Decentralized Web3 infrastructure supplier Ankr has develop into the most recent sufferer of a hacking assault concentrating on the defi area. The perpetrators who hit the platform have been in a position to mint and steal an enormous quantity of tokens in a multimillion-dollar exploit.

Defi Protocol Ankr Hit by Limitless Mint Bug Exploit Price Tens of millions

Ankr, a decentralized finance (defi) protocol primarily based on Binance’s BNB Chain, has been exploited by a hacker who apparently used a vast minting bug. On-chain analysts broke the information on social media and the assault, which occurred on Dec. 1, was confirmed by Ankr.

On Friday, the Web3 infrastructure supplier admitted on Twitter that its aBNB token had been exploited and introduced it’s working with exchanges to droop buying and selling. In a follow-up tweet, it additionally insisted that each one underlying property on Ankr Staking are protected and infrastructure companies unaffected.

Our aBNB token has been exploited, and we’re at the moment working with exchanges to right away halt buying and selling.

— Ankr (@ankr) December 2, 2022

Preliminary studies by blockchain safety firm Peckshield revealed the unknown attacker had been in a position to mint and dispose of roughly 10 trillion aBNB. It additionally discovered that a few of the stolen funds had been transferred to the Twister Money mixer. A portion was bridged via Celer and Debridgegate to ethereum.

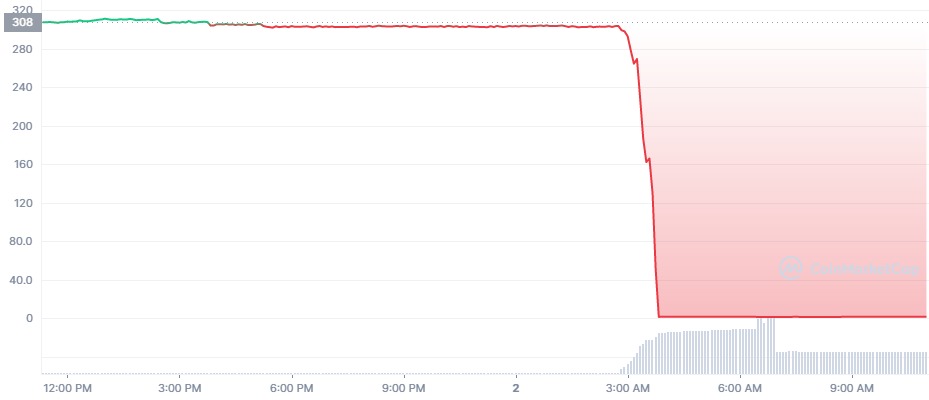

On-chain evaluation agency Lookonchain mentioned the exploiter minted 20 trillion tokens and dumped them on Pancakeswap, acquiring not less than $5 million within the stablecoin USDC. The value of the Ankr reward-bearing staked BNB (aBNBc) has since collapsed from over $300 to a bit over $1.50, on the time of writing.

Peckshield defined {that a} sensible contract for the aBNBc token had a vast mint bug which the hacker took benefit of. One other report instructed the attacker had managed to achieve entry to the Ankr deployer key.

Binance Freezes $3 Million Price Of Moved Funds

BNB Chain confirmed it was conscious of the assault and has blacklisted the exploiter. Binance founder and CEO Changpeng Zhao tweeted {that a} developer personal key was hacked and the hacker used it to replace the sensible contract. The alternate has frozen about $3 million of funds moved to its platform.

Attainable hacks on Ankr and Hay. Preliminary evaluation is developer personal key was hacked, and the hacker up to date the sensible contract to a extra malicious one. Binance paused withdrawals a couple of hrs in the past. Additionally froze about $3m that hackers transfer to our CEX.

— CZ 🔶 Binance (@cz_binance) December 2, 2022

In the meantime, the BNB Chain-based destablecoin hay, that CZ referred to in his tweet, has misplaced its $1 peg, additionally because of an obvious exploit which was confirmed by the crew of Helio Protocol. The token is at the moment buying and selling at a bit over $0.65.

The assaults are available a yr of quite a few safety exploits concentrating on defi and crypto platforms. In response to blockchain forensics agency Chainalysis, the ensuing losses in 2022 quantity to $3 billion. In early October, BNB Chain was quickly paused following a hack that value near $600 million.

What are your ideas on the most recent exploit within the defi area? Share them within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.