The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets publication. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

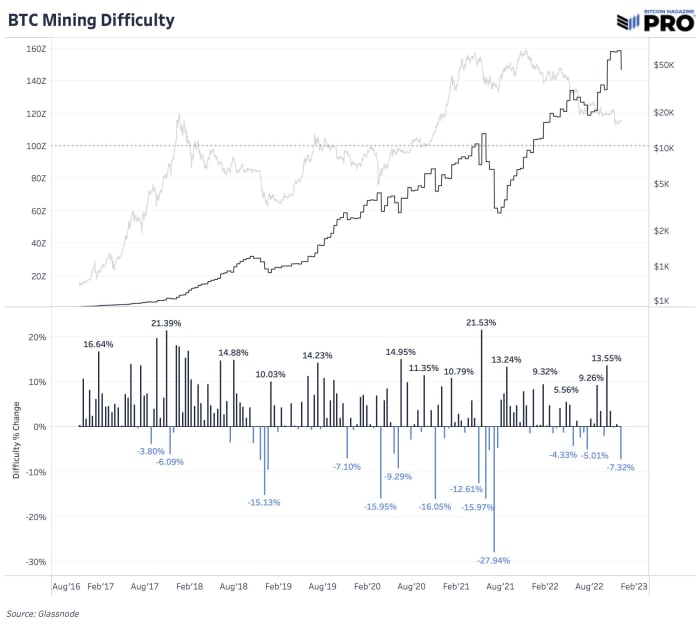

Document Downward Issue Adjustment

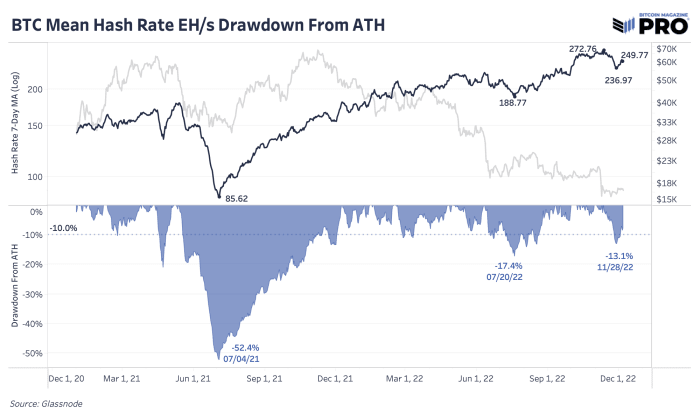

The mining business continues to take a beating as rising power inflation, debt burdens and depressed bitcoin costs take their toll. On the finish of November, we noticed a 13.1% decline in hash charge from all-time highs. Nonetheless, of the foremost hash charge declines since 2016, that’s nonetheless comparatively small in comparison with the handful of down intervals over 15% throughout that point.

The most recent 7.32% downward problem adjustment is a direct response to all of that hash charge going offline. As we stand at this time, the hash charge is true round 250 EH/s and down 7.84% from its all-time excessive of roughly 273 EH/s. That is the biggest downward problem adjustment we’ve seen since July 2021, after we noticed a sequence of downward problem changes following the Chinese language mining ban. This could carry some momentary aid to present miners, however it’s too early to say if this pattern in declining hash charge has already concluded.

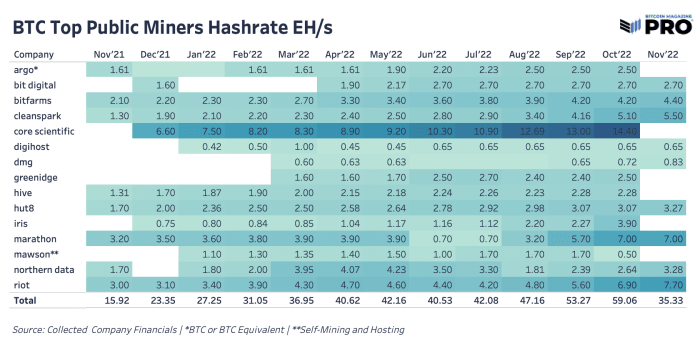

Even with the most recent drawdown in hash charge, we’re not seeing bulletins come from main public miners. Most public miners’ hash charge is both flat or is rising over the past month.

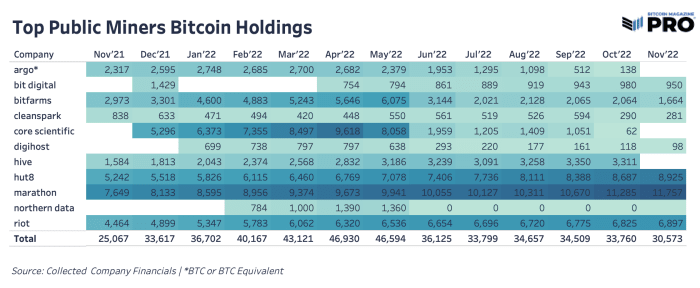

From those that have supplied month-to-month manufacturing updates to this point, bitcoin holdings are largely rising from the largest three treasuries throughout Riot, Marathon and Hut 8 accounting for 27,579 bitcoin. Bitfarms offered a significant quantity from their treasury which is probably going associated to paying down their present debt services.

In bitcoin phrases, miners’ inventory efficiency continues to fall this 12 months when taking a look at year-to-date returns versus bitcoin efficiency. The hash value bear market is alive and nicely, which has been a core thesis for us when evaluating the present prospects of investing in public miners versus bitcoin. Any miner outperformance in bitcoin short-term has confirmed to be a chance available in the market to reprice the fairness decrease.

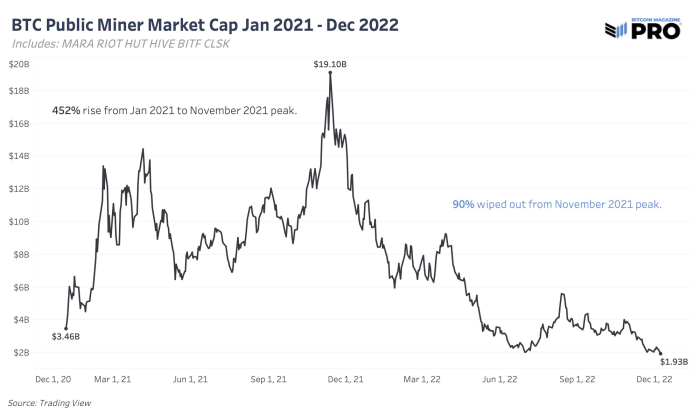

Wanting on the market caps of a proxy basket of six public bitcoin miners exhibits simply how a lot worth has been worn out from 2021. After a 452% rise in worth to its November 2021 peak of $19.1 billion, the market worn out 90% of worth in lower than a 12 months.

Whereas the worst of the drawdown of public miner market capitalizations and hash value (miner income per tera hash) has already taken place, we anticipate that the robust situations can final for a sustained time frame, squeezing many market members alongside the best way. The latest downward problem adjustment caused some aid, however it’s barely enough for a lot of miners who bought the majority of their machines in 2021, anticipating $30,000 as their “worst-case situation.”

Throw in an setting the place world power costs and rates of interest have skyrocketed and plenty of operations are dealing with immensely tough circumstances — notably internet hosting services the place corporations function intermediaries for purchasers seeking to reap the advantages of mining bitcoin. The elephant within the room for the state of the mining business is the truth that a number of the business’s greatest internet hosting services are both already bankrupt, teetering on the sting of chapter or are fully out of deployable hash charge for idle ASICs.

We shall be intently watching hash charge and the state of the mining business going ahead. Though the business has been bludgeoned over the course of 2022, we suspect it isn’t out of the woods fairly but.

The great thing about bitcoin and capitalism is that solely the robust will survive. Regardless, blocks will proceed to be mined each roughly 10 minutes.