That is an opinion editorial by Mickey Koss, a West Level graduate with a level in economics. He spent 4 years within the infantry earlier than transitioning to the Finance Corps.

All the time up, at all times having so as to add extra lest you fall behind. I may really feel the American dream slowly slipping away yearly. We dutifully paid our payments, contributed to retirement accounts, invested prudently and but it felt like yearly issues acquired slightly tighter. Somewhat tougher to contribute what we would have liked to. After we discovered Bitcoin, it gave us hope.

“Placing is mutual struggling. A recreation of rooster. Bitcoin modified the sport. It made hanging beneficial to the striker.”

–Matt Hill on “Bitcoin Audible,” episode 75

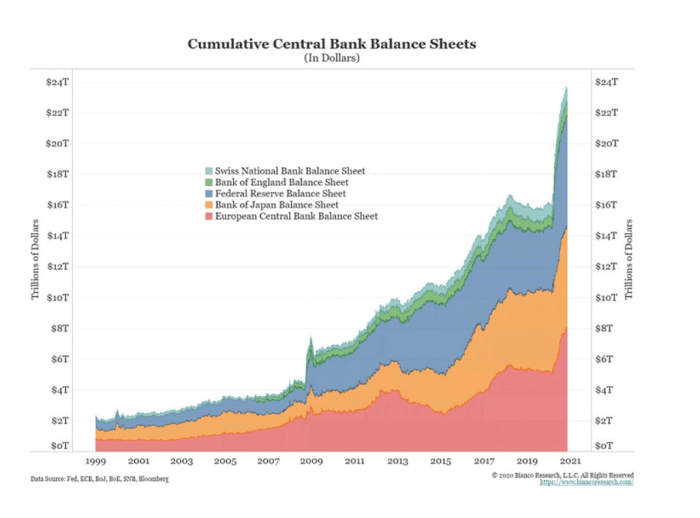

Now my spouse and I are on strike, like a lot of you studying this text in all probability are. As soon as the cash printers began roaring after the COVID-19 lockdowns started in 2020, I felt a sinking feeling that the world would by no means be the identical once more. Ungodly sums of cash have been thrown round on the information stations with such causal indifference. Finally, the outcomes converse for themselves:

We Want Higher Critics

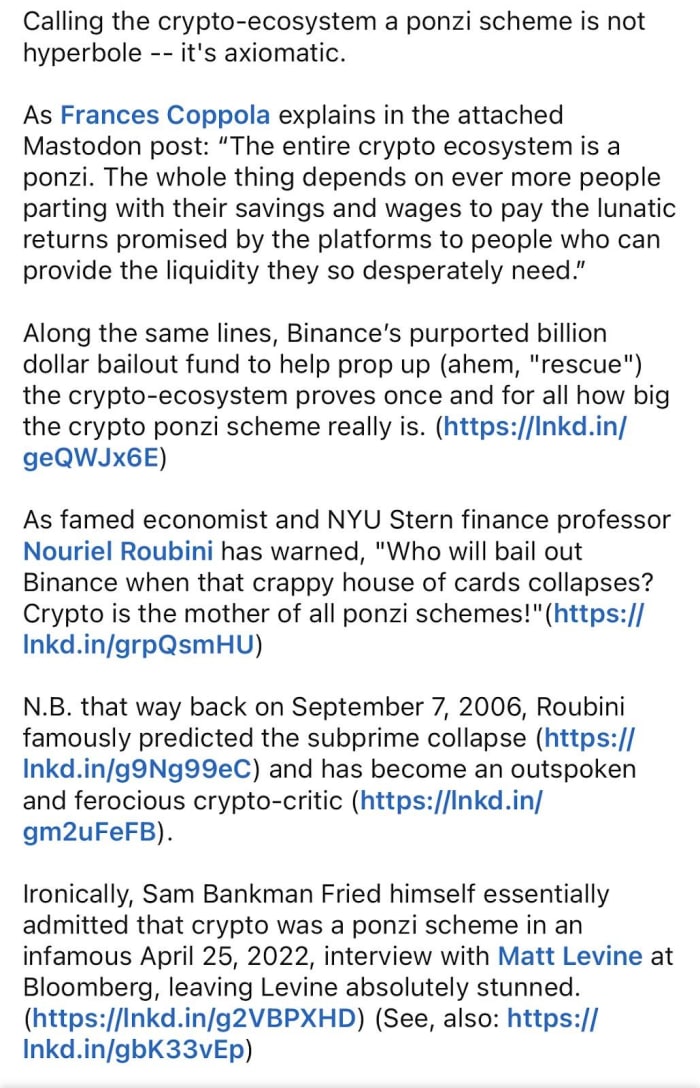

Some of the commonly-cited critiques I hear from seemingly-sophisticated buyers and financial PhDs alike is that Bitcoin is a Ponzi scheme: a recreation of the better idiot shopping for from the scammy huckster as the sooner buyers dump their baggage on the brand new.

The above put up superbly illustrated the entire lack of information, not to mention vital considering, surrounding this specific line of FUD. The abject lack of mental curiosity is astonishing, but someway unsurprising given my current stint in academia:

“The entire thing is determined by much more folks parting with their financial savings…”

Is that this not true for the inventory market? The housing market? The commodities market? By that logic, each market with fluidity of pricing primarily based on provide and demand is a Ponzi scheme. I assume it’s time to return to the barter economic system? Or does the inventory market go up on earnings alone with none patrons or demand?

In truth, It seems to me that costs have been going up sooner than earnings since about 1980, even when taking inflation into consideration:

The above picture depicts the Shiller PE ratio for the S&P 500. It’s the price-to-earnings ratio for the inventory market, however adjusted for inflation. Can anybody say “Cantillon impact”?

Fiat Is The Ponzi

Crypto is a symptom, not the underlying downside. Years of pent up nihilism unleashed into get-rich-quick pump and dumps because the world seemingly falls aside round us. It’s not arduous to see why. However Bitcoin isn’t crypto, and crypto isn’t Bitcoin.

In what now feels just like the blink of a watch, trillions of {dollars} have been created to forestall the system from imploding. Immediately, the inventory market was booming whereas it appeared like all the things was crumbling. I don’t even blame the central bankers. They responded to their incentives and did what they needed to, however the results have been dire. Should you weren’t already invested, you misplaced massive, making it simply that a lot tougher to get your {dollars} to be just right for you, to flee inflation and ultimately escape the rat race.

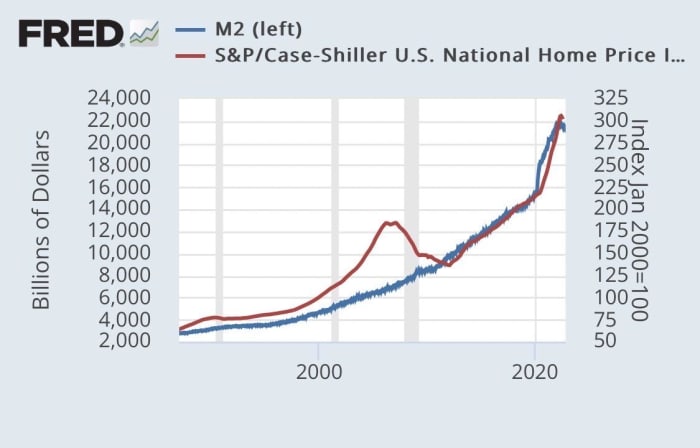

Some of the salient illustrations to me is the under graph. It demonstrates that you can purchase a home, any home, it doesn’t matter. As a result of when you don’t already personal a home, when you select to avoid wasting as an alternative, chances are you’ll by no means truly be capable of afford one. It doesn’t take plenty of empathy to grasp the monetary desperation many are feeling at this time.

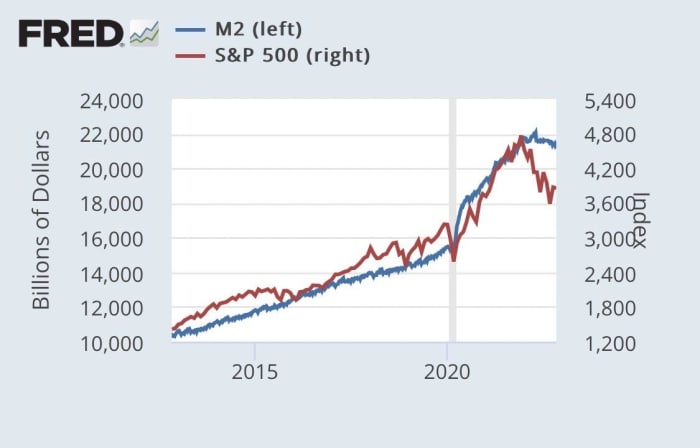

Now, I admit that I’m not an expert statistician, however the charts seem to have some important correlation. Maybe CPI inflation is probably not the one downside. Maybe asset value inflation could also be forcing savers to turn out to be part-time buyers. Provide and demand has a value influence on bitcoin, sure, however does the inventory market not require new cash to help costs as effectively?

Bitcoin Is Financial savings

Financial savings: Cash put by the surplus of revenue over expenditures.

–Merriam-Webster

So, why can’t we simply get monetary savings anymore? The FRED graphs included right here inform all of it. Should you don’t turn out to be an investor, you’ll by no means sustain. That’s, till now.

Bitcoin is our financial savings in a world bereft of issues worthy of funding. Even when it hits $1 million tomorrow, we’re not promoting. What would we even promote it for? To diversify? Into what? A inventory market utterly dependent upon cash printing? An funding property the place our tenants received’t should pay hire following the stroke of a politician’s pen? A shiny rock with “intrinsic worth”?

You see, how may Bitcoin be a Ponzi when Bitcoiners don’t even need your {dollars}? What you don’t perceive is that we’re taking part in a distinct recreation now. What you don’t perceive is that we’re attempting to construct one thing new; a greater future for our kids and grandchildren.

So, when you assume bitcoin is doomed to crash and burn then quick it. Attempt to revenue off our demise, although I don’t assume you’ll.

We are going to simply preserve shopping for and holding, persevering with to front-run you and Wall Avenue, and everybody else who refuses to even attempt to perceive Bitcoin. We maintain no anger or resentment towards you. We don’t need to eat the wealthy, or to burn the system down; we simply don’t need to play by your guidelines anymore. And if we go down with the ship, not less than we misplaced all of it combating for one thing we believed in.

This can be a visitor put up by Mickey Koss. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.