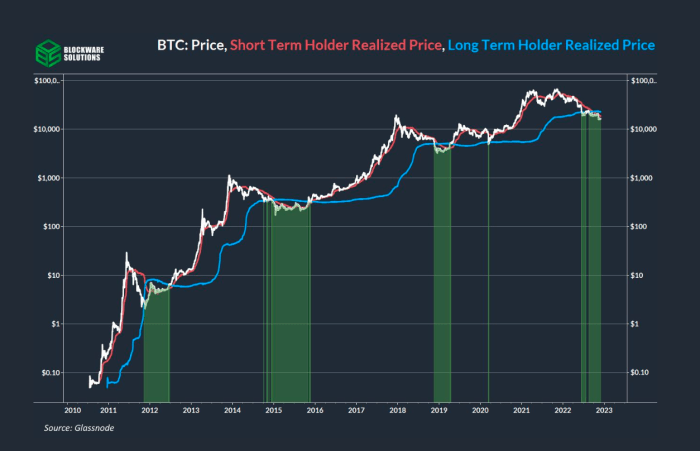

The report included a bigger macroeconomic overview and forecast, alongside bitcoin’s response in addition to on-chain indicators that recommend potential future actions. Brief-term holder realized value (STH RP), as indicated by the report, is a extra risky, quick-to-move metric decided by the worth of cash moved throughout a sure interval, whereas long-term holder realized value (LTH RP) is a much less risky, extra sticky metric decided by the worth of cash held which were unmoved for longer durations. When value dips beneath LTH RP, that means that the majority long-term holders are underwater, it typically coincides with earlier bear market lows. The report means that the worth of bitcoin is more likely to flip each LTH RP and STH RP, which it’s at present beneath, which might sign the low of the bear market.

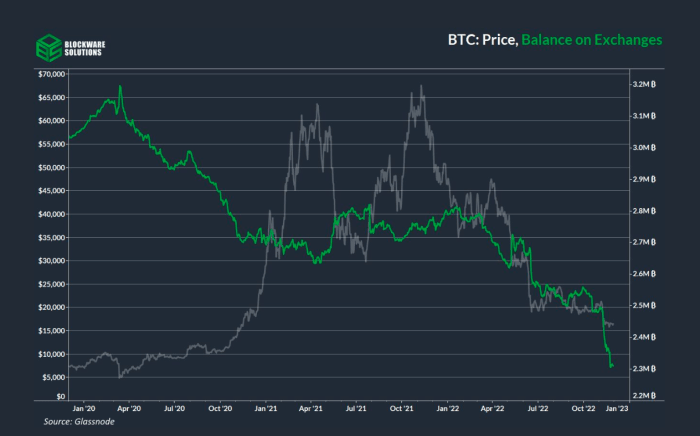

The report additionally famous the current collapse of a number of exchanges, particularly Celsius, BlockFi and FTX, which has contributed to rising self-custody of BTC. Self-custodying of bitcoin tends to extend costs as the worth suppression potential created by exchanges is eradicated.

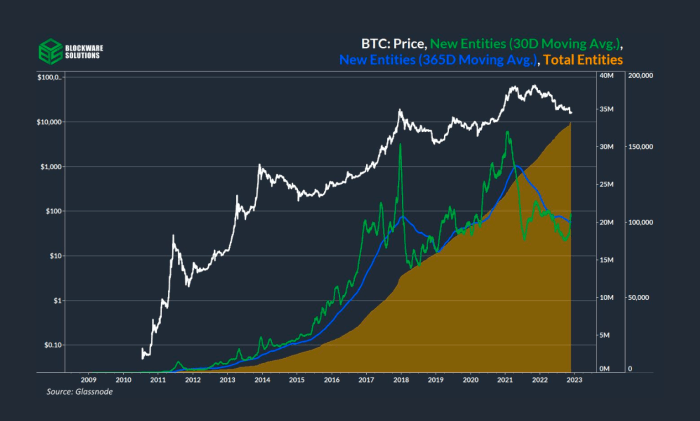

Additionally predicted is a significant improve within the variety of on-chain customers of bitcoin. Within the earlier 2018 cycle, the variety of on-chain customers rising at an rising charge indicated the beginning of the bull run. We now see as soon as once more {that a} constructive momentum shift within the variety of on-chain entities, suggesting rising adoption and potential seeds for the subsequent bull market.

As well as, it’s urged that present state-of-the-art ASICs, particularly the S19XP, might retain their worth for longer than earlier generations of ASICs, as producers method what’s thermodynamically potential. This could have ramifications on the worth of the ASIC and plans for future money flows for miners.

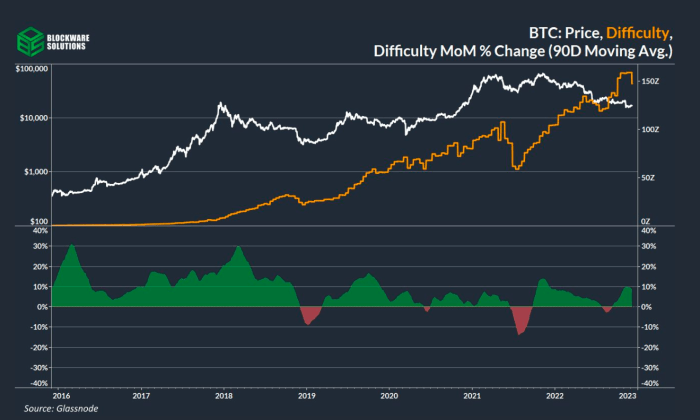

That is taken into consideration as nicely within the subsequent idea that Bitcoin hash charge development will gradual progress in 2023, noting three elements:

“1. ASIC Commoditization

2. Lack of Mining Funding in 2022

3. International Power Disaster (lack of obtainable low cost power).”

The worldwide power disaster is additional detailed — as regulators put extra strain on oil and hydrocarbon sources of power, additional driving up the worth, miners with fastened energy buying agreements would be the ones insulated from this volatility.

The report finishes with the prediction that in 2023, the USA would be the preeminent vacation spot for bitcoin mining as a result of power of the greenback, the soundness of power costs right here and the lesser impacts of inflation throughout the nation.