Center East-based Bitcoin (BTC) miner Phoenix Group turned the primary crypto-related agency to go public on the Abu Dhabi Securities Change (ADX) at present, Dec. 5, in response to a submit on social media platform X (previously Twitter).

The miner was initially scheduled to go public on Dec. 4 however shifted its debut to at present after the authorities marked the final three days as public holidays.

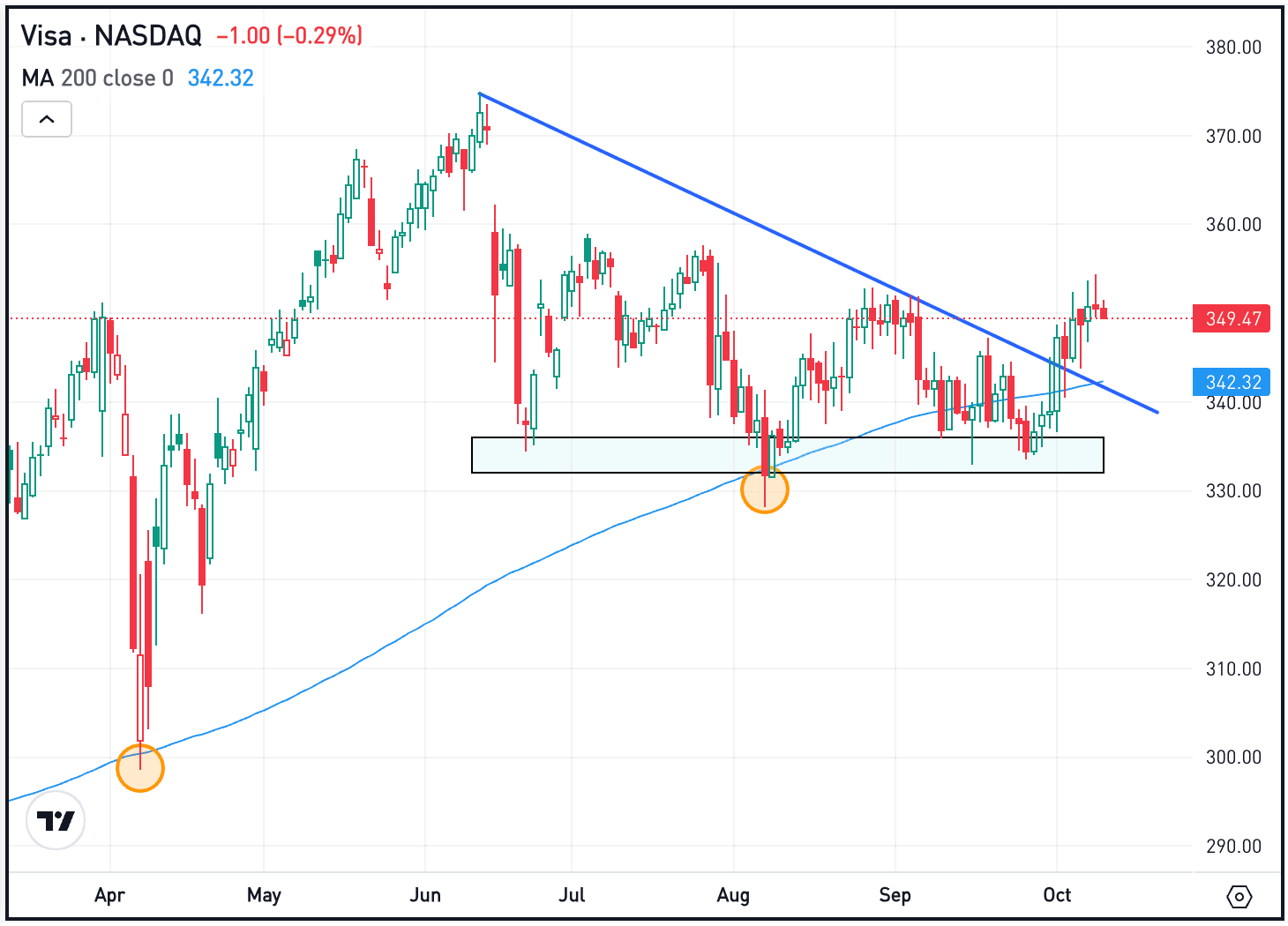

Nonetheless, the delay seems to not have impacted its inventory efficiency, as its value surged over 50% from the preliminary value of 1.50 AED (dirhams), equal to $0.41, to as excessive as 2.25 AED ($0.6) earlier than mildly retracing to 2.03 AED as of press time, in response to information on ADX web site.

This sturdy debut efficiency might be linked to the excessive curiosity and a spotlight Phoenix has generated since its preliminary public providing (IPO) raised $370 million in November. On the time, the agency defined that the IPO’s success surpassed preliminary expectations, elevating 33 occasions greater than the projected quantity. The miner mentioned its post-IPO valuation was estimated at roughly $2.47 billion.

Moreover, the Phoenix Group highlighted its strategic initiatives, notably a three way partnership with the Abu Dhabi authorities, as a convergence of public coverage and personal sector innovation. The agency additionally emphasised its dedication to environmental sustainability by outlining plans to create Abu Dhabi’s largest hydropower mining farm.

Established in 2015, Phoenix Group has solidified its standing as a significant BTC miner within the Center East, exemplified by an settlement to determine a $300 million crypto-mining farm in Oman. Notably, the agency has a 725MW international mining operation spanning internet hosting and mining companies throughout the U.S., Canada, Europe, and the Center East.

What’s driving curiosity in PHX?

The success of PHX’s IPO underscores rising investor curiosity in Bitcoin. Whereas institutional buyers have historically steered away from direct Bitcoin investments, they’ve not directly embraced publicity by investing in Bitcoin mining corporations’ shares.

In October, Worldwide Tech Group, a subsidiary of the biggest conglomerate in Abu Dhabi, Worldwide Holding Firm, acquired a big 10% stake in Phoenix, additional accentuating its attractiveness available in the market.

Past Bitcoin enthusiasm, components equivalent to hovering oil costs and governmental privatization initiatives have bolstered IPO actions throughout the area. Furthermore, the UAE’s supportive regulatory panorama has inspired extra crypto companies to determine a presence there.