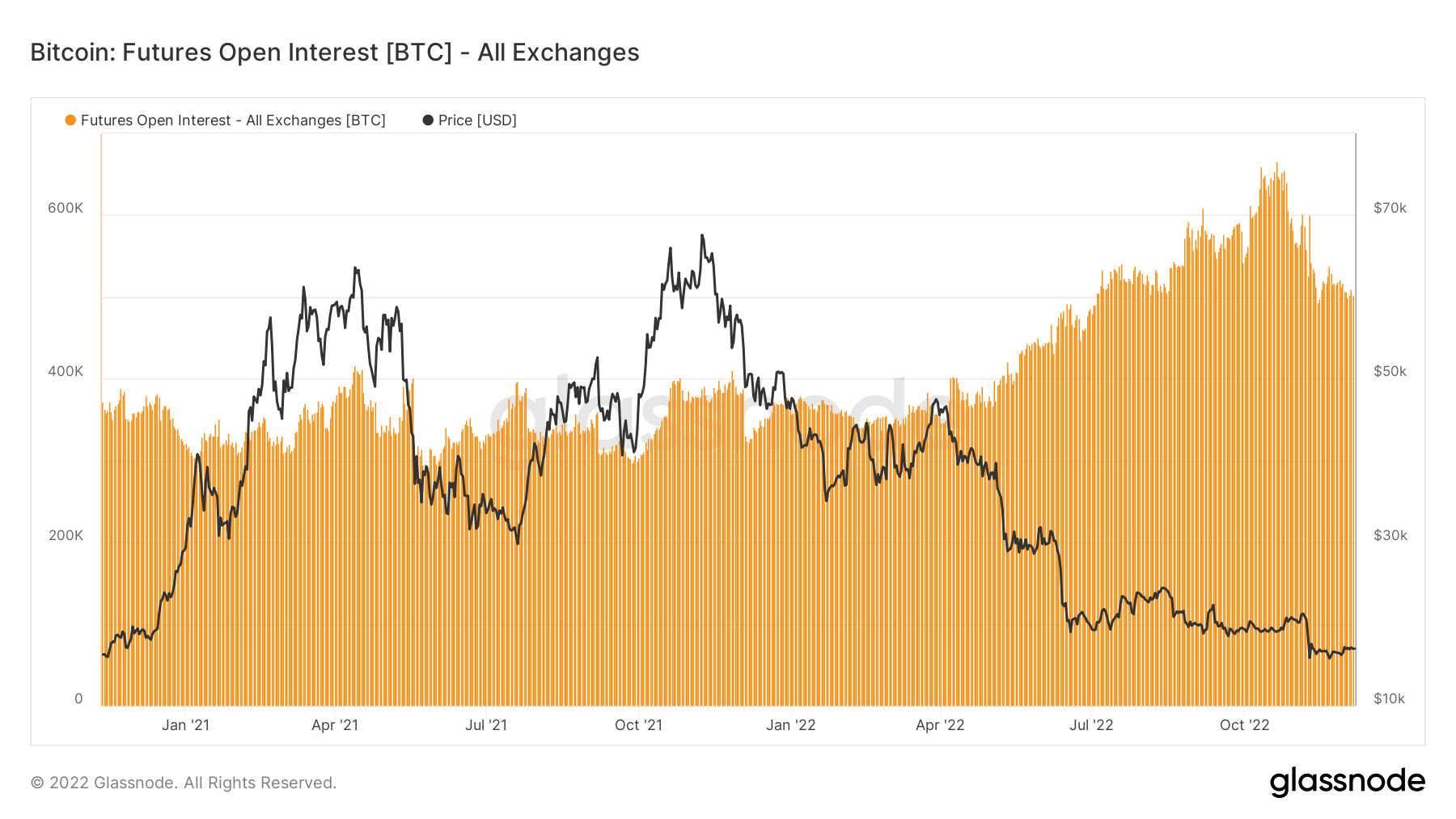

Bitcoin and Ethereum derivatives exhibits that they’ve been affected by the FTX fallout, with information analyzed by CryptoSlate exhibiting that over 160,000 BTC has been unwound for the reason that starting of October.

This information signifies that roughly $3 billion price of futures contracts have been closed out in two months.

Cryptocurrency derivatives are an essential indicator of the general well being of the market. In addition they function a pointer as to the place costs would possibly head subsequent, as they present the quantity of leverage the market is sitting on.

The open curiosity on Bitcoin futures exhibits a pointy decline within the quantity of funds allotted to open futures contracts, which is now again to ranges recorded in July 2022.

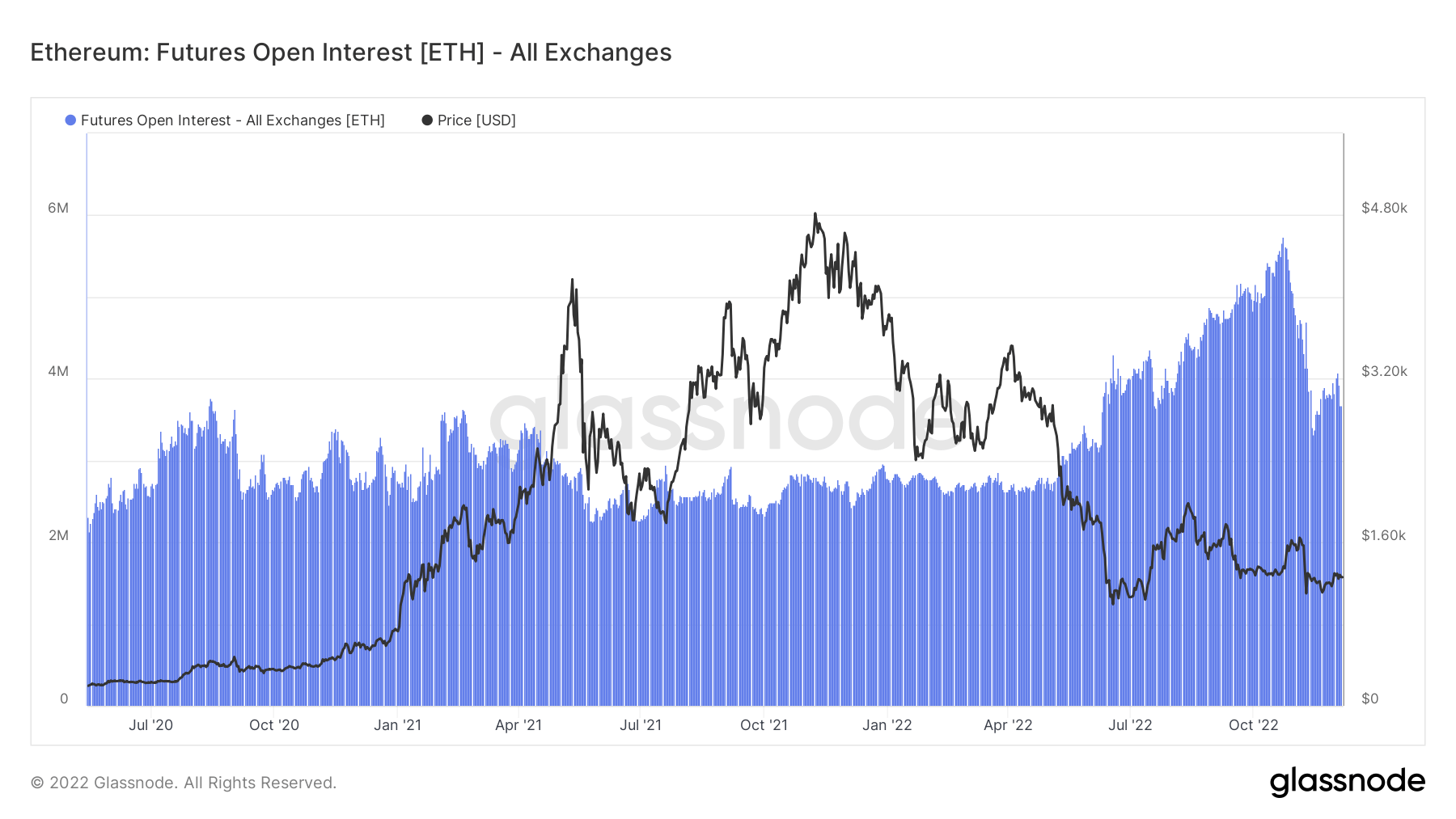

The same pattern can be current in Ethereum derivatives. Round 2 million ETH has been unwound since October, with the open curiosity on Ethereum futures now again to early 2022 ranges.

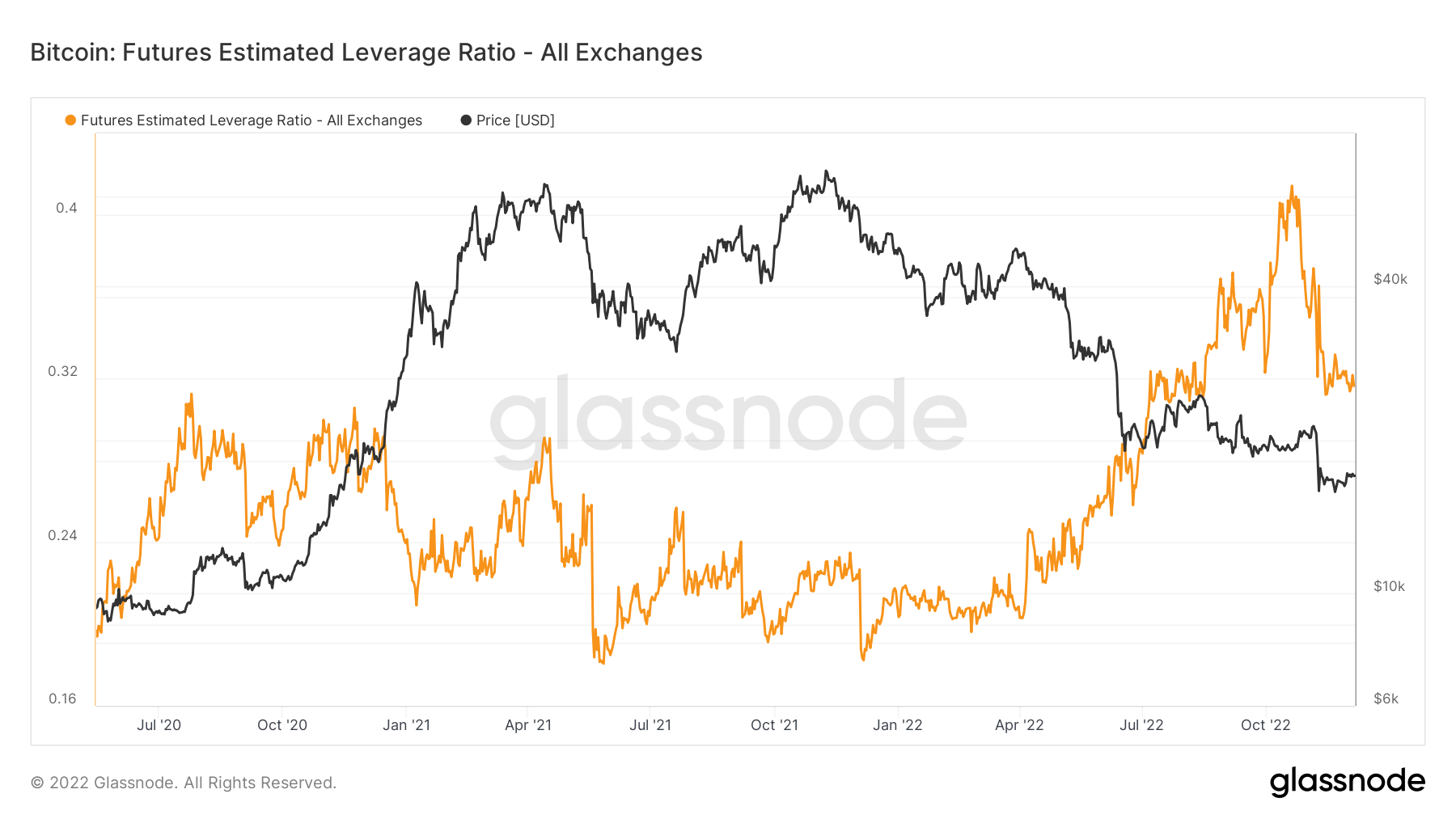

Except for open curiosity in futures contracts, one other approach of estimating the quantity of leverage out there is by trying on the Estimated Leverage Ratio (ELR). The Estimated Leverage Ratio is the ratio of open curiosity in futures contracts divided by the reserves of corresponding exchanges. It exhibits how a lot leverage there’s on exchanges and can be utilized to measure merchants’ sentiment. A excessive ELR signifies an overleveraged market and incoming volatility. A low ELR, however, exhibits a deleveraged market and signifies stability.

When the ELR begins lowering, it exhibits that extra traders are starting to take off leverage danger and shut their positions. And whereas an rising ELR would possibly present confidence in leveraged positions, it normally signifies that the market is ripe with high-leverage danger.

In October 2022, ELR peaked at 0.41 when Bitcoin’s value hovered round $19,000. Since then, the ratio decreased considerably and at present stands at 0.32. This lower exhibits {that a} important variety of derivatives positions have been unwound in simply two months, bringing a sure diploma of stability to the market.

However, ELR nonetheless stays elevated when in comparison with final 12 months. If the ratio begins rising or stays on a sideways trajectory, extra leverage will proceed to unwind.

And whereas this might threaten Bitcoin’s value, diving deeper into its derivatives exhibits some hope for stability.

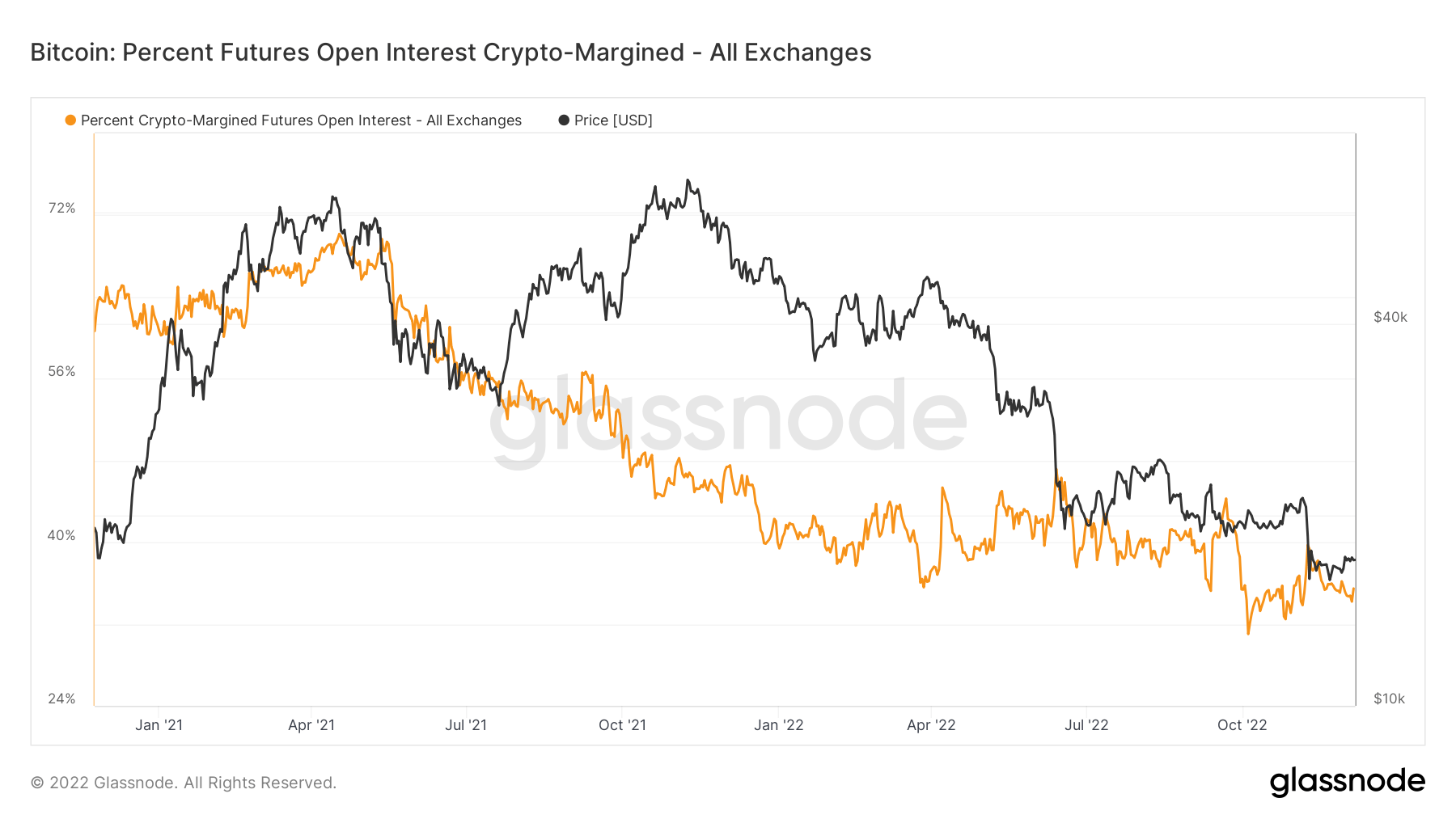

The proportion of open curiosity margined in Bitcoin is far smaller than the open curiosity margined in USD and USD-pegged stablecoins. Round 35% of open curiosity is crypto-margined, down from round 41% firstly of the 12 months.

A lowering share of crypto-margined open curiosity exhibits traders are taking much less danger with their Bitcoin. The unwinding that’s at present happening will in the end have a optimistic impact in the marketplace. Flushing out leveraged positions will trigger short-term volatility however result in a more healthy market in the long run, making a stable basis for future accumulation.