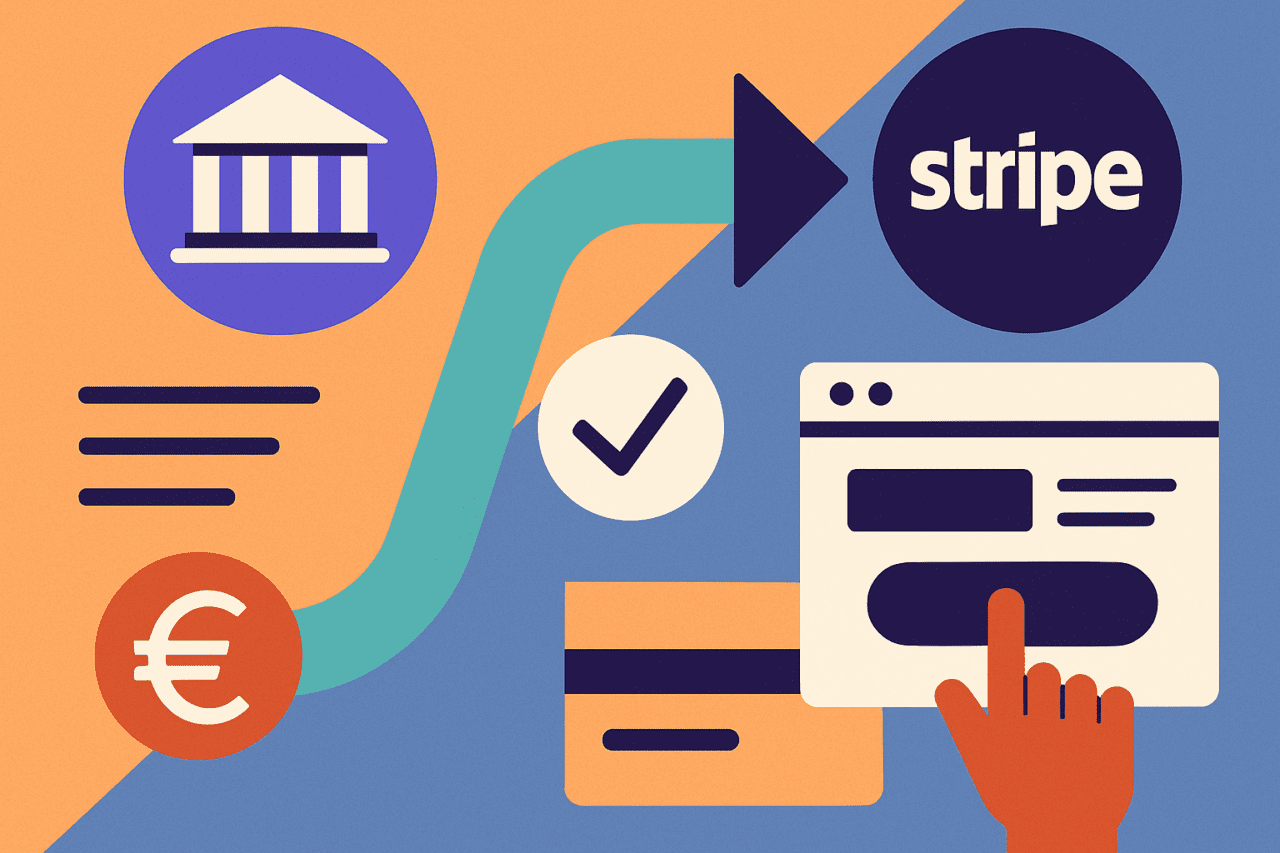

- Finastra and Clinc have partnered to combine Clinc’s conversational AI expertise into Finastra’s Fusion Digital Banking platform.

- Finastra will provide its 8,600 monetary instiution shoppers entry to Clinc’s AI digital assistants to assist mitigate the load on name facilities whereas offering high quality solutions to finish customers.

- Finastra was based in 2017 as a merger between Misys and D+H.

Monetary software program firm Finastra has tapped conversational AI fintech Clinc this week. The 2 have partnered to combine Clinc’s Digital Banking Assistant expertise into Finastra’s Fusion Digital Banking platform.

The added capabilities will allow Finastra’s 8,600 monetary establishment shoppers to extend digital engagement with their clients. Clinc’s Digital Banking Assistant helps banks handle widespread banking requests by way of totally different channels, which finally helps scale back the amount of calls into the decision middle.

Clinc was based in 2015 to construct what it calls a “human-in-the-room” stage of digital assistant powered by AI expertise and machine studying. The corporate’s resolution understands pure language and leverages parts from the person’s inquiry– comparable to wording, sentiment, intent, tone of voice, time of day, location, and relationships– to craft a solution that’s not solely human-like, but additionally helpful in answering the unique query.

“We’re extremely happy to have the ability to provide our AI resolution to banks in collaboration with Finastra, whose FusionFabric.cloud platform is considered all over the world as a number one monetary expertise ecosystem,” stated Clinc CEO Jon Newhard. “Our Digital Banking Assistant, which may be built-in seamlessly as a part of a digital transformation technique, allows monetary establishments to have interaction clients effectively however with out dropping the non-public contact. That is important in an period when rising numbers of customers are demanding genuine and intuitive experiences from chatbots.”

Clinc’s expertise can be obtainable in Finastra’s FusionFabric.cloud, a market that helps monetary providers companies discover pre-built, ready-to-integrate apps into their Finastra merchandise. Since launching in 2017, FusionFabric.cloud has had 566 clients enroll and has helped kind greater than 153 partnerships.

“Monetary establishments worldwide will profit from elevated entry to Clinc’s revolutionary chatbot expertise,” stated Finastra Chief Product Officer, Common Banking Narendra Mistry. “Understanding how actual individuals discuss and work together is essential as banks and credit score unions work to make sure that the client expertise stays sturdy whereas embracing new applied sciences. We’re delighted to welcome Clinc to our expertise ecosystem, and for Finastra’s clients to have the ability to simply provide conversational AI as a part of their digital technique.”

Finastra was based in 2017 as a merger between Misys and D+H. The latter acquired Mortgagebot in 2011 for $232 million. Mortgagebot was among the many first corporations to demo at a Finovate occasion. The corporate gained Better of Present at FinovateFall 2007. Finastra’s expertise spans lending, funds, treasury and capital markets, and common banking. The U.Okay.-based firm counts 90 of the world’s prime 100 banks as shoppers.

Picture by Miguel Á. Padriñán