That is an opinion editorial by Zack Voell, a bitcoin mining and markets researcher.

Bitcoin miners typically endure the brunt of bear market woes because of a few of the business’s highest capital expenditures, smallest margins and most unreliable infrastructure. Though the present bearish part has been one in all Bitcoin’s shallowest drawdowns, miners have suffered greater than ever.

Layoffs, bankruptcies, lawsuits and different adverse press have battered one in all Bitcoin’s most distinguished sectors. However each bear market ultimately finds a backside — the ache climaxes and issues slowly start to recuperate. Quite a lot of information recommend mining has reached this level of its market cycle, which may provide a little bit of optimism going into the brand new yr.

This text just isn’t meant to supply monetary or funding recommendation of any type. Quite the opposite, its meant function is data-driven evaluation of the present state of the bitcoin mining sector in context of some exogenous and endogenous influences that might form its near-term future.

Understanding Capitulation

Earlier than diving into the information, it would assist to grasp what “capitulation” is. The time period is usually utilized in monetary markets to reference an acute and sometimes dramatic crescendo of worry or widespread give up by buyers or companies throughout the throes of depressed market circumstances. Principally, everybody says, “It’s over. We will’t take this anymore.” For mining, capitulation principally means the economics turned so dangerous and working margins are so skinny that miners selected to stop or just can not function anymore and are squeezed out of the market.

Wall Road Analysts Flip Bearish

One of many hallmark indicators of miner capitulation (on this creator’s opinion) on the present stage of the continuing bear market is the complete pivot from monetary analysts who report on publicly-traded mining firms. For the previous 12 months, these analysts have preached concerning the upside potential of bitcoin mining shares. However now they’re “pulling the plug.” This language was utilized by Chris Brendler of DA Davidson to explain his outlook on the mining sector. Since July, Brendler has stated that the present market circumstances have been time to purchase mining shares, as reported by CoinDesk.

In December 2021, JPMorgan’s analyst Reginald Smith additionally wrote a memo that stated one explicit mining firm — Iris Power — has “greater than 100% upside.” He additionally prompt the present inventory value was at a “deep low cost.” Shares of the corporate have been buying and selling round $14 on the time of the memo. No they’re buying and selling beneath $2… an excellent deeper low cost!

If Wall Road giving up on mining isn’t capitulation, then what’s?

Bitcoin Hash Charge Begins Dropping

For the whole thing of the bear market so far, the Bitcoin hash fee has steadily grown bigger, forcing problem improve after improve on struggling miners. However that pattern could be altering. In early December, the following adjustment is ready to drop by almost 11% on the time of writing. This drop shall be brought on by hash fee falling, which is notably off its current all-time highs and at present sitting close to 240 exahashes per second (EH/s).

Usually a dip in hash fee and problem wouldn’t be too important. However seven of the previous 9 problem changes have been optimistic. And in context of the incessant hash fee progress and subsequent hash value collapse, the obvious pattern reversal for hash fee is notable. Some miners seem like throwing within the metaphorical towel and taking their machines offline. Discussing the hash fee and problem on Twitter in context of whether or not miners have been capitulating, Foundry Senior Vice President Kevin Zhang merely replied, “Sure.”

Bitcoin Miners Are Re-Accumulating

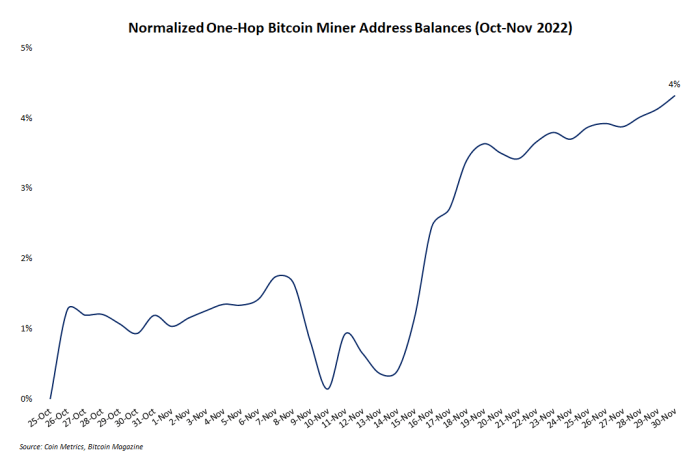

Producing worry, uncertainty and doubt (FUD) round on-chain actions of bitcoin from miner addresses is a well-liked pastime for Twitter influencers. And observing miner balances may be useful. Present information reveals notably bigger balances in comparison with only a month in the past. In brief, internet promoting exercise by miners seems to have subsided and their stockpiles of bitcoin are on the rise once more.

Bitcoin mining deal with balances have seen small reductions over the previous yr. However the line chart beneath reveals information that point out a pattern reversal is starting. One-hop miner balances have elevated by over 3%, or roughly 85,000 BTC since early October. Maybe miners determined it’s time to HODL once more.

Miner Outflows Spiked And Fell

One different piece of on-chain information that fuels mining FUD is outflows — the exercise of miner addresses shifting cash from these addresses to another location. In mid-November, these outflows spiked to their highest degree since June, which may point out that worry and panic out there has affected not less than a couple of miners. Not surprisingly, the spike in outflows occurred similtaneously the collapse of FTX and its subsequent fallout have been making headlines.

It ought to be famous that any inferences from on-chain information like outflows are knowledgeable guesstimates at finest. Bitcoin community information is a great tool for contextualizing sure market occasions, however it’s removed from infallible or un-manipulatable. However miners are notoriously dangerous at timing markets, and the timing of this sudden spike in coin actions may fairly recommend some panicking miners. Within the following week, nevertheless, outflows fell again to regular ranges and have remained there as of the time of this writing.

Did miners panic close to the market backside? Very presumably.

Bitcoin Mining In 2023

Assuming the above evaluation is appropriate and capitulation has occurred, the market is not going to instantly recuperate. Because the mud settles and survivors emerge, the method of constructing and scaling extra mining infrastructure shall be as sluggish, costly and tedious as ever. Winners are constructed within the bear market, and after a few of the largest mining firms have bought bitcoin balances down to just about zero and even bought important quantities of mining {hardware} in determined makes an attempt to remain operational, all that’s left is survival or chapter.

After all, issues may all the time worsen in a single day. However this text suggests the weak and panicked have been squeezed out, and the time for restoration is right here. Now’s the time to be optimistic, not bearish.

This can be a visitor put up by Zack Voell. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.