Be part of Our Telegram channel to remain updated on breaking information protection

Binance Coin (BNB) was the one prime 10-ranked crypto main worth drops on Tuesday as traders struggled to shake off Binance “FUD” that has been operating out there over the previous few days. The market can also be ready for inflation knowledge and the final United State Federal Reserve assembly of the yr 2022 is scheduled for later this week.

Binance Coin worth is buying and selling just under $270, down 5.48% on the day, in keeping with knowledge from CoinMarketCap. BNB is buying and selling in a 3rd straight bearish session having misplaced 9% since Sunday open. That is accompanied by a buying and selling quantity of $1.6 billion which has elevated by over 180% up to now 24 hours, suggesting elevated investor exercise largely directed towards promoting the coin. Its reside market cap now stands at $42,617,317,465, additionally down 5.48% up to now 24 hours.

Causes Why Binance Coin Might Drop Additional

After oscillating across the 100-day easy shifting common (SMA) on the finish of final week, BNB finally dropped under the shifting common on Sunday. The following sell-off noticed the BNB/USD pair lose the assist on the $280 psychological stage and the 200-day SMA which sat at $278.

The worth sank on the information that Binance, the corporate behind BNB, was reportedly dealing with fees of non-compliance with the U.S. Anti-Cash Laundering (AML) legal guidelines. In line with a Reuters report, the U.S. The Division of Justice (DoJ) was break up on whether or not to cost the world’s largest crypto trade and its Chief Government Officer (CEO), Changepeng Zhao, following 2018 AML investigations.

Including to the headwinds are recent considerations about Binance’s proof-of-reserves (PoR), with a number of questions raised in regards to the trade’s company construction, inner high quality management, and Bitcoin liabilities. In line with accounting and monetary specialists consulted by The Wall Avenue Journal (WSJ), the audit report launched by Mazar did little to spice up investor confidence in Binance’s monetary well being as info on the standard of inner controls and the way the trade liquidates property to cowl margin loans was missing.

One other situation identified by the WSJ’s consultants regards the Zhao-led agency’s company construction. In line with the report, Patrick Hillmann, the buying and selling platform’s chief technique officer was unable to present details about Binance’s father or mother firm, because the agency has been going by way of company reorganization during the last two years.

In line with the PoR report launched by the audit agency Mazars on December 7, Binance controls over 575,742.42 Bitcoin belonging to its prospects, price $9.7 billion on the time of the report. Which means that “Binance was 101% collateralized”, stated the corporate. This discovering was debunked by the WSJ outcomes which highlighted variations between the whole Bitcoin liabilities.

As a substitute, the investigation discovered that the trade was 97% collateralized excluding property lent to customers by way of loans or margin accounts, indicating that the 1:1 ratio of reserves to buyer property was not achieved. They poked holes into Marzars’s report saying:

“We discovered that Binance was 97% collateralized with out considering the Out-Of-Scope Property pledged by prospects as collateral for the In-Scope-Property lent by way of the margin and loans service providing leading to destructive balances on the Buyer Legal responsibility Report. With the inclusion of In-Scope Property lent to prospects by way of margin and loans that are overcollateralized by Out-Of-Scope Property, we discovered that Binance was 101% collateralized.”

This has raised investor considerations which numerous commentators have labeled as FUD aimed toward bringing the crypto big down.

#Binance is getting focused by ridiculous fud led by paid media and fud twitter accounts.

I imagine @SBF_FTX is behind it.

I will be shopping for extra $BNB as these information are simply empty phrases from dangerous actors.#crypto pic.twitter.com/fC1SuHzVNq— Carlo Kenolol ⚡🐳 (@CKenolol) December 13, 2022

BNB worth can also be set to drop additional as merchants are nonetheless afraid of the upcoming macro knowledge and authorized occasions tied to the FTX/SBF/Alameda fiasco. The November Shopper Value Index (CPI) knowledge due on December 13 is predicted to be a pivotal second for cryptocurrencies with the potential for important upside and draw back hinging on the numbers. Economists extensively count on the Fed to lift rates of interest by 50 foundation factors when its two-day assembly concludes Wednesday.

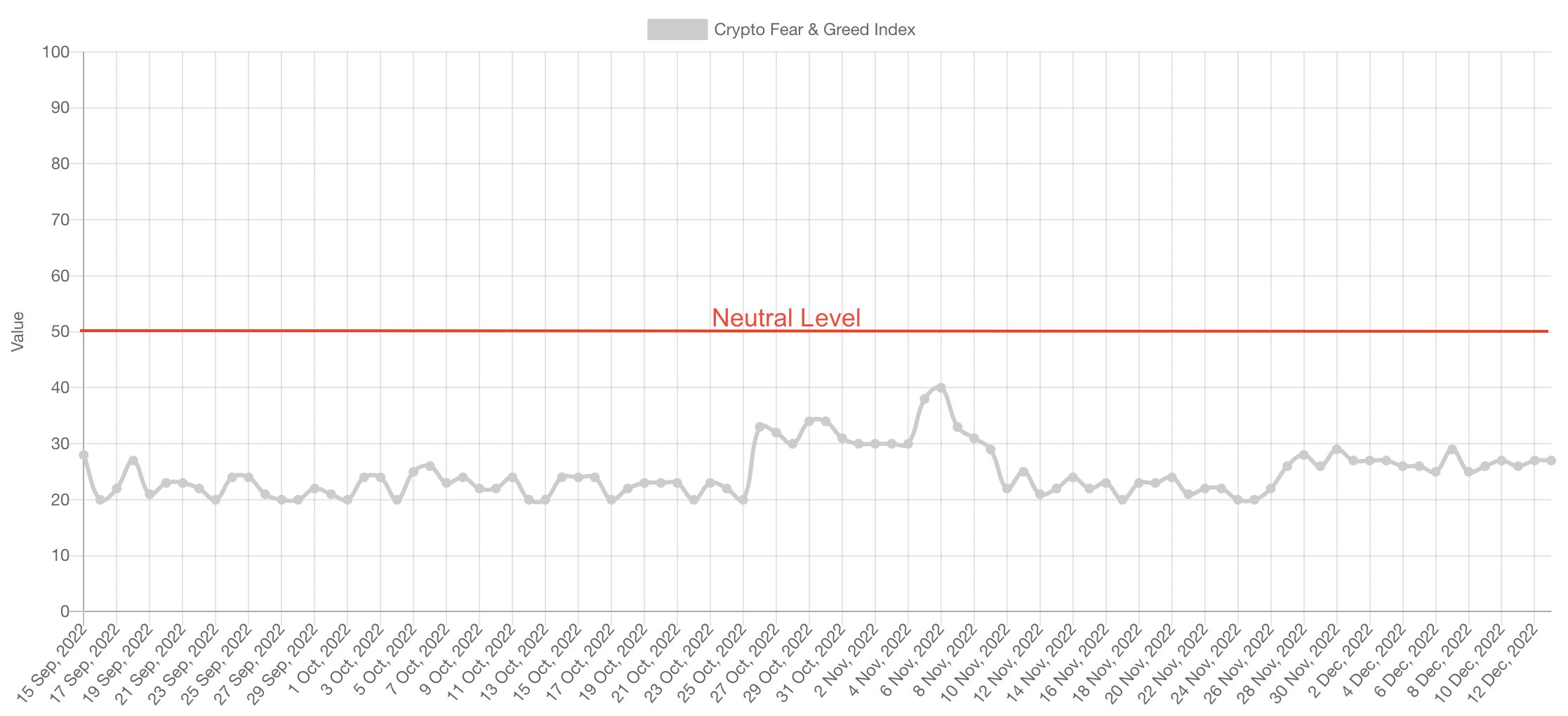

The crypto market sentiment remained weak in keeping with the Crypto Worry & Greed Index, which at the moment stands at 27 on the day – nonetheless under the impartial zone.

Crypto Worry And Greed Chart

Binance Value Bears Eye A Revisit Of $240

At press time, BNB worth traded under a descending parallel channel, including to bearish sentiments for the trade token. The Relative Energy Index (RSI) was dealing with downward and the worth power at 39 bolstered the sellers’ grip on BNB. The Transferring common convergence Divergence (MACD) indicator was additionally shifting downward away from the zero line, suggesting that the worth motion favored the draw back.

As such, if the present sell-off continues, Binance Coin worth might drop farther from the present ranges to revisit Tuesday’s swing-low at $255. In extremely bearish circumstances, the Binance Coin might decline additional to hunt solace from the $250 psychological stage or drop decrease to tag the November 23 swing low round $240. Such a transfer would symbolize a ten% descent from the present worth.

BNB/USD Each day Chart

On the upside, the BNB worth was required to shut the day above the rapid resistance at $275, embraced by the decrease boundary of the descending channel. If this occurs, the Binance Coin worth bulls shall be bolstered to push the worth increased reclaiming key assist ranges such because the 200-day SMA at the moment sitting at $277, the center boundary of the channel at $281, the 100-day SMA at 286 and the higher boundary at $287.

Overcoming this cussed provide zone may clear the way in which for a run-up to the 50-day SMA at $295 or increased towards the $310 vary excessive. This might deliver the whole positive factors to fifteen%.

New Tokens With Promising Returns As 2022 Ends

With the larger crypto market nonetheless struggling to recuperate from the FTX catastrophe and the uncertainties across the macro surroundings, it might be an excellent time to discover shopping for at decrease costs different altcoins that haven’t pumped not too long ago or investing in lower-cap tasks in presale.

There are a variety of tasks which have already raised a major quantity of capital of their presales and are poised for future progress. Sprint 2 Commerce (D2T) and Calvaria (RIA) are a number of the new tokens at the moment in presale promising returns as soon as they’re listed on exchanges within the close to future.

Sprint 2 Commerce (D2T)

Sprint 2 Commerce is a decentralized trade (DEX) constructed on the Ethereum blockchain that’s set for launch early subsequent yr. The group behind D2T has up to now raised $9.6 million with over 99.79% of tokens in stage 3 of the presale offered. Within the fourth and closing stage of the presale (which is ready to begin within the close to future), the D2T worth will rise to $0.0533. It might be good to spend money on the token now earlier than the worth will increase. The D2T growth group is forward of schedule making it potential to launch the presale dashboard before earlier deliberate.

Calvaria (RIA)

Calvaria is a blockchain-based card-trading recreation enabling gamers to battle with their NFT playing cards and earn rewards. RIA, the platform’s native token is at the moment within the final stage of the presale with over $2.4 million raised and solely 22% of tokens left.

Learn Extra:

Sprint 2 Commerce – Excessive Potential Presale

- Energetic Presale Stay Now – dash2trade.com

- Featured in Cointelegraph – $10M Raised

- KYC Verified & Audited

- Native Token of Crypto Indicators Ecosystem

Be part of Our Telegram channel to remain updated on breaking information protection