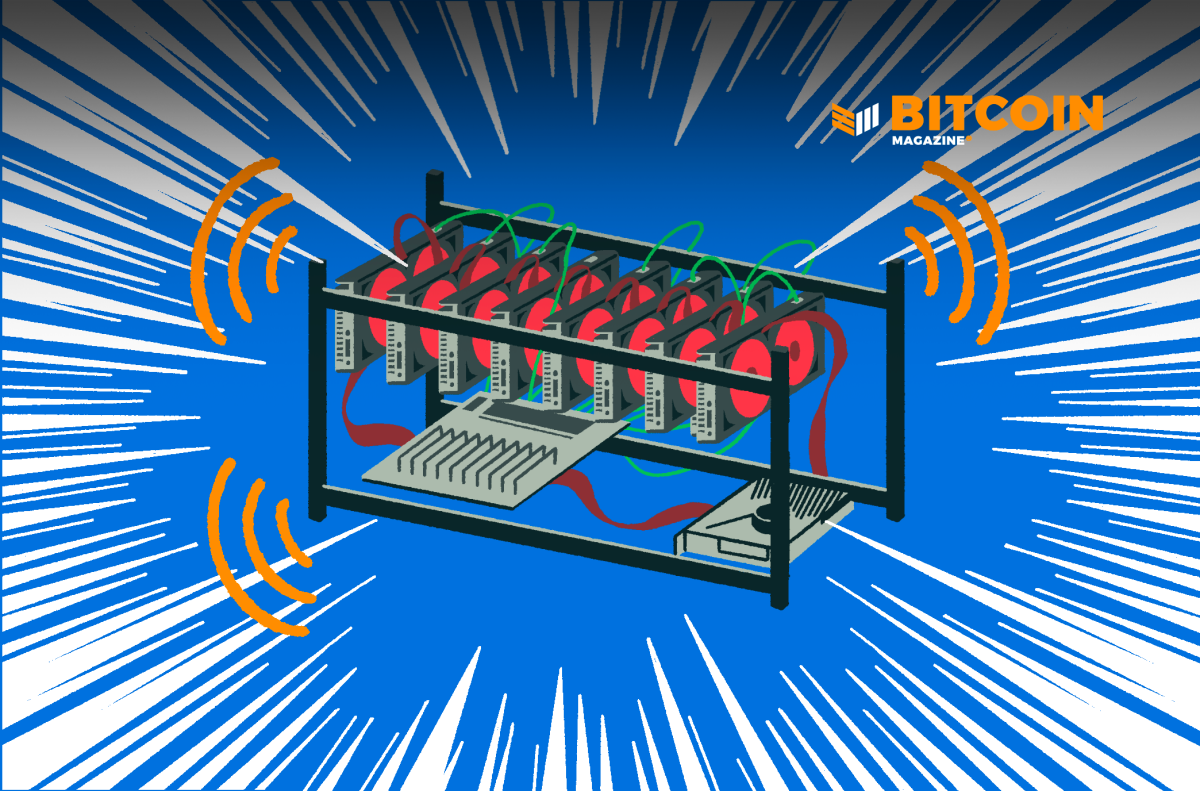

The low profitability of BTC mining remains to be puzzling for a lot of crypto fanatics and buyers. There’s no shock right here, given the ever-increasing power prices. Furthermore, the bear market can also be considerably impacting Bitcoin’s mining problem.

As for now, making affordable income from mining Bitcoin is just not possible. This truth, nonetheless, doesn’t indicate that BTC mining is fruitless. Quite the opposite, miners could be alright, offered they have interaction the fitting instruments within the mining course of.

The Issue of BTC Mining Drops

The BTC mining sector is experiencing a downturn. The issue share of mining Bitcoin dropped to about 7.32% on Tuesday. This incidence isn’t far-fetched from the plummeting costs of digital tokens, which has additionally lessened miners’ positive aspects.

In response to knowledge from the BTC.com mining pool, the system made essentially the most vital adjustment since July 2021, with block peak at 766,080. The adjustment matched July 2021, when many miners backed out of the system. This movement resulted from China’s ban on digital currencies on the time.

As per the BTC mining course of, the computing energy or hashrate upon mining defines the end result of mining problem. This method is important to stabilize the time required to attain one block of Bitcoin. Because the variety of miners will increase, so does the mining problem.

Along with the lowered mining problem, BTC miners are additionally seeing a gradual enhance in power prices and electrical energy charges. These occasions additionally negatively impacted miners’ income in the previous few months.

Howbeit, miners should not the one victims of the cussed plummeting value of Bitcoin. Acknowledged producers like Argo Blockchain (ARBK) and Core Scientific (CORZ) attempt to outlive bearish market liquidity pressures. Compute North, then again, noticed Chapter 11 chapter as the one method out.

The corporate witnessed a breakthrough after buying new and environment friendly tools just a few months again. On the time, they obtained new miners who drove a number of tasks into success.

Additionally, there was a notable enhance in problem and hashrate between August and November 2021, when the final optimistic adjustment was made.

Crypto Winter Turns into The Principal Affect

The corporate had hoped that the success would proceed, solely to be pushed by the opposed wind of the 2022 crypto winter. This was the start of the downturn of the hashrate. Nonetheless, it shows increased values than these proven instantly after China’s breakoff from the crypto sector.

Miners now search to have a lowered value of electrical energy because of the regular plunging in income. However, in keeping with a Luxor analyst, Jaran Mellerud, miners nonetheless pay between $0.07 and $0.08/kWh for a mean electrical energy value of $0.05/kWh. Within the meantime, the value of BTC stands at $16,961. The token reveals a 24-hour value change of -0.46%.

Featured picture from Pixabay, chart from TradingView.com