Non-fungible tokens (NFTs) have been the buzzword at Artwork Basel Miami Seashore (ABMB) final yr. From an official honest dialog, live-streamed on social media, to discussions at establishments such because the Pérez Artwork Museum Miami and the Flagler Avenue Artwork Pageant, non-fungible tokens have been entrance and centre in 2021. And naturally, there was ample alternative to purchase into the hype. On the VIP opening of ABMB, guests have been led by means of an entire room stuffed with NFTs courtesy of the blockchain Tezos, an official companion of the honest since final yr. Different initiatives mushroomed across the metropolis. At NFT BAZL’s gallery public sale, one NFT bought for $300,000, boosted by its chief govt Estelle Ohayon’s prediction that: “NFTs are the long run, and that is the best way ahead”.

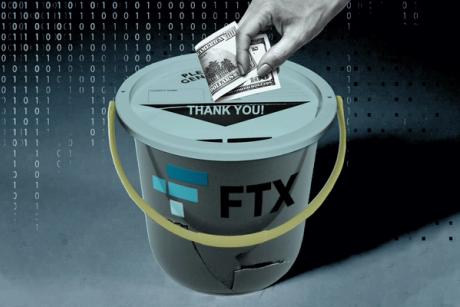

Or the best way backwards? Simply earlier than this yr’s honest, the crypto forex alternate FTX filed for chapter, devastating the entire crypto world. Bitcoin plunged to about $17,000, having topped out at round $64,000 a yr earlier than. And the marketplace for NFTs collapsed as dramatically—gross sales quantity stood at $9m in November, in contrast with $93m simply six months earlier than, in line with Non-Fungible.com.

Oh, and by the best way, all this appears to have shattered the much-touted principle that there’s an inverse correlation between NFTs and crypto.

This yr, NFT initiatives have been massively scaled again in Miami. Granted, there have been some occasions, resembling launch events for Moonbirds and Pudgy Penguins, and a few galleries resembling Tempo Verso have been persevering with their initiatives. However the warmth was positively off in contrast with final yr.

In addition to hammering the broader crypto and NFT world, the FTX catastrophe is a blow to Miami’s mayor Francis Suarez and his plans to show the town right into a crypto hub. And don’t even point out the promise that FTX would relocate its Chicago headquarters to Miami.

However there’s a extra vital drawback. One other potential sufferer of the meltdown is the entire Efficient Altruism (EA) motion. Briefly, this encourages folks to make huge sums of cash to allow them to then donate to good causes, notably “environment friendly” charities.

However now the entire “earn cash, do good” ethics of EA have been splattered by the FTX affair as a result of its founder, Sam Bankman-Fried, was the poster boy for the motion and one of many main contributors to the FTX Future Fund. This aimed to assist initiatives various from AI ethics to creating higher private protecting tools. Just lately the whole staff behind the fund resigned, saying they’d: “Basic questions concerning the legitimacy and integrity of the enterprise operations that have been funding the FTX Basis and the Future Fund.”

And lots of are actually suggesting that EA was only a manner of “greenwashing” by deflecting nearer scrutiny of a few of Bankman-Fried’s extra questionable enterprise practices at FTX.

Talking from Miami, the philanthropy adviser Scott Stover commented: “Sure, the FTX meltdown has to have an effect on EA. The fundamental tenets of EA pose severe points—you need to query if it was enticing to individuals who have been morally corrupt.” Stover hosts the podcast Giving again is useless, which couldn’t be a extra apt title for the catastrophe at FTX.