Be part of Our Telegram channel to remain updated on breaking information protection

To find clients’ lacking billions, FTX has employed a forensics workforce

Based on experiences, the brand new administration of the bankrupt cryptocurrency change FTX has employed a gaggle of economic forensic investigators to search out the lacking buyer cryptocurrency valued at billions of {dollars}.

As per a Dec. 7 Wall Avenue Journal article, monetary advisory agency AlixPartners was chosen for the job and is run by Matt Jacques, a former chief accountant for the Securities and Trade Fee (SEC).

As a part of the restructuring work being accomplished by FTX, the forensics agency will reportedly be tasked with finishing up “asset-tracing” to search out and get better the lacking digital property.

Hackers stole over $450 million value of property

Hackers stole over $450 million value of property from wallets owned by FTX and FTX.US on November 11.

Sam Bankman-Fried, a former CEO, claimed in an interview with cryptocurrency blogger Tiffany Fong on Nov. 16 that he had “narrowed it right down to eight folks” and was near figuring out the hacker, who was “both an ex-employee or someplace somebody put in malware on an ex-employee’s laptop.”

A lawyer for FTX debtors claimed on November 22 that “a considerable quantity of property have both been stolen or are lacking” from FTX. On the time, it was made identified that blockchain analytics corporations like Chainalysis had been employed to help within the case.

Since then, the FTX funds have been stolen and have been transferring by way of varied cryptocurrency exchanges and mixers to be laundered.

On Nov. 20, the hacker moved their Ether (ETH) holdings to a brand new pockets handle, exchanged a few of the ETH for an ERC-20 variant of Bitcoin, after which related the funds to the BTC Community.

On Nov. 29, they despatched the BTC by way of a crypto mixer and the OKX change utilizing a laundering technique known as peel chaining, which divides the holdings into successively smaller quantities throughout a number of wallets.

On November 21, the hacker made one other try at peel chaining by distributing 180,000 ETH amongst 12 freshly made wallets.

Sam Bankman-Fried, a former CEO, has additionally up to now asserted that buyer funds at FTX and its sister buying and selling firm Alameda Analysis have been “unknowingly commingled” with buyer funds at FTX that have been loaned to Alameda.

John Ray III, the brand new CEO and chief restructuring officer of FTX, was scathing in his preliminary chapter submitting, claiming that he had “by no means” witnessed “such a whole failure of company controls” in his 40-year profession.

Utilizing “software program to hide the misuse of buyer funds,” he asserted that Bankman-Fried and his closest associates are “doubtlessly compromised.”

As FTX collapses, a US lawmaker queries the largest cryptocurrency exchanges about shopper safety.

Following the liquidity issues and chapter of FTX, Ron Wyden, the chairman of the Senate Finance Committee in the USA, has requested six cryptocurrency corporations for data relating to shopper safety.

In varied letters dated Nov. 28, Wyden focused Binance, Coinbase, Bitfinex, Gemini, Kraken, and KuCoin, asking them for particulars on the safeguards they’d in place within the occasion of a failure much like the one which occurred at FTX. The senator claimed that FTX clients who had cryptocurrency funds had “no such protections” as clients of banks or licensed brokers lined by the Securities Investor Safety Company or Federal Deposit Insurance coverage Company.

Wyden stated,

As Congress considers much-needed rules for the crypto business, I’ll give attention to the clear want for shopper protections alongside the strains of the assurances which have lengthy existed for purchasers of banks, credit score unions and securities brokers. If these protections had been in place earlier than the failure of FTX, far fewer retail traders could be dealing with precipitous monetary hurt right this moment.

Shoppers who entrusted their property to companies like @FTX_Official are discovering they haven’t any protections when corporations go bust. As Congress considers much-needed rules for the crypto business, I’m laser-focused on guaranteeing actual protections for shoppers. https://t.co/QRdSUKe0A3

— Ron Wyden (@RonWyden) November 29, 2022

By December 12, Wyden requested the six corporations to reply to questions on their subsidiary corporations, the safety of shopper property, using buyer information, and safeguards in opposition to market manipulation. On December 1, the Senate Agriculture Committee will maintain a listening to to debate the demise of FTX. Senators Sheldon Whitehouse and Elizabeth Warren have urged the Justice Division to contemplate bringing felony fees in opposition to these answerable for wrongdoing on the change.

On December 13, the Home Monetary Providers Committee will maintain the same inquiry listening to into FTX within the opposing chamber. Maxine Waters, the committee’s chair, and Patrick McHenry, the committee’s rating member, have each endorsed the congressional motion, with McHenry dubbing the circumstances surrounding the unsuccessful change a “dumpster hearth.”

The District of Delaware is at the moment internet hosting FTX’s chapter proceedings, which have revealed the change could owe greater than 1 million collectors cash. The chapter case’s subsequent listening to has been set for December 16.

Associated

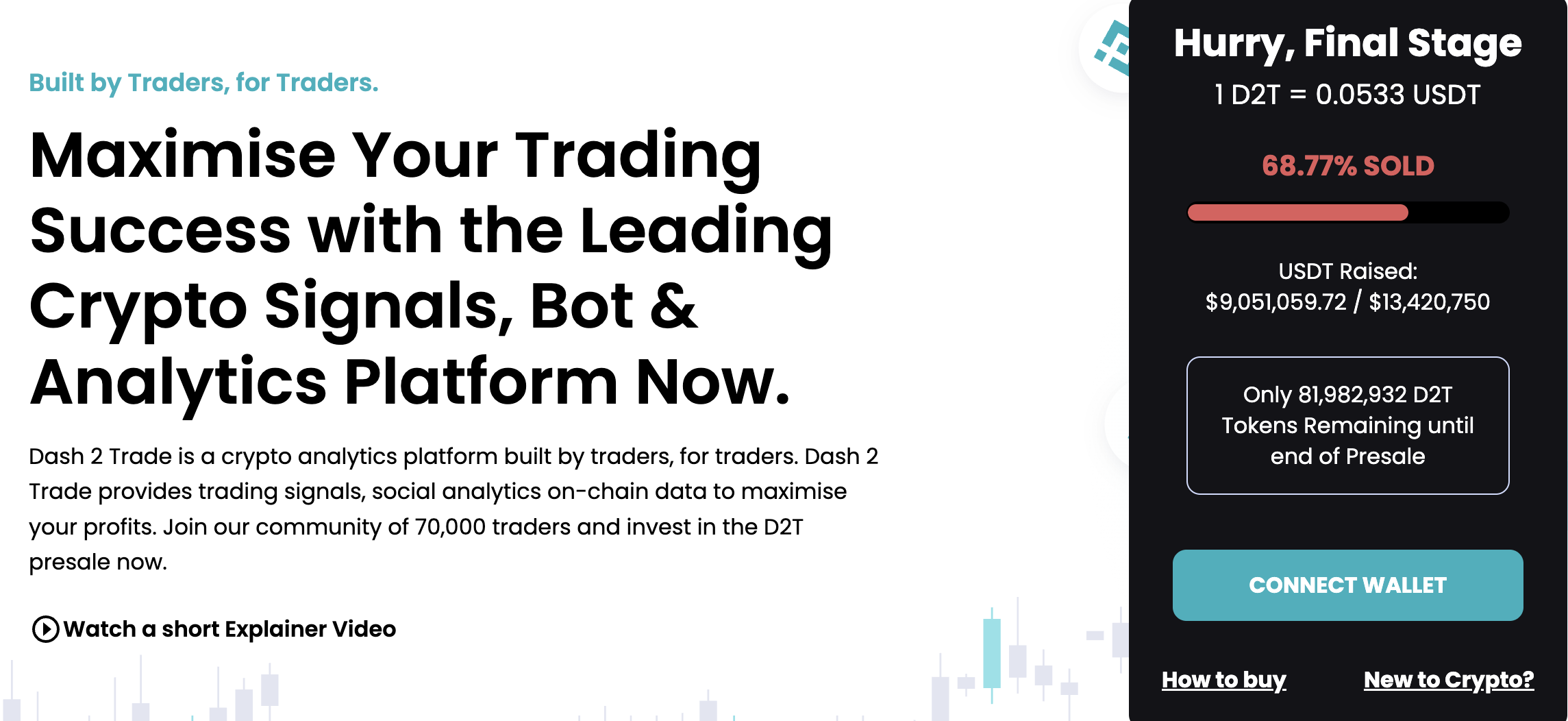

Sprint 2 Commerce – Excessive Potential Presale

- Energetic Presale Stay Now – dash2trade.com

- Native Token of Crypto Indicators Ecosystem

- KYC Verified & Audited

Be part of Our Telegram channel to remain updated on breaking information protection