Key Takeaways

- Exchanges balances are decrease by almost 200,000 bitcoins in comparison with pre-FTX, as clients have misplaced all belief in exchanges

- This trumps the Celsius insolvency of June, the place 128,000 bitcoins have been pulled from exchanges within the month following Celsius’ demise

- Terra collapsed in Might, however seeing because it was a DeFi protocol, belief in centralised entities had not but damaged at that time

- Solely time will inform how dangerous the contagion from the FTX chapter is

Belief in cryptocurrency exchanges is at an all-time low. It’s not tough to determine why, because the collapse of FTX has despatched shockwaves by means of the business. As of lower than a month in the past, FTX was thought of among the many most secure exchanges on the market.

Clients pull bitcoins from FTX

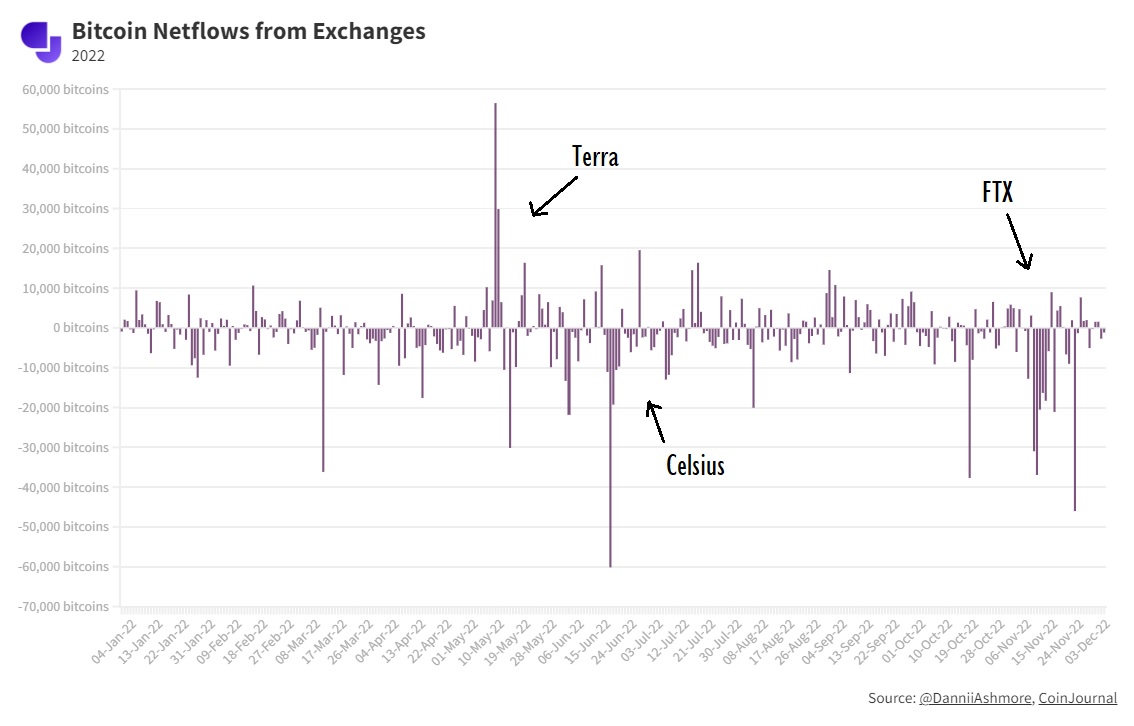

The numbers again this up. We at CoinJournal.web seemed on-chain, the place we have now seen Bitcoin circulate out of exchanges at unprecedented pace within the aftermath of the FTX chapter.

Within the 27 days because the FTX story began to interrupt, a web determine of almost 200,000 bitcoins has been pulled from exchanges. It seems hundreds of Bitcoin holders are operating for the hills with their Bitcoin, pulling to the security of chilly storage.

“FTX was tier-1 royalty when it got here to exchanges. Its collapse has spooked buyers, because it ought to. The transparency of exchanges is extremely low, and the truth is that it’s nearly unimaginable to know what’s going on behind the scenes. The motion of Bitcoin off these exchanges exhibits that clients are realising this”, stated Max Coupland, director of CoinJournal.

Sadly, the FTX scandal is way from the one one which has rocked crypto this yr. So, how does the response of consumers differ this time spherical?

Celsius introduced comparable panic

When Celsius despatched an e-mail out to clients on Sunday, twelfth June, 2022 that it was suspending withdrawals on its platform, it was a dagger to the guts of any buyers who held belongings on the platform.

Whereas these belongings have been clearly inaccessible, clients quickly panicked that funds held on different lending platforms may quickly come below menace, as contagion continued to ripple by means of the business.

The important thing distinction right here was that exchanges weren’t below strain. Nonetheless, clients nonetheless panicked, because the graph beneath exhibits. Exchanges balances have been decreased by 128,000 bitcoins over the subsequent month, with over 100,000 flowing out in a 5-day interval quickly after Celsius have been declared bancrupt.

Terra demise spiral was totally different

The third stunning variable to rock crypto markets this yr was the Terra demise spiral in Might. The truth is, this was the place the whole lot began. Celsius fell to the following contagion (one thing I used to be caught up in too) – alongside Three Arrows Capital,Voyager Digital and a complete load of different companies.

Notably, this was additionally when buying and selling agency Alameda Analysis suffered massive losses which led to Bankman-Fried allegedly sending buyer deposits from FTX to shore up liquidity on the agency. So in a technique, all of it stemmed from Terra.

However Terra was totally different in that this was not a centralised agency and proved bancrupt. This was a decentralised finance protocol with a flawed mannequin. The response from clients was due to this fact vastly totally different.

We are able to see this by trying on the circulate of Bitcoins to and from exchanges within the beneath chart.

Be aware that the primary few days present a large inflow of Bitcoins to exchanges. This was the warchest that the Luna Basis Guard held, despatched to exchanges to be redeemed as Terra desperately floundered to defend the peg.

After that, the exercise is sort of regular, with no discernible sample between bitcoins flowing to and from exchanges.

2022 Abstract

Belief in exchanges has not been this low because the Mt Gox collapse of 2014. However in trying by means of the whole yr of change exercise, it’s clear that two incidents cratered this belief greater than every other: Celsius and FTX.

Relating to the longer term, solely time will inform how badly crypto’s status has been dented within the long-term.

When you use our knowledge, then we might respect a hyperlink again to https://coinjournal.web. Crediting our work with a hyperlink helps us to maintain offering you with knowledge evaluation analysis.

Analysis Methodology

Knowledge taken from on-chain. Wallets correspond to identified public change wallets.