That is an opinion editorial by Kudzai Kutukwa, a passionate monetary inclusion advocate who was acknowledged by Quick Firm journal as considered one of South Africa’s top-20 younger entrepreneurs underneath 30.

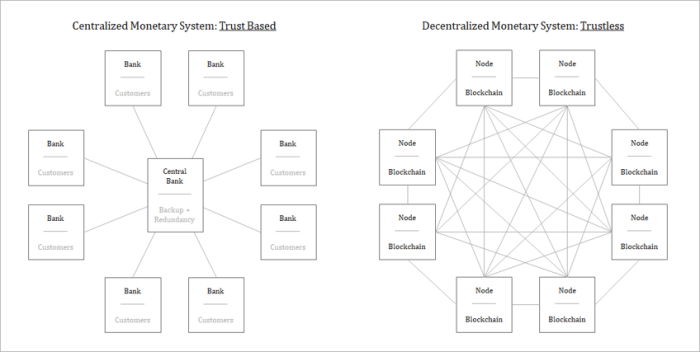

Satoshi Nakamoto brilliantly specified by a couple of quick sentences the key downside with the present monetary system; it’s dependency on belief. “The basis downside with typical foreign money is all of the belief that’s required to make it work. The central financial institution should be trusted to not debase the foreign money, however the historical past of fiat currencies is stuffed with breaches of that belief. Banks should be trusted to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with barely a fraction in reserve.” In different phrases what actually drives the fiat financial to an important extent is belief, as a result of with out it the system as we all know it wouldn’t be practical, nevertheless the belief is being positioned in untrustworthy people and establishments. The Bitcoin financial system is trustless and decentralized by design and is reliant on cryptographic proof as an alternative, thus eradicating altogether the necessity for “trusted intermediaries” in each monetary interplay, from the central financial institution all the way in which right down to transactions between people.

The Blocksize Battle of 2015-2017 is among the most vital occasions in Bitcoin’s historical past. This was actually a battle between people who favored centralization of the protocol by a handful of builders, exchanges and miners (akin to what you might have in Ethereum at the moment) versus people who favored decentralization, safety and resilience over the long run. For the primary time in its existence Bitcoin confronted a possible hostile takeover engineered by highly effective company entities that wished to seize and impose their will on Bitcoin. What began out as a disagreement on how one can scale Bitcoin, whether or not the dimensions restrict of the blocks that make up the Bitcoin blockchain ought to be elevated or not, ultimately morphed right into a two yr lengthy tug of battle over the very soul of Bitcoin itself. Two camps emerged; the “massive blockers”, who had been in favor of accelerating the block dimension as their precedence was making certain quicker and cheaper transactions on the base layer thus making Bitcoin into a worldwide funds system that will rival Visa (i.e. company management); and the “small blockers” who had been extra targeted on Bitcoin being a brand new type of cash, which needed to stay totally decentralized if it was to attain the purpose of separating cash and state (i.e. particular person management).

Jan3 CEO, Samson Mow, who was on the frontlines of the block dimension battle, in a latest article made the next comment concerning the small blockers, “They prioritized integrity, resilience and safety, arguing that if blocks turned massive, it might change into costly for customers to run a node and would thus incentivize internet hosting nodes in knowledge facilities; a one-way avenue in the direction of centralization and management by a couple of, not a lot totally different from different programs like banks. This is able to imply the demise of the dream of an apolitical, incorruptible, decentralized cash.” The small blockers foresaw a state of affairs wherein additional time it might be costly for customers to run full Bitcoin nodes which might have led to additional centralization and thus recreating the trusted third events in one other type; the very middlemen that Bitcoin was designed to disrupt. Satoshi designed Bitcoin with the intention of it remaining a technically and socially sturdy peer-to-peer (P2P) community which ought to by no means be “corrupted” by means of centralization. He summarized it this manner, “Digital signatures present a part of the answer, however the principle advantages are misplaced if a trusted occasion remains to be required to stop double-spending.”

To ensure that Bitcoin to stay user-controlled, each try or type of centralization needs to be fiercely resisted, particularly given the innate human tendency to lean extra in the direction of centralized programs with a frontrunner. If a handful of enterprise entities and builders may drive such a big change with out consensus would that not be akin to how the Federal Reserve plans the financial system by dictating rates of interest and sustaining “value stability?” As acknowledged earlier, it wasn’t nearly block sizes anymore but it surely was now an ideological conflict about management. Who had management, was it the customers or the miners or the builders that will steer the protocol? Within the guide, “The Blocksize Battle,” the writer precisely described this phenomenon and the way it was an underlying driver for the large blockers when he famous;

“In some folks’s minds, the thought of a system managed by finish customers is simply too tough to understand. As an alternative, they search for any person or some entity who controls the system. Some folks can’t fathom the thought of a system which has international consensus, however lacks a frontrunner…As for whether or not Bitcoin actually is the leaderless system it proclaims to be and whether or not it will all the time stay the case, the jury remains to be out. Nevertheless, after the drama and shenanigans of the blocksize battle, one factor is obvious: there may be nonetheless hope that the declare is true.”

Finally, it was the small blockers that prevailed and in consequence Bitcoin remained firmly within the customers’ management.

In relation to Bitcoin many of the consideration is concentrated on bitcoin the asset and fewer on the infrastructure required to keep up this international, decentralized peer-to-peer (P2P) community. Whereas the small blockers’ victory within the blocksize battle secured Bitcoin’s path in the direction of future mass adoption, it nonetheless stays unclear to most individuals why operating a node is so vital that it was price combating for. Let’s begin by defining what a node is. A full node is any laptop that maintains and shops the complete Bitcoin blockchain; to be able to confirm and report new transactions as they occur, based on a typical set of community consensus guidelines. Within the absence of a central occasion, it’s these nodes that act as referees of the Bitcoin community by independently validating all transactions and blocks; and filtering out invalid transactions. That is how the Bitcoin community removes belief in any centralized entity and ensures the integrity of its 21 million provide cap.

Whereas operating a full node is vital, it’s nonetheless optionally available to take action. Operating a full node, grants anybody the flexibility to broadcast transactions (or blocks) on a permissionless foundation. The extra nodes there are on the community, the extra decentralized Bitcoin turns into. This not solely will increase redundancy, but it surely ends in Bitcoin being safer by making it more and more tougher to deprave or censor. Every full node executes the consensus guidelines of the community, an vital aspect being Bitcoin’s mounted provide. Bitcoin Core developer, Luke Dashjr, completely summarized it this manner, “All of Bitcoin’s benefits — together with its safety from outright theft and the 21 million BTC cap — stem from the idea that almost all of the financial system are utilizing their very own full nodes to confirm funds to them. Centralized verification and third-party/custodial wallets are a much bigger risk to Bitcoin than the rest.” In different phrases, nodes are crucial components of the Bitcoin community’s protection mechanism with reference to processing transactions, and they’re the final line of protection towards centralization and malicious actors. Extra data concerning operating your personal node will be discovered right here.

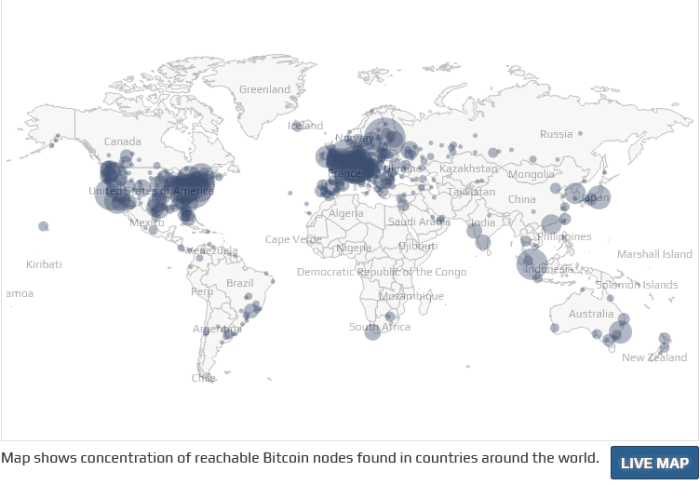

Regardless of the vital function that nodes play within the Bitcoin ecosystem, it’s estimated that the variety of Bitcoin nodes has dropped significantly from a peak of 200,000 in 2018 to lower than 45,000 at the moment as of time of writing based on Dashjr’s knowledge. Given the truth that customers having the ability to run full nodes was one of many largest elements that culminated within the blocksize battle, it’s undoubtedly of nice concern that we’re seeing a discount of nodes on the community in 2022 in comparison with 2018. This might probably make the Bitcoin community much less safe and rather more liable to centralization. Moreover from a geographical standpoint, 32.8% of Bitcoin nodes globally are positioned in simply seven nations — the USA, Germany, France, the Netherlands, Canada, Finland and the UK, as of time of writing based on knowledge from BTC nodes analytics platform Bitnodes.

Paradoxically within the international south the place there’s a enormous want for Bitcoin from a monetary inclusion perspective, there’s a paucity of Bitcoin nodes in that a part of the world. There are quite a few causes that may clarify the lower of Bitcoin nodes or the shortage thereof in different areas; firstly there are lots of people that aren’t educated concerning the significance of operating a full Bitcoin node, particularly given the present obsession with quantity go up. Secondly, as a result of vital bandwidth utilization of Bitcoin full nodes particularly because the community scales, the prices of doing so are prohibitive; particularly in locations with subpar web connectivity. That is the place Erlay is available in. Erlay is a brand new environment friendly transaction relay protocol that goals to considerably reduce the bandwidth utilization required to attach Bitcoin full nodes.

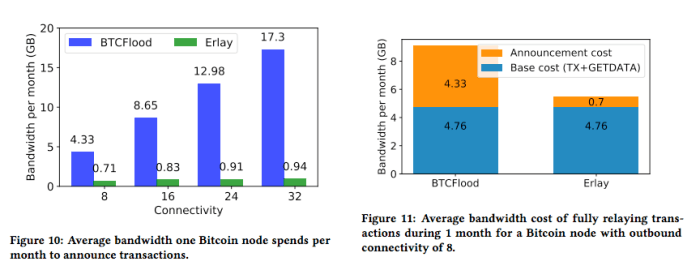

Roughly 50% of the bandwidth required to run a Bitcoin node is used only for asserting transactions. When a brand new bitcoin transaction is broadcast, it’s despatched to all nodes on Bitcoin’s p2p community and this happens in two methods. Firstly, after receiving a transaction, a node sends a transaction identifier (i.e. transaction ID) to all the friends it’s linked with. This transaction ID is subsequently verified by all these friends to make sure that they haven’t obtained the transaction in query from one other peer. If not, the entire transaction is requested from the node that despatched the transaction ID. This course of repeats constantly and the top result’s that there’s a plethora of redundant messages being shared on the Bitcoin community, thus unnecessarily consuming numerous bandwidth. It’s estimated that 44% of general bandwidth used between nodes consists of those redundant messages. The lengthy and wanting it’s that this strategy has excessive redundancy and poor bandwidth effectivity. The bandwidth prices subsequently change into an enormous obstacle for some customers to run a full node, which severely limits the extent of decentralization of the community.

Secondly, the decentralized nature of the community provides rise to a different vital subject with reference to Bitcoin’s node connectivity, which is that it additionally makes use of giant quantities of bandwidth to maintain the connection open with all the opposite nodes. In different phrases the present protocol will increase bandwidth consumption because the variety of connections between nodes will increase. This additionally will increase the prices to run a Bitcoin full node because the community scales, which might make the community extra liable to centralization. Over and above that, for the reason that safety of the Bitcoin community is closely reliant on the connectivity between nodes (i.e. larger connectivity ends in a safer community) fewer connections between nodes could be bandwidth environment friendly however would end in a much less safe and borderline centralized community. In keeping with the white paper that was co-authored by Gleb Naumenko, Bryan Bishop, Pieter Wuille, Greg Maxwell, Alexandara Fedorova and Ivan Beschastnikh; Erlay will scale back the quantity of bandwidth required to keep up present ranges of connectivity between Bitcoin nodes by 40%, whereas concurrently sustaining bandwidth utilization because the connectivity between nodes will increase. To place this in perspective, at present a connection to 32 nodes makes use of roughly 17.3GB per 30 days to relay transactions and Erlay drastically reduces this to a meager 0.94GB per 30 days! This can be a enormous quantum leap for bandwidth effectivity as proven by the diagrams under:

The paper additional states that; “By permitting extra connections at a small price, Erlay improves the safety of the Bitcoin community. And, as we exhibit, Erlay additionally hardens the community towards assaults that try to be taught the origin node of a transaction.” In different phrases Erlay considerably improves bandwidth effectivity by decreasing bandwidth used for transaction relay in addition to scalability of connections between friends thus making the community extra immune to partitioning assaults and fortifies single nodes towards eclipse assaults. Whereas Erlay protocol help signaling has efficiently merged into Bitcoin core, this was a improvement that took three and a half years to materialize, given the intensive evaluate and testing that needed to be accomplished beforehand, as a result of stability and safety on the base layer are all the pieces.

Whereas Bitcoin is a big breakthrough in making a trustless and decentralized financial system with superior financial properties, its success will not be assured except we the customers stay dedicated to defending the ideas upon which it’s anchored. The victory by the small blockers within the blocksize battle wasn’t handed to them on a silver platter but it surely took place by means of relentless dedication to the purpose of separation of cash and state. It was all or nothing. Many extra makes an attempt to manage Bitcoin on the protocol stage shall be launched, nevertheless they are going to be doomed to fail if we stay resolute and unwavering in preserving the community’s core tenets; of which decentralization is chief amongst them, in my humble opinion. By holding the prices of operating a node as little as attainable,extra particular person customers from around the globe are in a position to take part in validating the community, that is what Erlay represents. It’s a protection towards centralization of the community by bigger gamers thus preserving Bitcoin’s id as a totally decentralized, permissionless and trustless peer-to-peer financial system.

This can be a visitor submit by Kudzai Kutukwa. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc. or Bitcoin Journal.