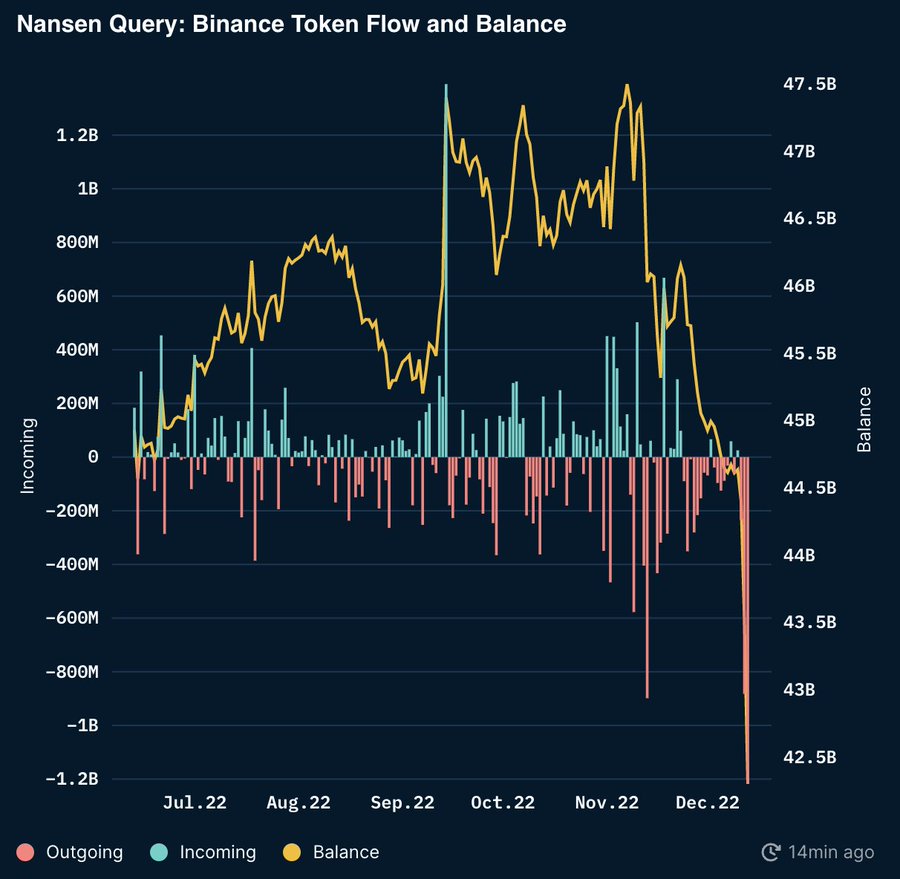

Binance recorded over $2 billion in outflows in Ethereum-based tokens since Dec. 12 –its highest day by day withdrawal since June– based on Nansen information.

When Binance customers’ withdrew belongings this aggressively in June, the crypto market was reeling from Terra Luna’s collapse.

A separate tweet from the blockchain intelligence platform reported that the alternate recorded over $2.5 billion in withdrawals within the final 24 hours and has a destructive netflow of $1.57 billion. The alternate had an influx of round $935 million throughout this era.

In the meantime, Binance has processed $6.6 billion in withdrawals on the seven days metrics. It noticed $4.6 billion in inflows and has a destructive netflow of $1.9 billion. Nansen famous that this was nonetheless lower than the destructive $2.3 billion weekly netflow Binance processed following the FTX collapse.

Market makers withdraw funds

Andrew Thurman reported that two market makers, Leap Buying and selling and Wintermute, had been among the many accounts that withdrew funds within the final 24 hours. Thurman stated Leap withdrew over $146 million prior to now week and redeemed $245 million BUSD over the previous month.

Alternatively, Wintermute withdrew almost $10 million. Lookonchain reported that the market maker later despatched $149.85M USDC to Binance –the final time it transferred to the alternate was 20 days in the past.

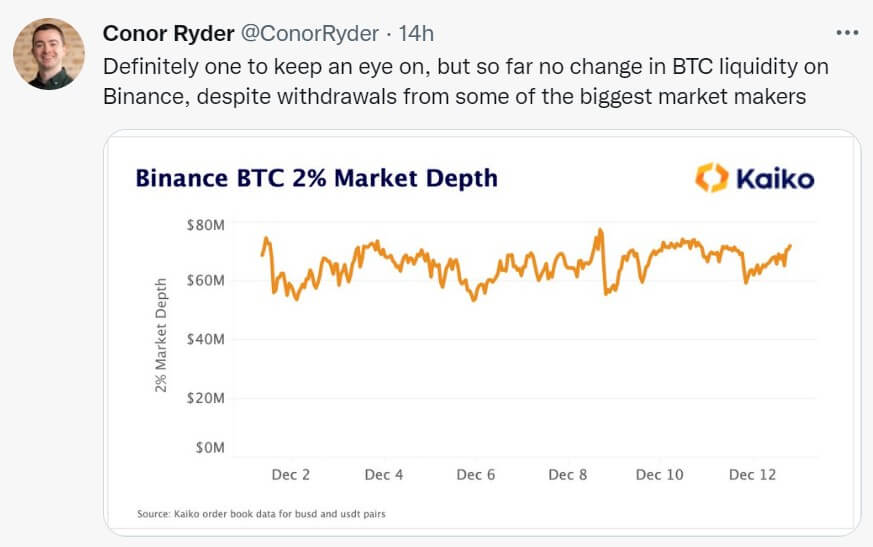

In the meantime, regardless of these withdrawals Conor Ryder, citing Kaiko information, stated there was no change in Bitcoin liquidity on Binance.

Binance’s Nansen dashboard confirmed that its belongings are price $62.6 billion, with the bulk in BUSD, Ethereum, Bitcoin, and Tether.