The largest information within the cryptoverse for Dec. 9 features a Twitter sparring between Binance CEO Changpeng Zhao and former FTX CEO Sam Bankman-Fried, and Hut8, Riot, and Marathon are rising as the one public miners that elevated their BTC holdings in November.

CryptoSlate Prime Tales

The Synthetic Intelligence (AI) cryptocurrency sector grew 12.3% over the past 24 hours, making it the second greatest gaining sector after hashish.

Notable high 10 AI cryptocurrency performers had been Cortex, which develops machine studying fashions on blockchain, up 93.7%, and Fetch, which leverages AI and automation for dApp and peer-to-peer purposes, gaining 33.7%.

The drama surrounding FTX and Binance continues to unfold as new textual content messages emerge that present what went on behind the scenes because the change crumbled.

The New York Instances obtained textual content messages from a gaggle chat with Sam Bankman-Fried, Changpeng Zhao, and numerous different cryptocurrency executives that had been exchanged on Nov. 10 — the day earlier than FTX filed for chapter.

The collection of round a dozen texts confirmed that each one crypto executives feared the scenario might worsen. Furthermore, the fearful exchanges reportedly grew to become more and more tense as CZ accused SBF of making an attempt to control the value of Tether (USDT).

Within the texts, CZ mentioned that SBF used Alameda Analysis to depeg the stablecoin. Binance’s CEO identified a $250,000 commerce and mentioned Alameda particularly positioned it to destabilize USDT.

Sam Bankman-Fried (SBF) has spoken out following Binance founder Changpeng Zhao’s (CZ) public thread referring to Kevin O’Leary’s protection of FTX and referring to SBF as “a fraudster.”

The feud continued following CZ’s latest allegations that CZ accused SBF of making an attempt to depeg USDT by way of Alameda.

CZ alleged that SBF “launched a collection of offensive tirades at a number of Binance workforce members” in his Twitter thread.

In rebuttal, SBF introduced that CZ had “gained” and alleged that CZ had lied concerning the small print surrounding Binance’s buyout of FTX.

FTX former CEO Sam Bankman-Fried helps restarting the bankrupt change by issuing new FTT tokens to collectors and giving 100% earnings to token holders.

Crypto Dealer host Ran Neuner first proposed the thought on Dec. 9, including that it might make the brand new change the “greatest change on the earth.”

In response, SBF tweeted that he thinks “that this might be a productive path for events to discover.”

Analysis Spotlight

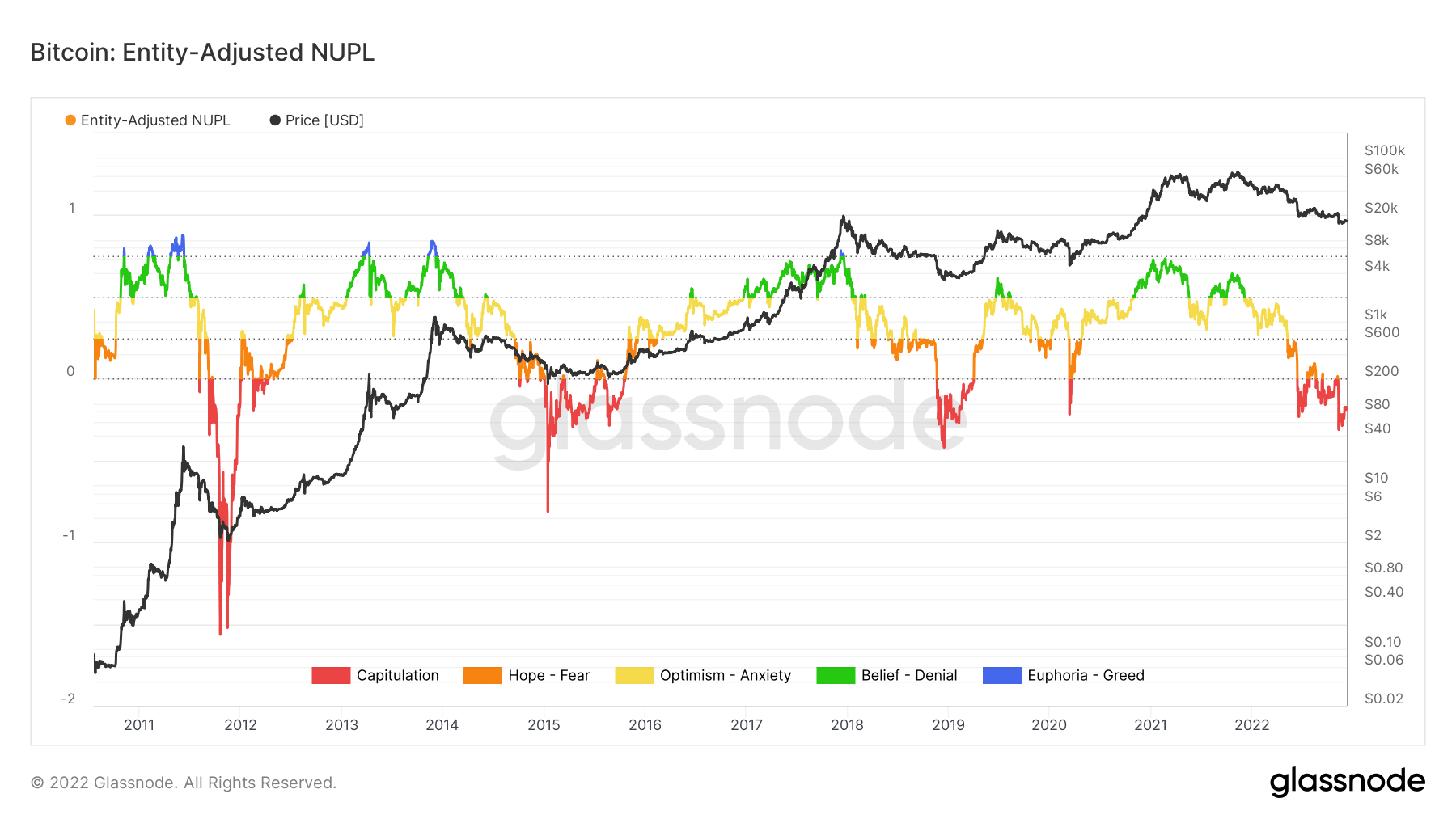

Since June, Bitcoin (BTC) – and the final market subsequently – has been in capitulation, aside from a handful of rallies seen in the summertime of this ongoing bear market, based on on-chain knowledge offered by Glassnode and analyzed by CryptoSlate.

Each bull and bear markets reveal on-chain sentiment knowledge, starting from ‘Capitulation’ to ‘Euphoria – Greed. Within the peak of a bull market, the highest is traditionally indicated when Euphoria grips tightly. However, capitulation normally alerts the underside.

The chart beneath exhibits that BTC has firmly sunk into the Capitulation sentiment because the Internet Unrealized Revenue/Loss (NUPL) on-chain knowledge shows a descent into purple territory seen beforehand solely in 2012, 2015, and 2019.

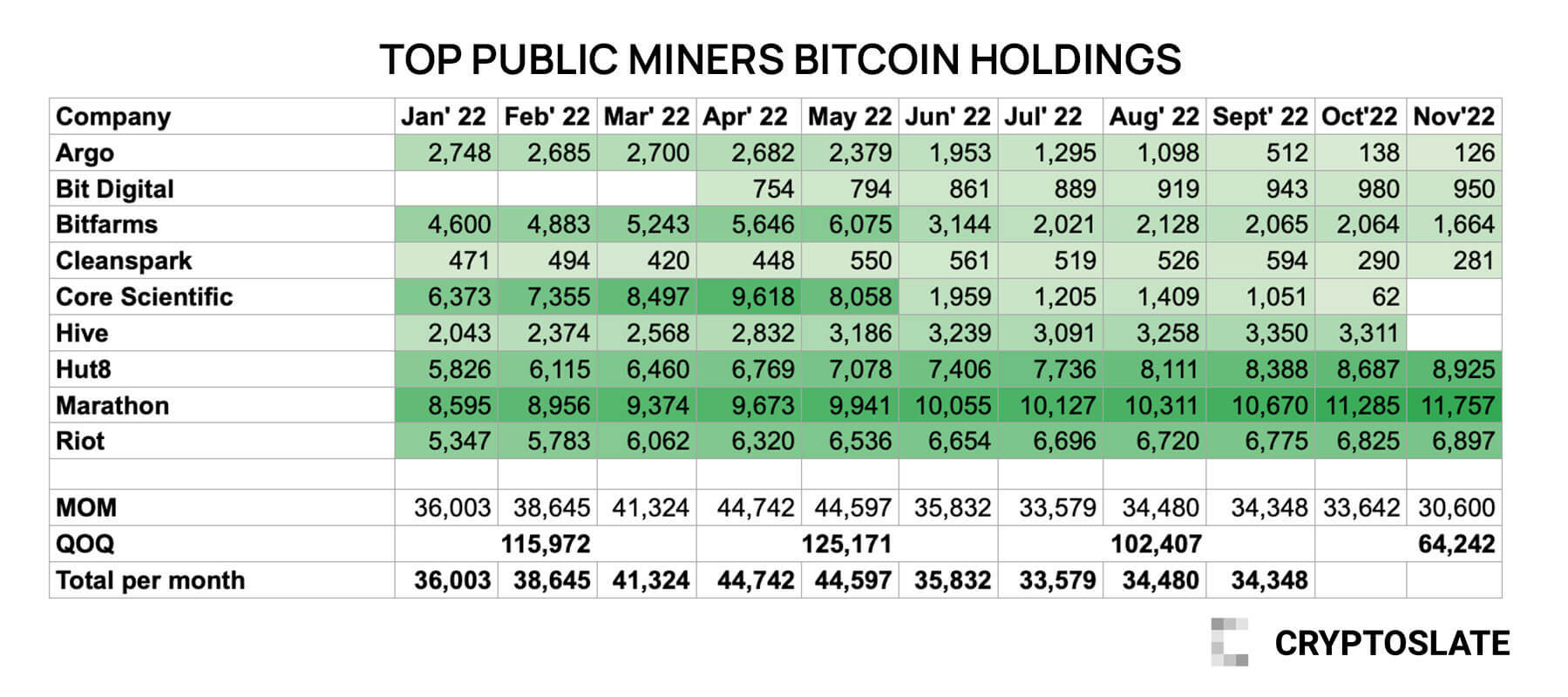

Mining corporations have been releasing their November manufacturing charges all through the week. CryptoSlate analysts introduced the numbers collectively and revealed that Hut8, Riot, and Marathon are the one ones who elevated their BTC holdings in November.

The chart above contains the highest 9 BTC miners’ month-to-month reserves ranging from January 2022. The numbers present that Hut 8, Riot, and Marathon added 238, 472, and 72 BTC to their reserves in November, respectively.

However, Argo, Bit Digital, Bitfarms, and Cleanspark shrank by dropping 12, 30, 400, and 9 BTC in the identical month.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 0.75% to commerce at $17,147.91, whereas Ethereum (ETH) elevated by 1.16% to commerce at $1,270.72.

Greatest Gainers (24h)

- Mass Automobile Ledger (MVL): +30.26%

- Ampleforth (AMPL): +26.01%

- Fetch (FET): +21.52%

Greatest Losers (24h)

- Radix (XRD): -10.64%

- Neutrino USD (USDN): -7.14%

- Celsius (CEL): -6.73%