Aptos crypto is surging amid APT value progress, however the Community is spending aggressively on monetary incentives. Will this be sustainable for APT crypto in 2025?

If you’re new to crypto, there are a number of choices to make use of or launch from. Solana and Ethereum are for these looking for exercise, and Algorand and Cardano are for decentralization followers.

These eager on efficiency can go for Aptos. It is likely one of the few blockchains that helps parallel transaction execution with out sacrificing decentralization and safety.

Constructed utilizing Transfer, a programming language, Aptos has a thriving ecosystem and has drawn exercise and customers since launching.

'@Aptos $APT is displaying robust progress:

– 3M day by day transactions

– 15M month-to-month energetic addresses

– Over $1B Complete Worth Locked (TVL)

– 180 weekly energetic builders pic.twitter.com/ZXSZ6EePXL— Immortal

(@BitImmortal) November 25, 2024

Whereas Aptos has made important strides over time, it seems that it’s spending an excessive amount of on incentives to draw exercise and safe the community.

Aptos Crypto Spent $494 Million As Incentivizes In 2024

Taking to X, one analyst notes that Aptos spent a whopping $494 million in 2024 alone, solely to generate simply $1.38 million as income from gasoline charges.

This interprets to a price of $358 spent for each $1 payment earned, a stark and worrying distinction to the financial effectivity of different blockchain networks.

Understandably, new platforms like Aptos should lay our a fortune to stop “chilly begin” issues. Aptos can appeal to builders, initiatives, and validators by dangling monetary incentives.

The extra customers there are, the extra transaction charges are earned. Moreover, extra validators result in a safer platform, and elevated customers accelerates adoption.

Nevertheless, for traders who poured billions into guaranteeing Aptos operates in accordance with their whitepaper, it is just pure to ask: How did the crew spend $494 million?

Understanding the operational framework of Aptos is important to reply this query.

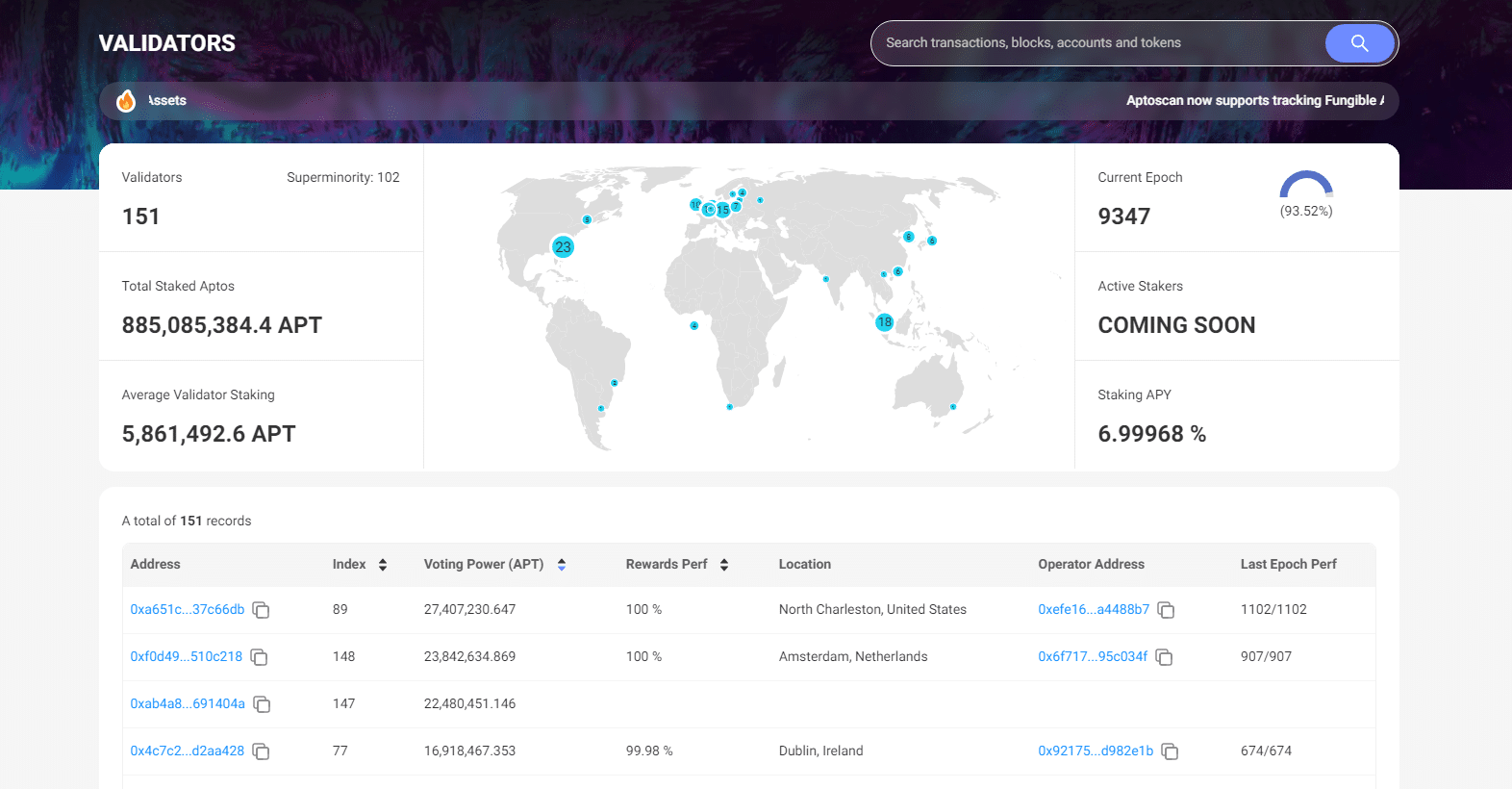

Since Aptos crypto depends on validators for transaction processing and decentralization, the crew spent $3.27 million per validator distributed among the many 151 nodes.

(Supply)

This incentive is critical and important. Validators, as talked about, are crucial for transaction validation, block creation, and total community safety.

With $3.27 million spent by every validator, it’s clear that Aptos is spending a premium to make sure every node is useful and dependable, all whereas guaranteeing the community is sufficiently decentralized.

Whereas enticing for supported validators, will this mannequin be sustainable? Will Aptos ultimately transit in order that validators are sufficiently compensated from gasoline charges as major income in the long term?

DON’T MISS: Finest New Cryptocurrencies to Spend money on 2024

Evaluating Aptos Crypto with Avalanche, Ethereum, and Avalanche

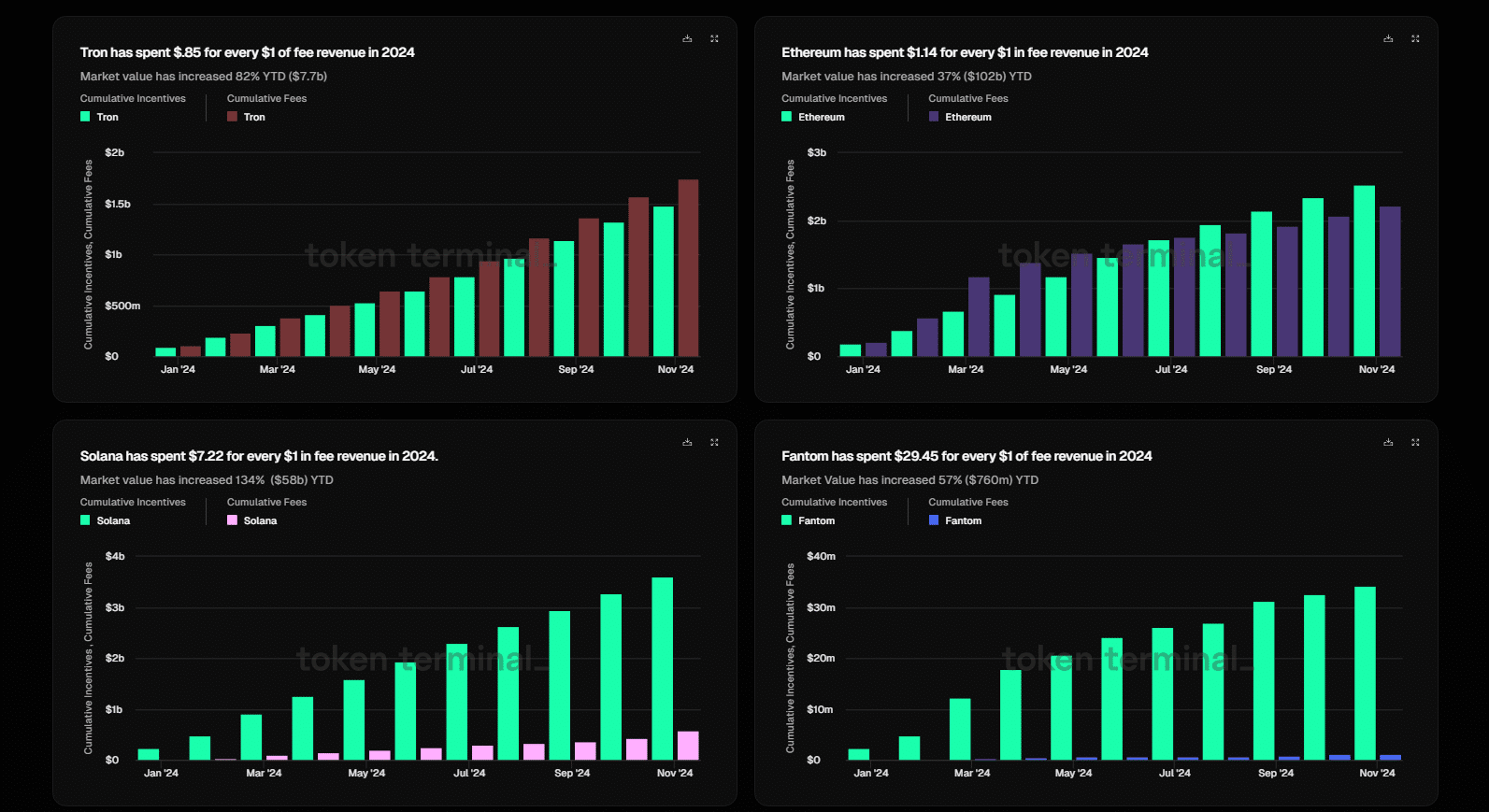

Contemplating how different public ledgers carry out, the $358 spent for each $1 community payment generated is excessive.

The ultra-low charges and comparatively low community exercise might be responsible, however the incentive payment is astronomical.

For each $1 of community charges generated, Solana, a contemporary and extremely scalable platform, spent $7.22.

One other comparatively new community, Avalanche, spent $63 for each $1 payment generated. Although excessive, that is nonetheless way more environment friendly than Aptos spends on validators.

(Supply)

In the meantime, Ethereum, contemplating its comparatively excessive gasoline charges on the mainnet and an internet of layer-2s, spent $1.14 for each $1 of charges.

Going ahead, will probably be fascinating to look at how Aptos evolve.

The analyst noticed that Ethereum, Avalanche, and Solana printed historic peaks within the final bull cycle, reaching $4,900, $144, and $260, respectively.

Though APT costs are recovering after plunging to as little as $3 on December 22, they’ve but to retest their all-time highs of round $20, which had been printed in early 2023.

(APTUSDT)

As APT costs rise, the greenback worth for charges generated will improve, justifying the $3.27 million spent on every validator.

On the identical time, with APT at contemporary all-time highs above $20, it’s seemingly that extra customers will select Aptos, pushing exercise to new ranges.

EXPLORE: BONK Flips WIF Targets DOGE Crown: Some Merchants Are Now Storing Income In BONK Somewhat Than SOL

Be part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The submit Aptos Spent $494 Million On Incentives: Is This Sustainable? Income Is Worryingly Low appeared first on .