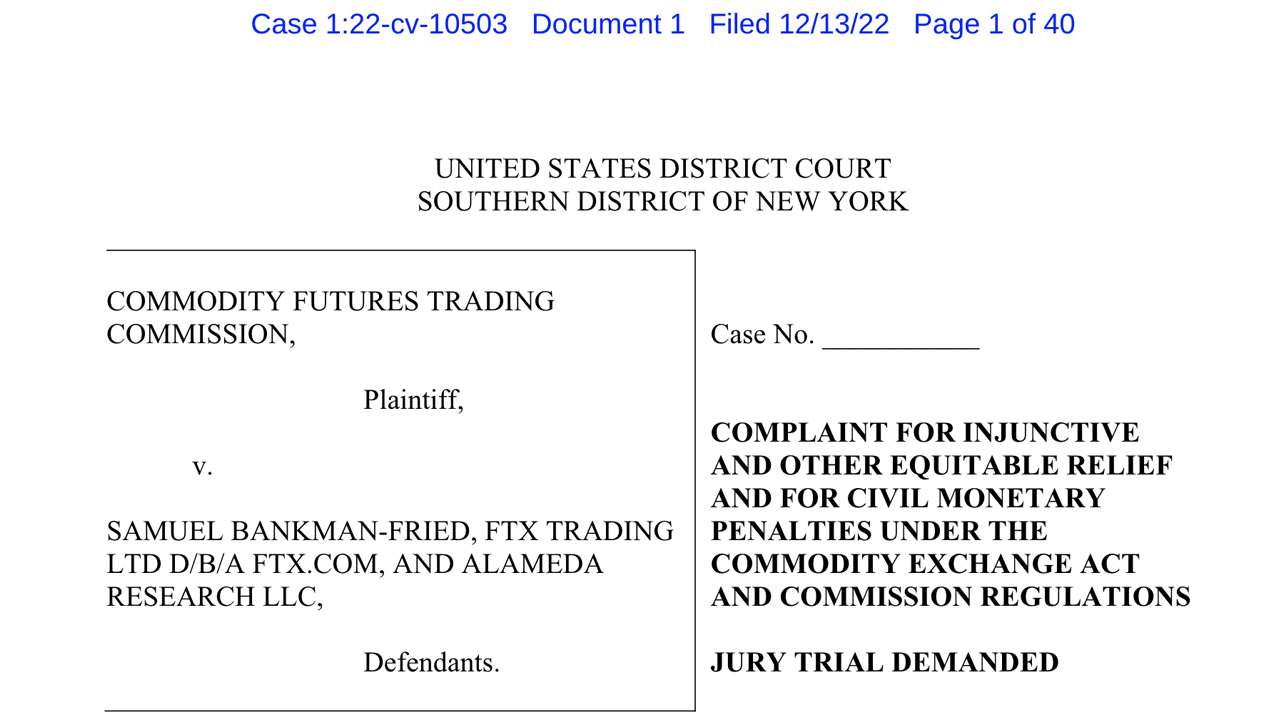

On Dec. 13, 2022, the U.S. Commodity Futures Buying and selling Fee (CFTC) filed a lawsuit in opposition to Sam Bankman-Fried (SBF), FTX Buying and selling LTD., and Alameda Analysis. The CFTC alleges that FTX buyer deposits, “all through the related interval,” together with each fiat currencies and cryptocurrencies, have been reportedly “appropriated by Alameda for its personal use.”

U.S. Commodity Futures Buying and selling Fee: ‘FTX and Alameda Comingled, Mishandled, and Misappropriated FTX Buying and selling Buyer Funds’ From Day One

The U.S. Commodity Futures Buying and selling Fee (CFTC) has filed a lawsuit (Case 1:22-cv-10503) in opposition to SBF and his corporations FTX and Alameda Analysis. The lawsuit claims that “at Bankman-Fried’s route, FTX executives created options within the underlying code for FTX that allowed Alameda to take care of an basically limitless line of credit score on FTX.”

The CFTC alleges that SBF and his interior circle “took lots of of thousands and thousands of {dollars}” in loans from Alameda and used the funds for Bahamian actual property, “political donations, and for different unauthorized makes use of.”

The CFTC’s courtroom submitting insists:

By way of this conduct and the conduct additional described herein, [the] defendants violated Part 6(c)(1) of the Commodity Trade Act.

The U.S. commodities regulator is searching for “civil financial penalties and remedial ancillary aid.” Moreover, just like the latest SEC prices, the CFTC needs SBF banned from buying and selling actions. The CFTC believes it has jurisdiction over SBF, as Bankman-Fried is a U.S. citizen who has resided in numerous places worldwide. SBF and his corporations have performed enterprise dealings within the U.S. as properly for a “related interval,” the CFTC courtroom doc declares. As an illustration, Alameda Analysis is a Delaware restricted legal responsibility firm registered in the US.

“The FTX Enterprise failed to look at company formalities, together with failure to segregate funds, operations, sources, and personnel, or to correctly doc intercompany transfers or funds and different sources,” the CFTC lawsuit alleges. “The entities usually shared workplace house, techniques, accounts, and communications channels. On data and perception, property flowed freely between the FTX Enterprise entities, usually with out documentation or efficient monitoring,” the courtroom doc provides.

The U.S. CFTC courtroom doc additional states:

FTX and Alameda comingled, mishandled, and misappropriated FTX Buying and selling buyer funds from the second of FTX’s launch.

The not too long ago printed prices stemming from the U.S. Securities and Trade Fee (SEC) on Dec. 13, additionally point out that the SEC believes the FTX fraud started from day one. The SEC prices are much like the CFTC’s lawsuit, as each complaints word that Alameda allegedly had an “limitless” line of credit score that derived from FTX and basically buyer funds. Along with the CFTC, the Southern District of New York’s Lawyer’s workplace indicted SBF with eight counts of monetary crimes prices.

What do you consider the CFTC’s lawsuit in opposition to FTX and Sam Bankman-Fried? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

_id_3946e2f2-d00c-4dcf-82a4-682125cda574_size900.jpg)