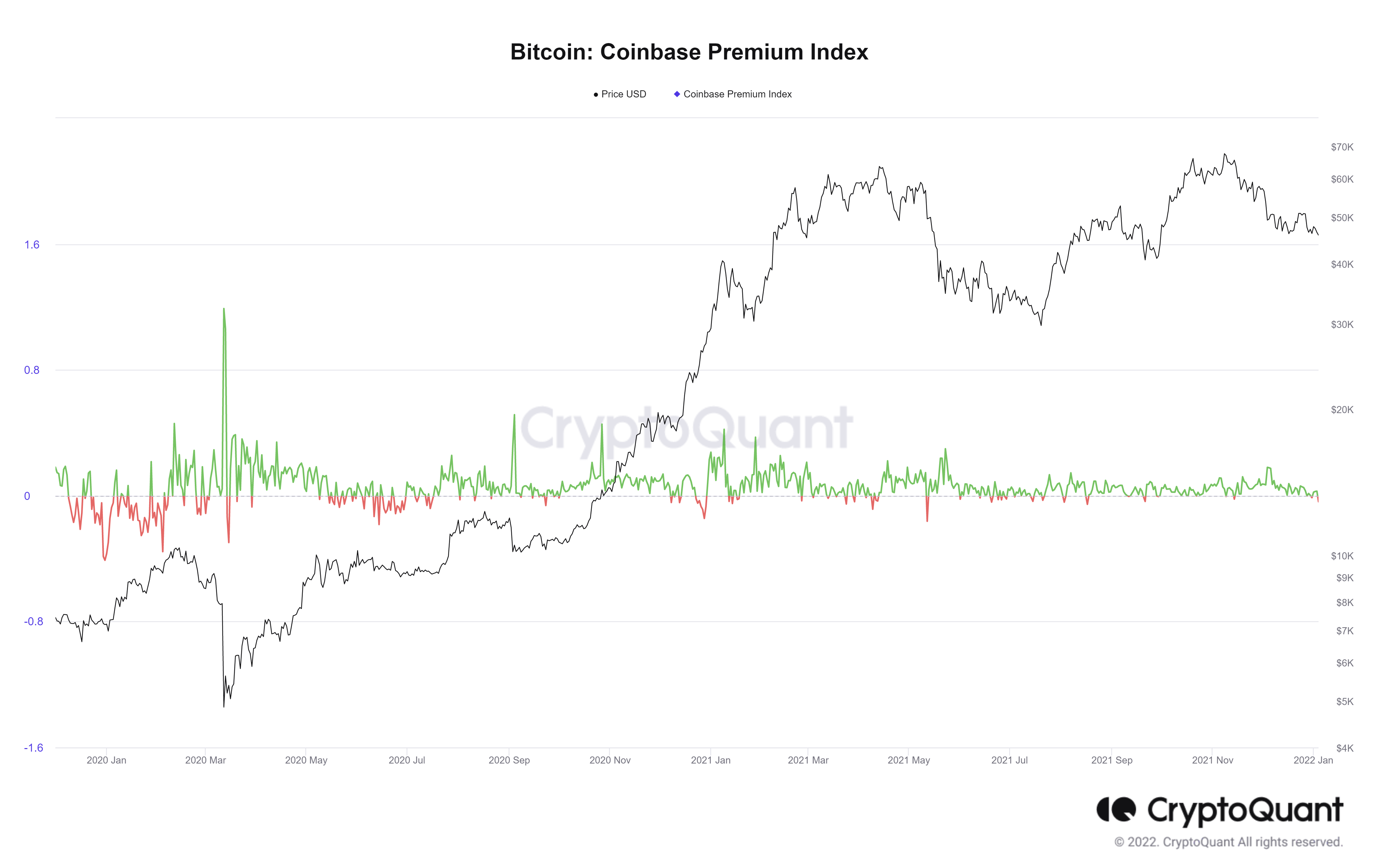

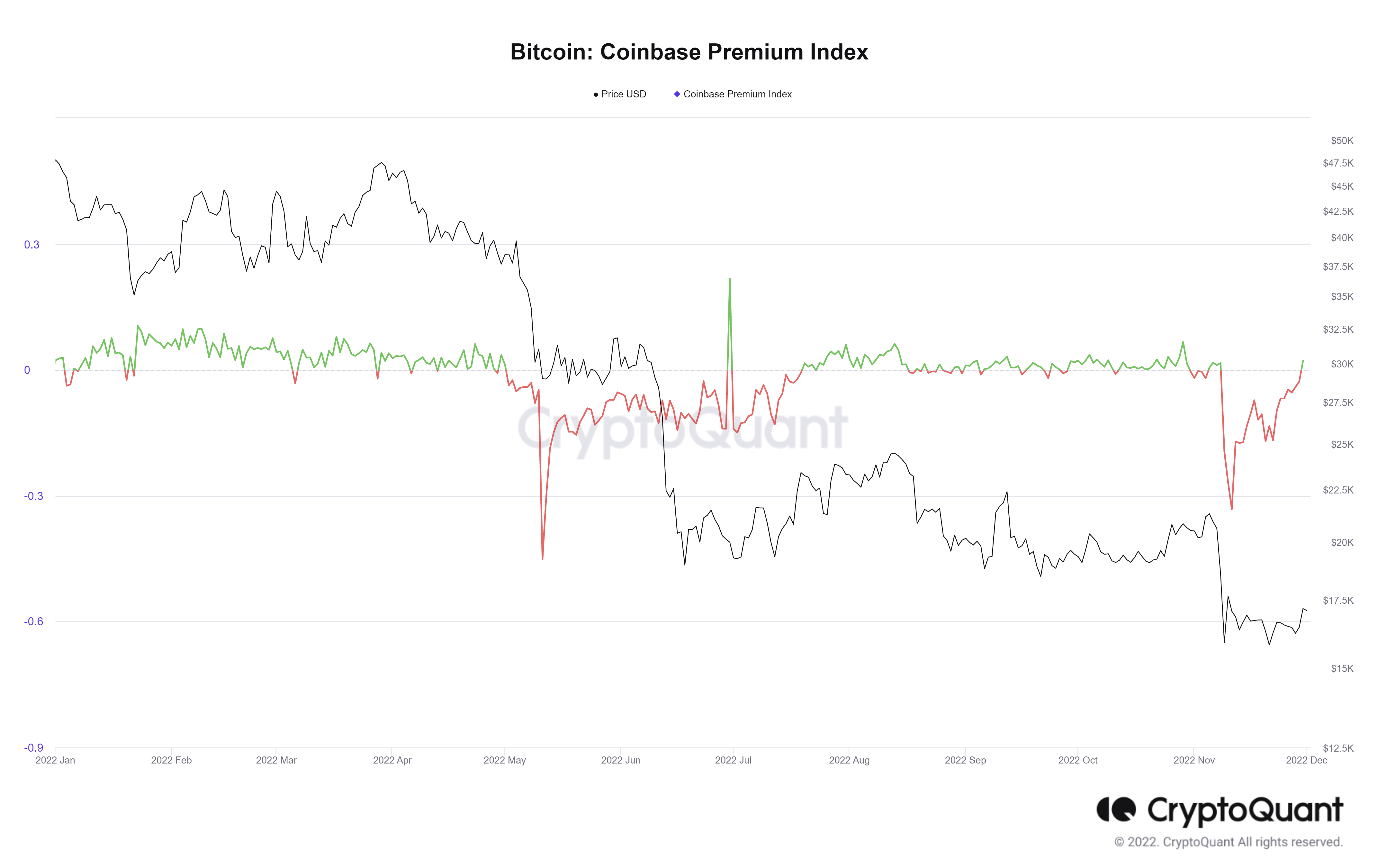

In response to the on-chain knowledge and analytics supplier, CryptoQuant, the Coinbase Premium Index has turned inexperienced for the primary time for the reason that fallout of the FTX collapse.

As an indicator that exhibits an indication of “whale accumulation,” Coinbase Premium is the worth distinction between Coinbase’s BTC/USD pair and Binance’s BTC/USDT pair.

“For instance. when the Bitcoin value repeatedly broke 20k, 30k, and 40k whereas the Coinbase premium was sustaining greater than $50 premium. It signifies that in these dips, establishments or different whales have been accumulating.”

Coinbase Professional is taken into account “the gateway” for institutional investor purchases of cryptocurrencies, and as such, Coinbase Premium is used to trace institutional whale’s motion.

CryptoQuant states that the “2020 bull run was pushed by institutional buyers and excessive net-worth people within the U.S., which makes buyers examine Coinbase Premium greater than ever.”

Traditionally, the highs and lows of the Coinbase Premium Index have signaled potential sturdy buys and powerful sells from Coinbase.

For instance, when the Coinbase Premium reaches excessive values, it alerts Coinbase whales could also be accumulating Bitcoin whatever the excessive value. Nonetheless, the reverse additionally applies when the Index falls to low values, indicating Coinbase whales are both not shopping for as repeatedly or probably promoting their cash.

Reviewing the 12 months thus far, the Coinbase Premium Index has flipped between purple and inexperienced marginally – solely straying from this sample through the two main capitulation occasions witnessed this 12 months (Luna and FTX). This exhibits a stage of uncertainty and an absence of conviction from establishments this 12 months in comparison with earlier years.