The largest information within the cryptoverse for Dec. 13 consists of the arrest of former FTX CEO Sam Bankman-Fried, the testimony of FTX’s new CEO John Ray on what led to the alternate’s failure and Binance reportedly having billions saved away in secret reserves.

CryptoSlate Prime Tales

The indictment filed by the US Lawyer for the Southern District of New York (SDNY) Damian Williams for the arrest of FTX founder Sam Bankman-Fried consists of eight prison costs.

The fees embrace conspiracy to commit cash laundering, conspiracy to commit wire fraud on clients and lenders, conspiracy to commit commodities and safety fraud, and separate wire fraud on clients and lenders.

The Indictment additionally consists of conspiracy to defraud america and violating marketing campaign finance legal guidelines.

Furthermore, the Securities and Trade Fee (SEC) and the Commodity Futures Buying and selling Fee (CFTC) have each filed separate costs towards the ex-CEO.

Binance CEO Changpeng Zhao was undeterred after $1.4 billion value of belongings had been withdrawn in a day.

Regardless of uncertainties, the CEO believes it’s a good suggestion to “stress check withdrawals” on every centralized alternate on a rotating foundation.

Nevertheless, Nansen, a Hong Kong-based blockchain analytics platform, reported that belongings value $3 billion had been faraway from Binance within the final 24 hours.

Former FTX CEO Sam Bankman-Fried (SBF) claims in his deliberate testimony earlier than the U.S. Home of Representatives Committee on Monetary Providers that he was pressured into submitting for chapter for the FTX corporations by the regulation agency Sullivan & Cromwell, asserting that their motivation for doing so was the potential authorized and consultancy charges.

SBF was set to testify earlier than the U.S. Home of Representatives Committee on Monetary Providers on Dec. 13. Nevertheless, he was arrested within the Bahamas on Dec. 12, on the request of the U.S. authorities.

Forbes obtained a draft of Bankman-Fried’s deliberate testimony and has printed it verbatim.

Within the testimony, SBF makes a declare below ‘Chapter 11’ that he had obtained an “supply for billions of {dollars} to assist make clients entire,” shortly after signing a nomination for John Ray to take over FTX as CEO.

Binance’s publicly reported reserves might solely be a fraction of all of the belongings it holds and the alternate has “more cash than it’s letting on,” a supply informed CryptoSlate, citing folks accustomed to the matter — together with ex-Binance staff.

Sources informed CryptoSlate that “Binance is protected” because the alternate’s CEO Changpeng ‘CZ’ Zhao has disclosed “possibly solely half or a fraction of what he really owns.”

“Within the early days of Binance a lot of the funds had been going on to CZ which implies there’s reserves behind the reserves.”

In regards to the potential lack of transparency round Binance’s reserves, sources stated “you need to be extra nervous if there have been no cash behind CZ.”

FTX CEO John Ray III Dec. 13 testimony to the U.S. Congress revealed that the bankrupt alternate commingled belongings and saved wallets’ non-public keys with out encryption.

In accordance with Ray, FTX’s collapse was attributable to the failure of company controls — the worst he has seen in over 40 years of dealing with chapter instances. He famous that FTX’s operation was concentrated within the arms of a “very small group of grossly inexperienced and unsophisticated people” who did not implement the type of management vital for an organization holding different folks’s cash.

Earlier within the day, FTX co-founder Sam Bankman-Fried was arrested within the Bahamas on the orders of the U.S. authorities. A Dec. 12 press assertion by the Bahamas Lawyer Basic revealed that the U.S. authorities had filed prison costs towards SBF and is prone to request extradition.

The U.S. Lawyer for the Southern District of New York, Damian Williams, confirmed the event. Williams stated SBF “was arrested on the request of the U.S. Authorities, based mostly on a sealed indictment filed by the SDNY.”

Binance recorded over $2 billion in outflows in Ethereum-based tokens since Dec. 12 –its highest each day withdrawal since June– in accordance with Nansen knowledge.

When Binance customers’ withdrew belongings this aggressively in June, the crypto market was reeling from Terra Luna’s collapse.

A separate tweet from the blockchain intelligence platform reported that the alternate recorded over $2.5 billion in withdrawals within the final 24 hours and has a damaging netflow of $1.57 billion. The alternate had an influx of round $935 million throughout this era.

Analysis Spotlight

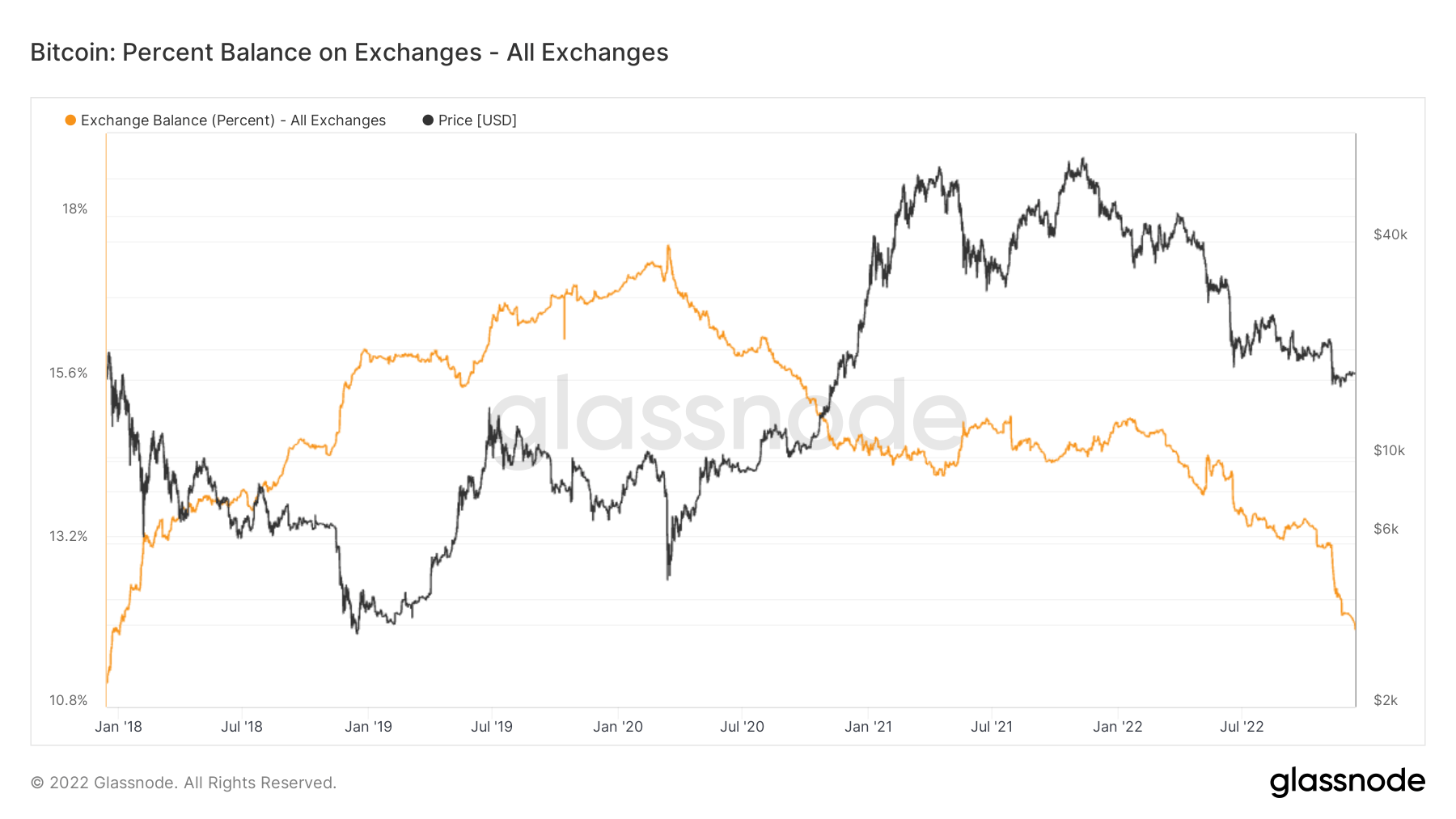

Lower than 12% of the present Bitcoin (BTC) provide is held on exchanges, marking a brand new low since January 2018, in accordance with Glassnode knowledge analyzed by CryptoSlate.

The chart under demonstrates the BTC steadiness held on exchanges with the orange line and begins in Jan. 2018, when the steadiness was simply above 10.8%.

Exchanges’ BTC reserves grew exponentially between Jan. 2018 and Jan. 2020, when the COVID-19 pandemic began. On Jan. 2020, almost 18% of all BTC provide was held on exchanges. After that peak, the quantity of BTC held on exchanges began to shrink steadily and fell as little as at this time’s 12%.

Crypto Market

Within the final 24 hours, Bitcoin (BTC) elevated by 4.01% to commerce at $17,717.64, whereas Ethereum (ETH) elevated by 4.92% to commerce at $1,316.80.

Greatest Gainers (24h)

- Siacoin (SC): +25.91%

- Tribe (TRIBE): +15.32%

- LooksRare (LOOKS): +11.95%

Greatest Losers (24h)

- ABBC Coin (ABBC): -14.69%

- Kaspa (KAS): -14.04%

- Neutrino USD (USDN): -12.6%