Every week couldn’t be extra necessary for Bitcoin and the broader crypto market! On Tuesday, at 08:30 ET, there would be the launch of the Client Worth Index (CPI).

Simply at some point later, on Wednesday, December 14 at 14:00 ET, the Federal Open Market Committee (FOMC) will maintain its final assembly of the yr. For the fourth time this yr, there can be an up to date forecast for inflation and rates of interest (dot plot).

Typically, there’s a easy base case state of affairs: if the numbers are higher than anticipated, there can be a rally for risk-on property like Bitcoin. If the CPI falls wanting expectations, Bitcoin might face a brand new bear market low.

Did Bitcoin Overreact To The PPI?

To evaluate how seemingly each eventualities are, it is usually price wanting again on the latest producer value index (PPI) launch. The PPI was larger than anticipated.

Nonetheless, expectations had been comparatively excessive. The core PPI was forecast at 7.2% in October, however really fell to six.7%, a 0.5% month-to-month decline.

The core PPI November forecast was 5.9%. In actuality, although, the PPI got here in at 6.2%. Whereas this appears to be like bearish at first, it actually wasn’t. This nonetheless represented a 0.5% decline month-over-month.

The PPI reveals the identical story. The worth fell for 2 consecutive months, 0.5% and 0.6%. The expectation was a 1.1% decline in a single month, which was extraordinarily unrealistic.

The markets’ projected goal was a particularly low quantity, and the failure to satisfy that expectation was, in a way, an overreaction. Inflation has continued to fall considerably, simply lower than lower than anticipated.

In the end, expectations had been a bit out of contact with actuality. As well as, the PPI is basically extra unstable than the CPI, and likewise fluctuates seasonally. With the Christmas and gift-giving season, fluctuation shouldn’t be unusual.

A Recreation Of Expectations

So what are the expectations for the CPI? CPI fell 0.5% in October to 7.7%, whereas 8.0% was predicted. Tuesday’s expectations at the moment are 0.4% decrease. The forecasted CPI is 7.3%.

Core CPI is anticipated at 6.1%, which might signify a 0.2% decline. The October studying was 6.3%, whereas the expectation was 6.5%, making a optimistic shock.

The forecast for the CPI and the Core CPI are thus far more average and fewer unrealistic than for the PPI. In contrast to the PPI, there aren’t any extraordinarily excessive expectations.

Even a “small” shock may very well be sufficient to show the market bullish. In a best-case state of affairs, we see various round 7% for the CPI on Tuesday.

Furthermore, a renewed drop within the CPI might verify that inflation peaked. If the CPI falls for the sixth month in a row, fears of a second wave of inflation would even be allayed for now.

All Eyes On The FOMC Assembly

Final however not least, the CPI numbers can be fairly essential for the FOMC determination on Wednesday. The market has priced in a 78% likelihood that the Fed will sluggish the tempo of fee hikes to 50 foundation factors at that assembly.

Nonetheless, the phrases spoken on the FOMC press convention are more likely to be much more necessary, in addition to the forecasts of up to date financial projections.

For the primary time since September, the market will see an up to date dot plot, a particularly necessary piece of knowledge, as NewsBTC reported.

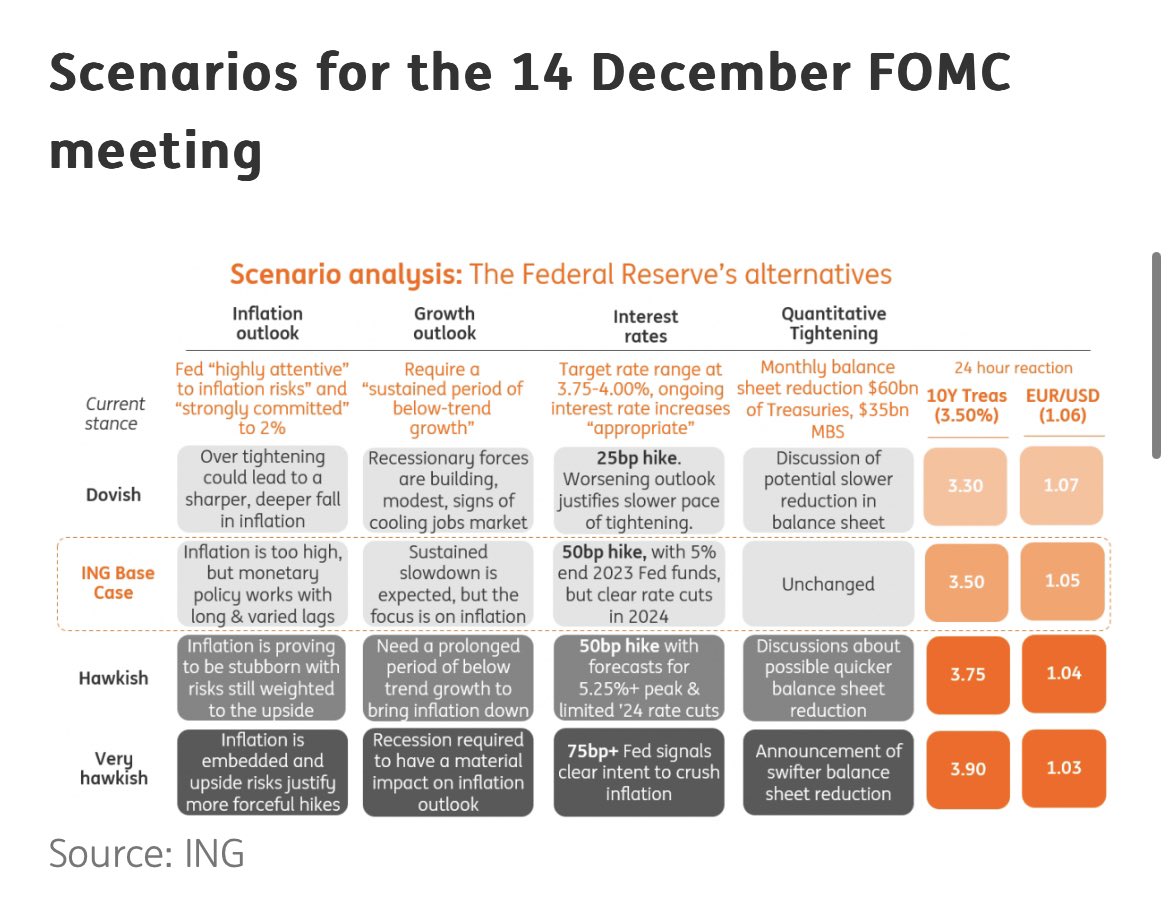

Banking big ING, in the meantime, laid out some potential eventualities that would put the market in risk-off or on mode. ING’s base case is that the Federal Reserve will hike charges by 50 bps, with 5% finish 2023.

Because the financial coverage works with lengthy & diverse lags, ING expects a slowdown in future fee hikes, and clear cuts in 2024. This state of affairs might present the bulls with the powder they should begin a rally.

At press time, the Bitcoin value dropped to $16,920 in Monday morning buying and selling in Asia.