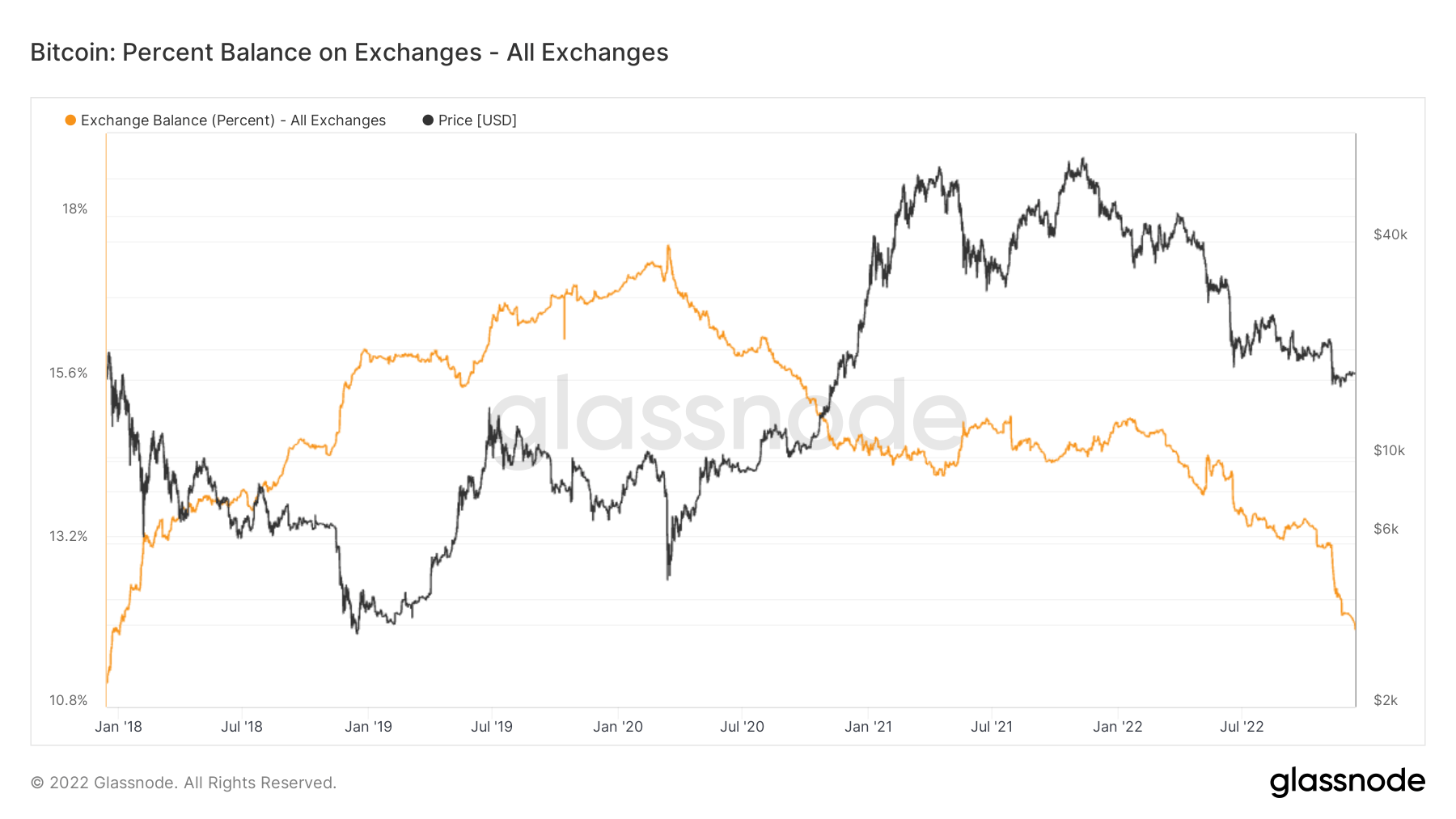

Lower than 12% of the present Bitcoin (BTC) provide is held on exchanges, marking a brand new low since January 2018, in keeping with Glassnode knowledge analyzed by CryptoSlate.

The chart beneath demonstrates the BTC steadiness held on exchanges with the orange line and begins in Jan. 2018, when the steadiness was simply above 10.8%.

Exchanges’ BTC reserves grew exponentially between Jan. 2018 and Jan. 2020, when the COVID-19 pandemic began. On Jan. 2020, almost 18% of all BTC provide was held on exchanges. After that peak, the quantity of BTC held on exchanges began to shrink steadily and fell as little as at this time’s 12%.

Coinbase and Binance

Coinbase and Binance, the 2 main exchanges, collectively account for five.5% of the 12% held in exchanges.

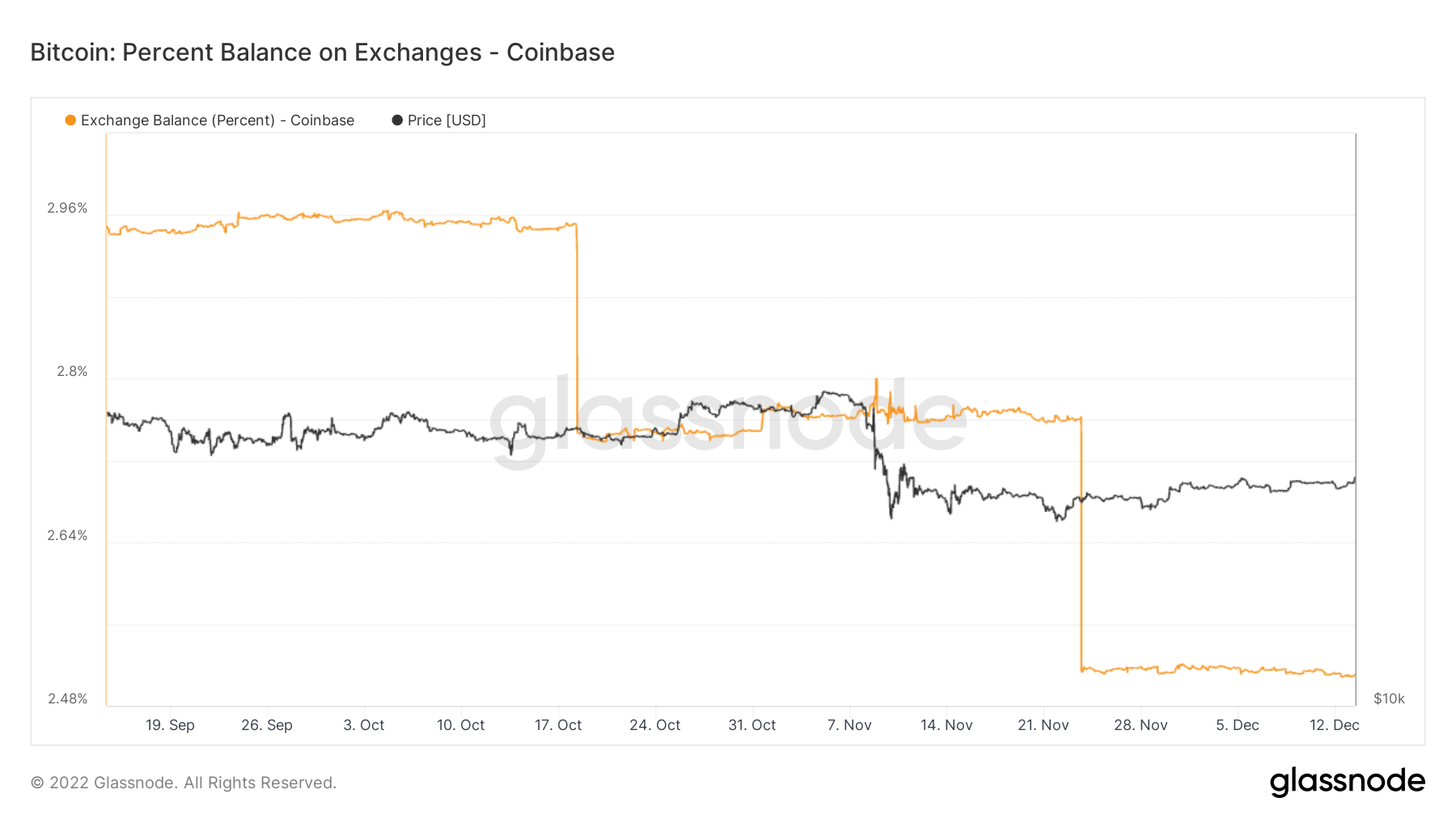

Coinbase

Coinbase’s title has been on the headlines through the previous two months for shrinking its BTC reserves. The chart beneath demonstrates Coinbase’s BTC reserves since mid-September and reveals two sharp downfalls.

On Oct. 18, round 50,000 BTC had been withdrawn from the change. This incident was the primary hefty withdrawal since June 2022. On the time, Coinbase held round 525,000 BTC in its reserves, which was 22% decrease than at the start of the 12 months.

Coinbase recorded one other hefty withdrawal equating to over $3.5 billion between Nov. 23 and Nov. 27, which lowered the change’s reserves to new lows. Regardless of these, Coinbase nonetheless holds round 2.52% of the entire BTC provide.

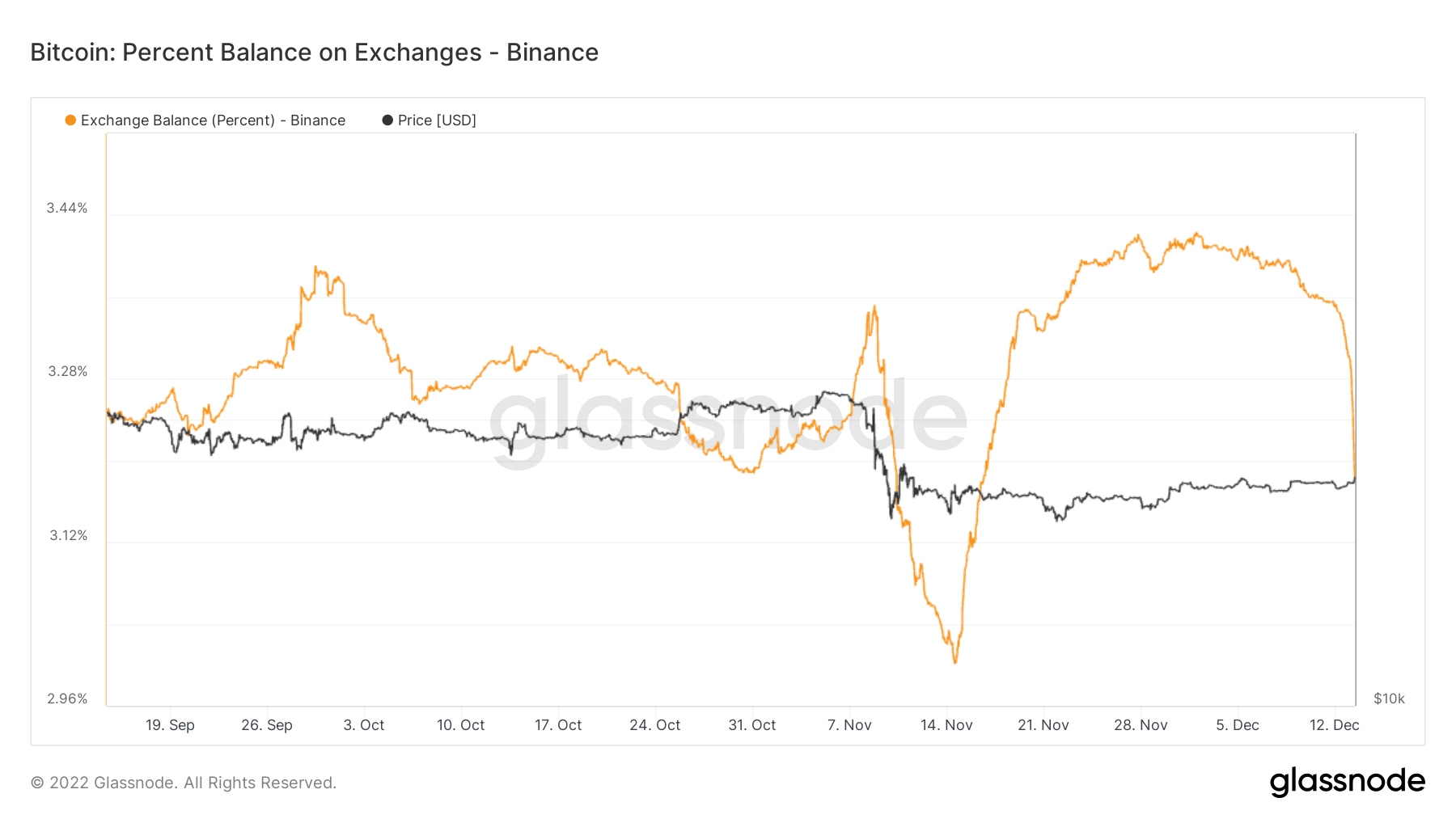

Binance

Binance’s BTC reserves, then again, didn’t shrink steadily like Coinbase. Whereas Coinbase recorded its giant withdrawals on Oct. 18, and Nov. 23-27, Binance has been accumulating BTC.

Solely a pointy decline in Binance’s BTC reserves was recorded between Nov.7 and Nov. 14. Nevertheless, the change rapidly recovered its earlier BTC depend and even exceeded above to account for almost 3.40% of the entire provide.

Binance’s BTC holdings have been lingering round at 3.40% when current occasions lowered it to beneath 3.20%.

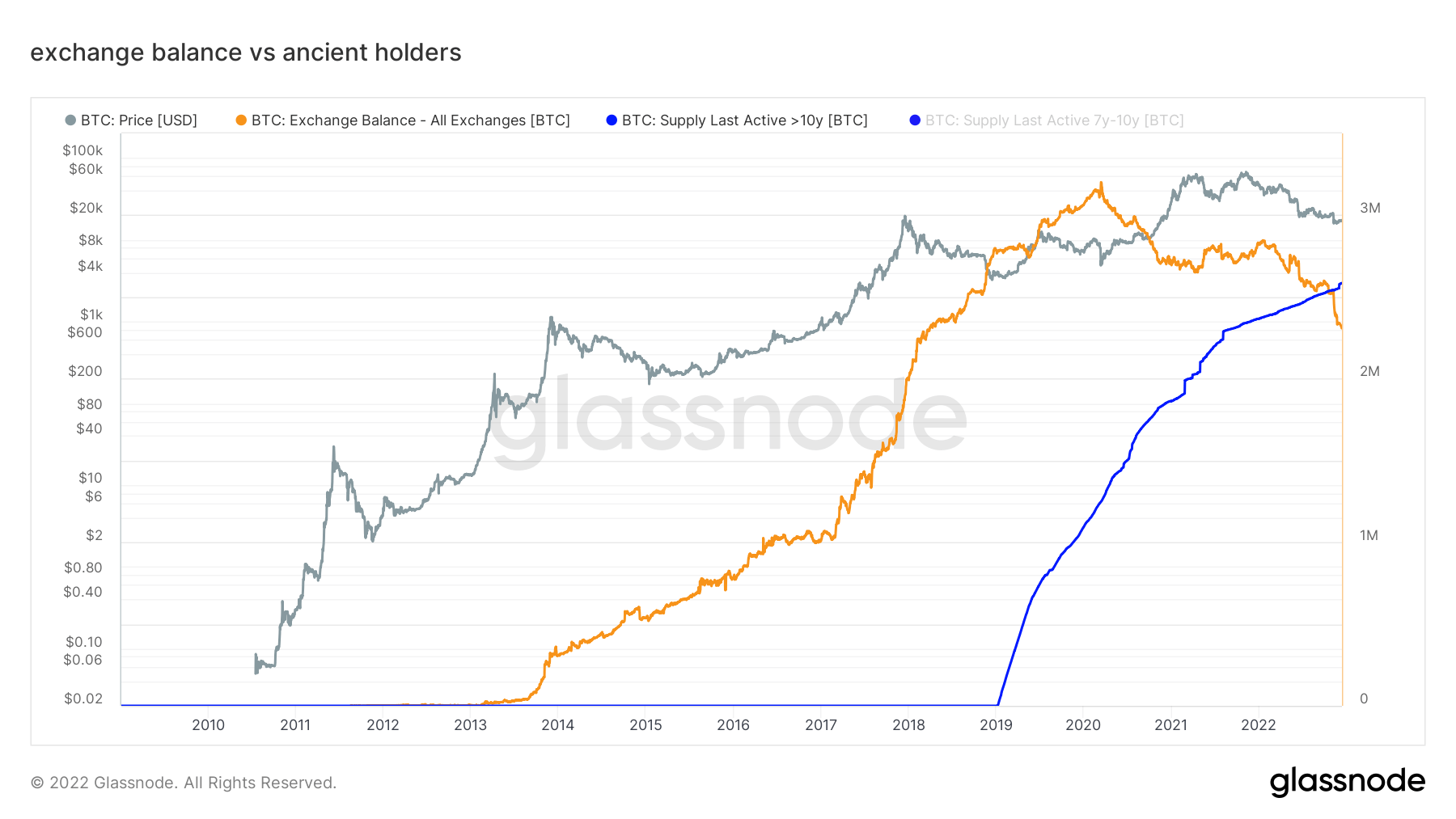

Historical holders and exchanges

The info additionally reveals that “historical” wallets maintain round 2,6 million BTC, whereas all exchanges maintain round 2,3 million.

The time period “historical” refers to addresses which were holding BTC and was final energetic over ten years in the past. The chart beneath demonstrates their complete BTC steadiness with the blue line, whereas it represents the steadiness on exchanges with the orange one.

The chart begins from even earlier than 2010. Since then, the entire reserves of the traditional holders have been beneath the entire reserves of exchanges. Historical holders surpassed the exchanges for the primary time in November 2022, through the FTX collapse.