Mining corporations have been releasing their November manufacturing charges all through the week. CryptoSlate analysts introduced the numbers collectively and revealed that Hut8, Riot, and Marathon are the one ones who elevated their BTC holdings in November.

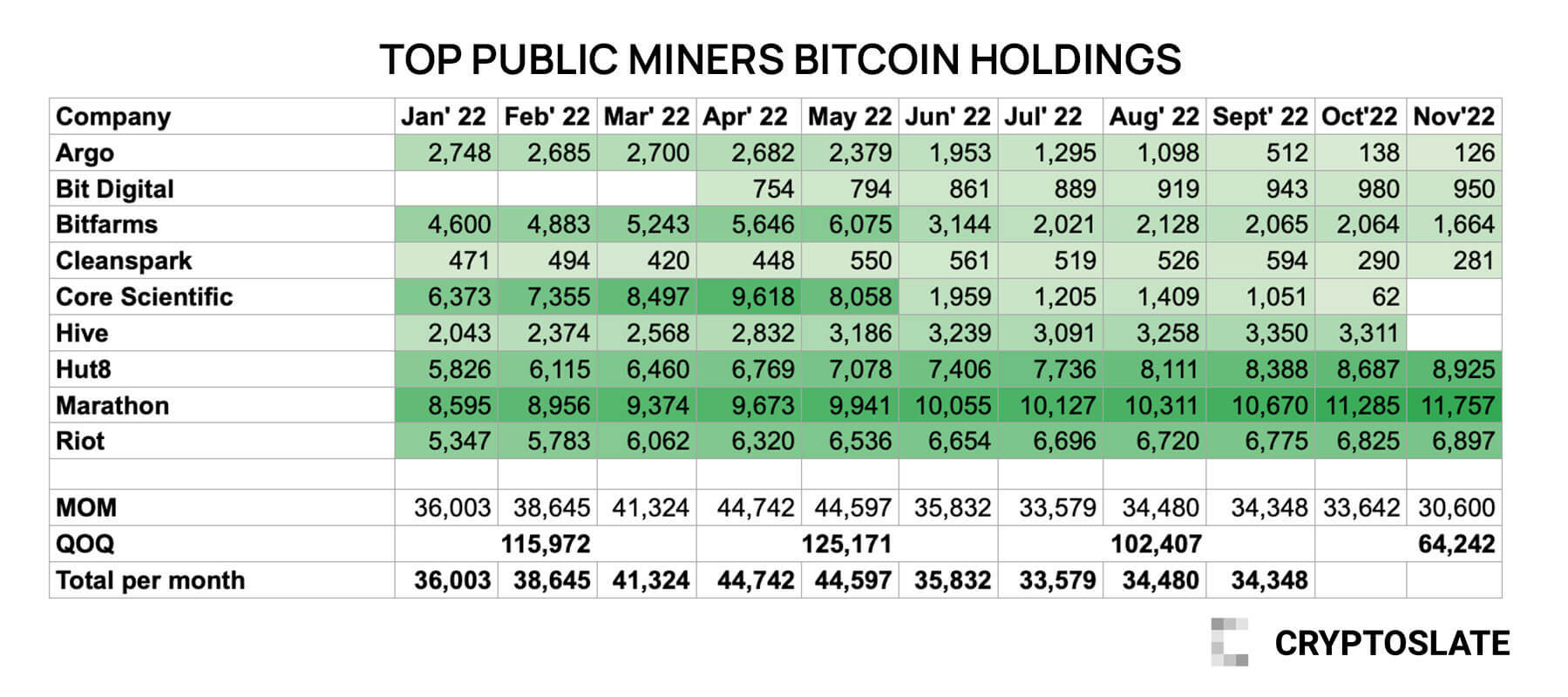

The chart above consists of the highest 9 BTC miners’ month-to-month reserves ranging from January 2022. The numbers present that Hut 8, Riot, and Marathon added 238, 472, and 72 BTC to their reserves in November, respectively.

Then again, Argo, Bit Digital, Bitfarms, and Cleanspark shrank by dropping 12, 30, 400, and 9 BTC in the identical month.

Within the meantime, Hive additionally launched its numbers for November. Sadly, although the announcement mentions 264 BTC for the month of November, it isn’t clearly said whether or not this quantity is mined all through the month or is the dimensions of the BTC reserves as of November. Due to this fact, the chart above leaves Hive’s November knowledge clean.

Progress charges since January

Despite the fact that Marathon at present holds the biggest BTC pool, Hut8 emerges because the miner recording the best progress for the reason that starting of the 12 months.

Hut8 recorded a 53.1% progress since January by rising its reserves from 5,826 BTC to eight,925 BTC. Riot follows Hut8 by recording the second-largest progress of 28.9%, rising to six,897 BTC from 5,347 BTC in January.

Marathon, however, comes third in progress charges. The corporate managed to develop by 16.7% by rising its reserves to 11.757 BTC from 8,595 BTC in January.

Argo and Core Scientific alerts insolvency

In terms of the reserve that shrunk probably the most, Core Scientific claims the primary place on the listing.

Core Scientific shrunk to 62 BTC in October from the 6,373 BTC held in January. This marks a 99% lower in reserves, and the corporate didn’t launch its numbers for November. On Oct. 26, Core Scientific held 24 BTC and round $26.6 million in money. On Nov.23, the corporate launched its quarterly report and acknowledged that it might not be capable of make it till the tip of the 12 months.

Argo carefully adopted Core Scientific because the second mining firm that had probably the most vital drop in BTC held. Argo recorded a 95.4% fall from 2,748 BTC to 126 BTC in 11 months. As well as, the corporate revealed that it’s dealing with liquidity issues because it did not safe a $27 million strategic funding that was supposed to supply liquidity. Argo stated it’s promoting 15% of its shares to a sole investor to get out of this insolvency.

Bitfarms ranks third on the listing by dropping greater than half of its BTC reserves since January. The corporate recorded a 63.8% fall in 11 months, reducing to 1,664 BTC from 4,600 BTC. Lastly, Cleanspark shrunk by 40.3% from its 471 BTC in January by disclosing its November rely as 281 BTC.