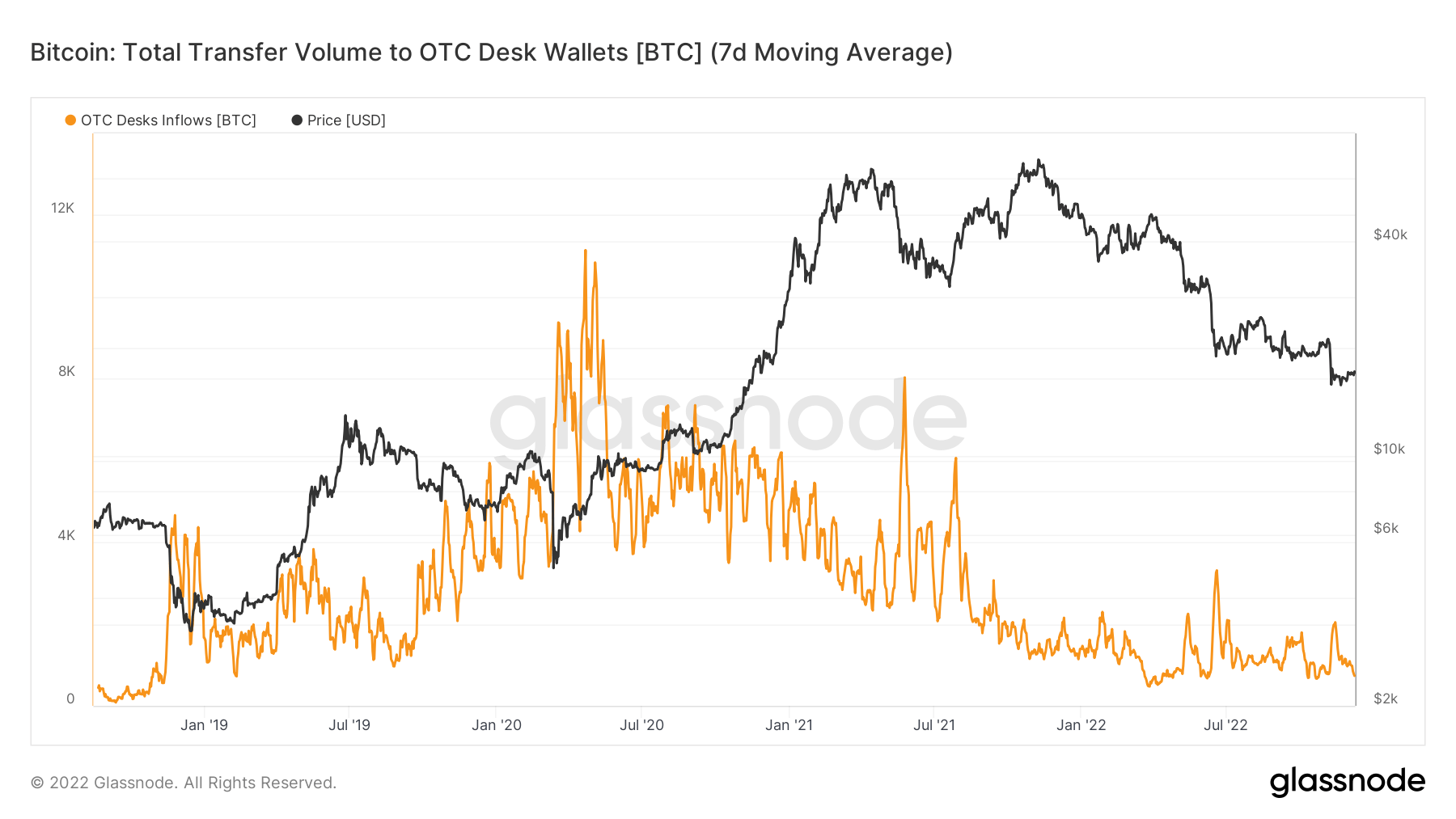

Institutional urge for food for Bitcoin (BTC) has slowly evaporated because of the present bear market scenario and is mirrored within the vital drop in over-the-counter (OTC) trades, in response to an evaluation of Glassnode information by CryptoSlate.

A bull run in 2021 noticed a number of institutional gamers pile into the flagship digital asset, however that curiosity pale as the value plunged to new lows in 2022. Knowledge from three totally different OTC desks confirmed that the movement of funds from this group has slowly evaporated.

Based on River Monetary, an OTC desk acts as a seller for merchants seeking to commerce a given asset which might be securities, currencies, and so forth. They’re often used when a given commerce is unattainable on centralized exchanges.

CryptoSlate’s evaluation confirmed that the seven-day shifting common for whole transfers to OTC desk wallets is now near 2018 lows. OTC trades peaked throughout covid 19 pandemic when BTC was buying and selling at round $3000.

Since then, the market witnessed appreciable spikes all through 2021 however slowed because the yr ended. OTC trades in 2022 noticed a big spike in July when traders had been nonetheless reeling from the Terra ecosystem collapse.

Since then, the 7-Day shifting common for OTC desk inflows has fallen and is now approaching a year-to-date (YTD) low.

Objective ETF has seen no exercise since early August

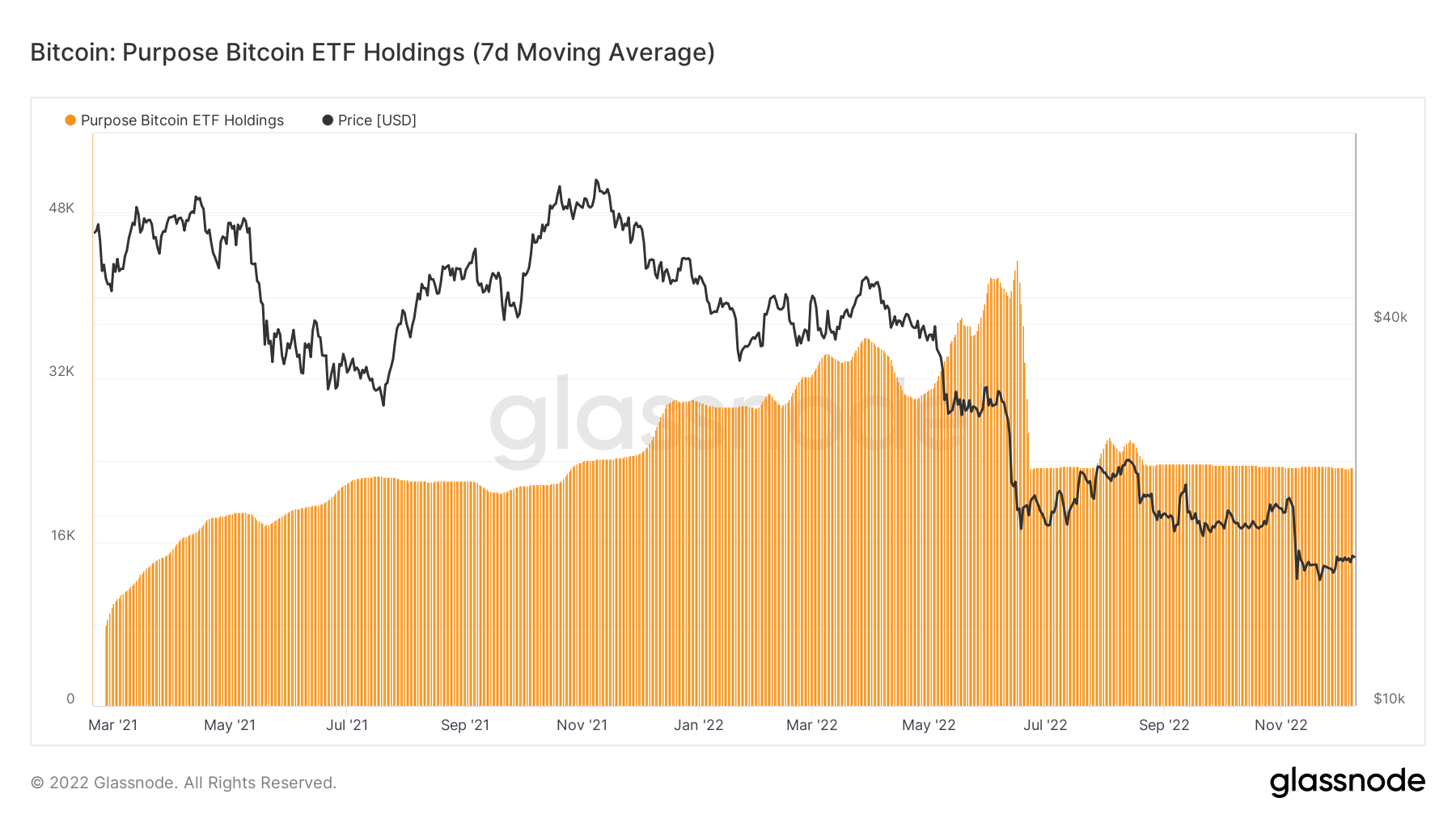

The world’s first Bitcoin ETF, Objective Spot Bitcoin ETF, has had a reasonably quiet yr.

CryptoSlate evaluation revealed that the ETF had not seen any main exercise since late July and early August. Based on Glassnode information on its 7-Day shifting common, Objective ETF BTC holdings peaked between June and July 2022.

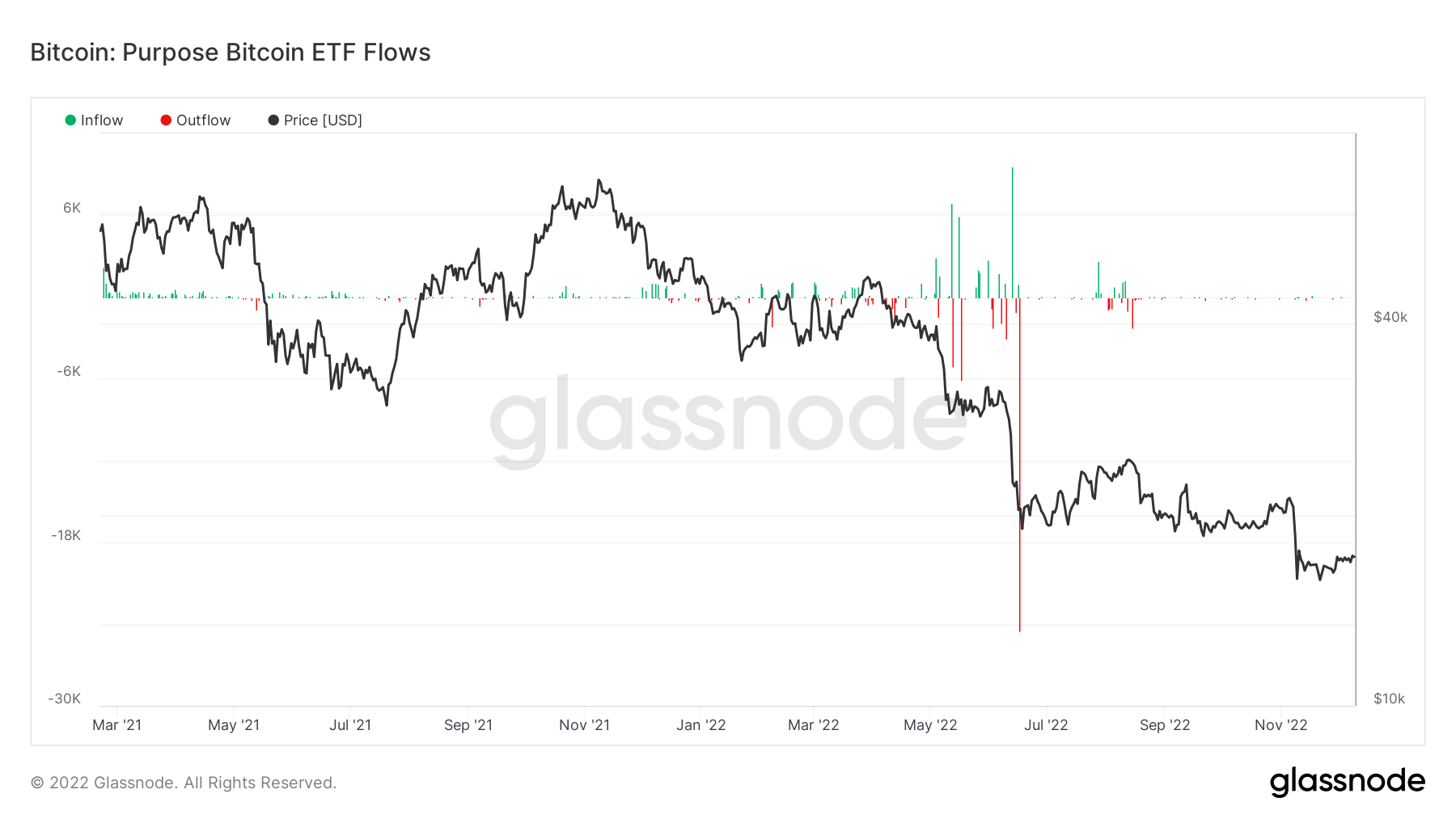

The Glassnode chart on its inflows and outflows confirmed that the ETF had skilled heavy outflows between Could and July 2022, coinciding with when BTC’s worth dipped by 40%. In July primarily, Objective ETF noticed its largest wick of outflow.

It skilled some inflows and outflows in early August and has seen little to no exercise since then.

Regardless of the months of inactivity, the ETF holdings are nonetheless considerably above the degrees in March 2021 when it launched. Based on Objective Make investments, the ETF’s asset underneath administration sits at $396.7 million (23,240 BTC).