The capital portfolio of the fallen quantitative cryptocurrency buying and selling agency Alameda Capital was lately launched by Monetary Occasions, revealing some attention-grabbing investments.

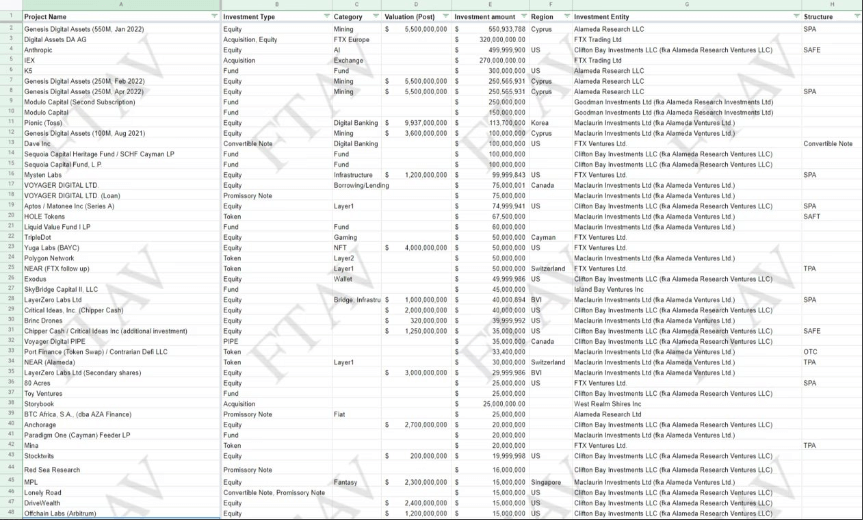

In response to the spreadsheet, there are almost 500 illiquid investments unfold throughout ten holding corporations within the portfolio of FTX/Alameda value $5.4 billion.

Two of essentially the most important investments had been cryptocurrency mining agency Genesis Digital’s $1.15 billion funding and Open AI based Anthropic’s $500 million funding. Crypto influencer Wu Blockchain thinks the investments had been “ridiculous. “

The 2 largest investments, the $1.15 billion funding in Genesis Digital, a cryptocurrency mining firm, and the $500 million funding in Anthropic, based by OpenAI staff, are ridiculous.

— Wu Blockchain (@WuBlockchain) December 6, 2022

Investments in Sequoia and Skybridge

A $200 million funding in Sequoia, the enterprise capital agency that wrote down its FTX stake to zero earlier, can also be included among the many fallen buying and selling agency’s holdings.

Additional, the Alameda doc lists an funding of $45 million in Anthony Scaramucci’s SkyBridge Capital. Per the spreadsheet, FTX transferred 30% of its stake in SkyBridge to Alameda to guard buyers’ belongings. Later, its founder Anthony Scaramucci revealed that SkyBridge had misplaced cash on its holdings of FTX’s FTT tokens.

Moreover, the portfolio revealed the most important token investments within the type of HOLE – $67.5 million, Polygon – $50 million, NEAR (FTX) – $50 million, Port Finance – $33.5 million, and NEAR (Alameda) – $30 million.

Final month, FTX introduced submitting for Chapter 11 chapter together with its sister entity Alameda Analysis and roughly 130 different corporations associated to FTX.

Nevertheless, an evaluation by Arkham Intelligence on Nov. 25 revealed that Alameda Analysis withdrew over $200 million from FTX.US earlier than the corporate declared chapter. As well as, Arkham disclosed in a Twitter thread that Alameda Analysis, FTX’s sister firm, had collected $204 million from FTX US within the last days earlier than the collapse of varied crypto belongings.