Over the previous couple of months, the crypto market has largely been fairly serene. Bitcoin had been in crab movement round $20,000 for fairly some time, because it plodded alongside whereas ready for the broader macro circumstances to make a transfer.

I wrote in late October to be cautious round this worth motion, and that Bitcoin could possibly be one bearish occasion away from an aggressive downward wick. What I didn’t besides was that occasion to be shake crypto to its bones, as one of many blue-chip firms within the area, FTX, inexplicably descended into insolvency.

This clearly shook markets. Final week I assessed how the stream of bitcoins out of exchanges has been fierce, as folks’s belief in these central entities to retailer their cash was understandably at an all-time low.

The truth is, I noticed yesterday that 200,000 bitcoins have left exchanges because the FTX implosion. However now, the information means that the market is calming down a bit. And once more, it looks as if we could enter crab mode till macro gives an impetus a technique or one other – or an surprising crypto-specific improvement comes out of the woodwork.

The primary method to display that the mud is starting to settle is by taking a look at Bitcoin’s volatility. This clearly spiked as Sam Bankman-Fried’s “video games” had been revealed to the general public. However after remaining elevated all through the previous couple of weeks, it has fallen again right down to extra normal ranges in the previous couple of days.

One other method to view that is the falloff in massive transactions. These transactions (outlined as better than $100,000) jumped up within the few days across the chapter, however have fallen steadily since, again to the identical ranges we have now seen all through a lot of 2022.

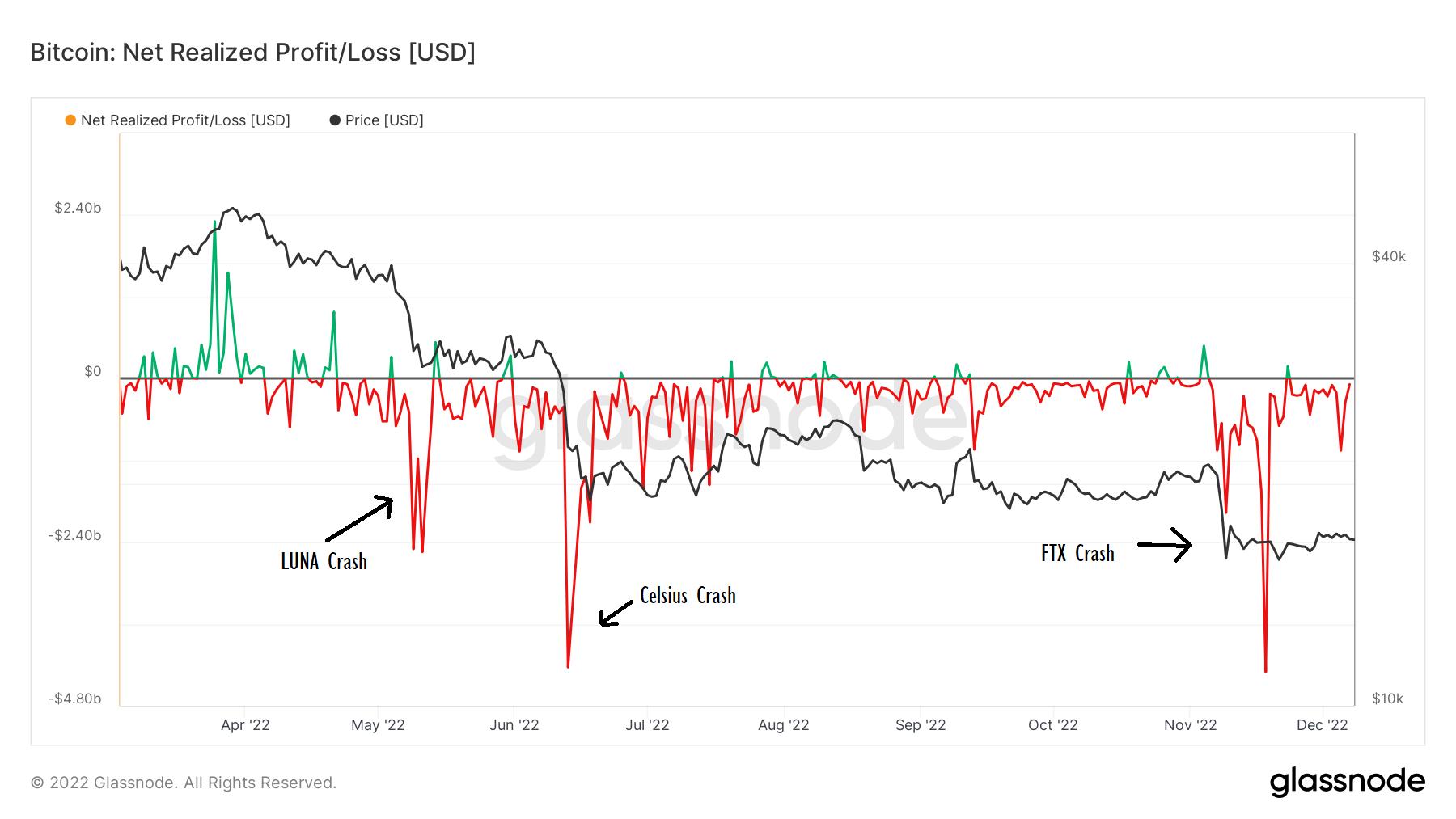

One other helpful metric to trace is the online realised revenue or lack of moved cash. This spikes in instances of disaster as the value abruptly drops, earlier than usually coming again in the direction of the $0 mark because the markets settle down.

The under chart reveals this properly, with trades on November 9th netting an unsightly $2 billion loss, earlier than November 18th then topped this with a $4.3 billion loss. That’s decrease than the worst mark post-Celsius crash ($4.2 billion loss) and Luna ($2.5 billion loss).

This displays the continued downward strain on Bitcoin’s worth, however the development has bounced again as much as near zero once more.

FTX was a central a part of the ecosystem, and its chapter understandably rocked the market. As I wrote lately, this contagion isn’t over.

FTX was a central a part of the ecosystem, and its chapter understandably rocked the market. As I wrote lately, this contagion isn’t over.

But information from the final week or so means that normalcy is returning to the crypto markets. Going ahead, it could tread water once more for some time. With China opening up post-lockdown, the newest inflation numbers imminent and the EU ban on Russian crude imports, macro definitely has rather a lot occurring.

Crypto buyers will simply have to hope that the crypto-native scandals are out of the way in which in the intervening time.