Buying and selling quantity on decentralized exchanges (DEXs) hit $32 billion inside seven days in mid-November, recording one other excessive since early June this 12 months. This got here after an explosive, tumultuous week within the crypto business, which drove many buyers — each seasoned and new alike — to take refuge in self-custodial, permissionless and decentralized buying and selling platforms.

Quite a lot of DEX fashions can be found available on the market at current; constructed on the rules of decentralization and monetary freedom for all with out restrictions, DEXs have been welcomed for the next causes:

- Removing of intermediaries supervising trades, the place merchants execute their trades based mostly on immutable good contracts

- Higher safety and privateness as solely merchants are aware of their knowledge and such knowledge can’t be shared/seen by others

- Merchants personal their funds and property, with a number of options for fund restoration within the occasion of platform service suspensions or disruptions.

- No entry restrictions based mostly on geographical places or profiles, i.e., no KYC necessities

- Group-focused, the place stakeholders share within the platform’s income for offering liquidity, staking, and extra.

DEXs corresponding to Uniswap dominated the surge in November 2022, and merchants are spoilt for selection when selecting a DEX to depend on, given the a number of choices available on the market. For seasoned merchants looking for a derivatives different to seize buying and selling alternatives and use each buying and selling sign to the fullest, one might flip to derivatives DEXs — the place margin buying and selling and leverage choices exist for customizable orders on numerous standard contracts.

Right here’s a comparability of three derivatives DEXs which have proven up on merchants’ radars not too long ago, two of that are acquainted to most merchants — dYdX and GMX. The final DEX we’ll be taking a look at is the newly-launched ApeX Professional, which has more and more gained consideration after its beta launch again in August with recorded 6,000% development in buying and selling quantity.

Let’s dive into the element

dYdX is a number one decentralized change that helps spot, margin and perpetual buying and selling. GMX is a decentralized spot and perpetual change that helps low swap charges and 0 value affect trades and works on a multi-asset AMM mannequin. And at last, ApeX Professional is a non-custodial spinoff DEX that delivers limitless perpetual contract entry with an order e book mannequin.

Comparability Standards

For this text, we’ll be trying broadly at these three measures: (1) safety and privateness, (2) transaction and price effectivity, and lastly, (3) token ecosystems and reward-generating choices.

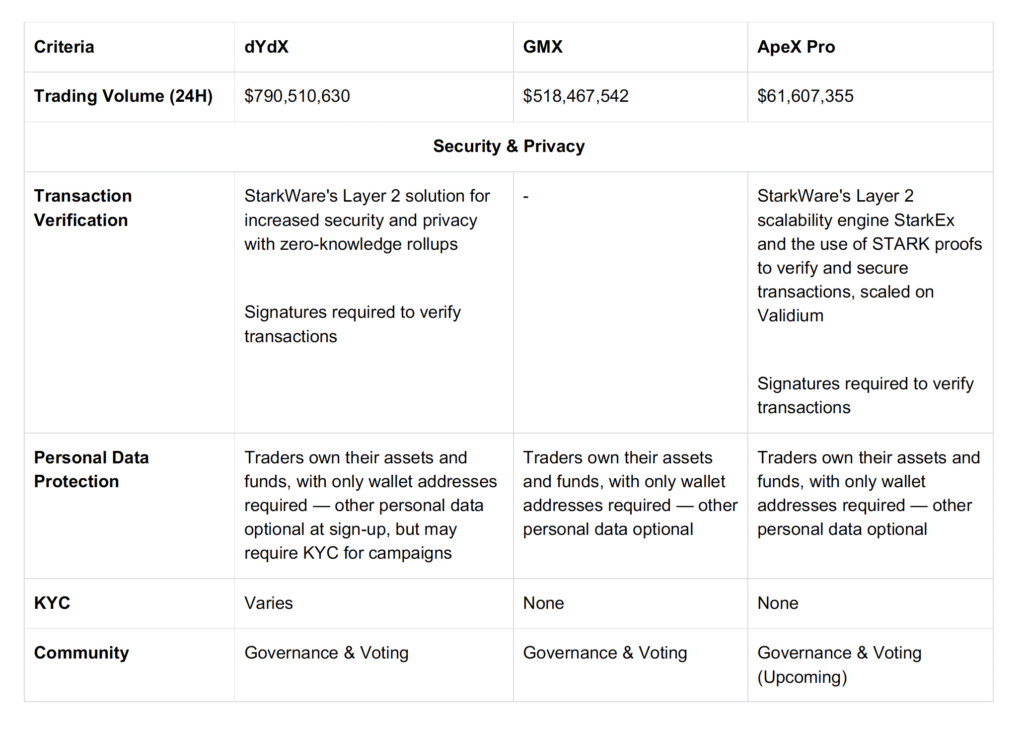

The above is a non-exhaustive checklist of notable highlights from the respective DEXs. dYdX and GMX are dealer favorites for good causes, so let’s see how the brand new ApeX Professional fares towards the opposite two DEXs.

(1) Safety & Privateness

All three DEXs are on comparatively equal grounds concerning privacy-preserving measures, of which self-custody of funds is a standard denominator throughout — the significance of a buying and selling platform that’s non-custodial is plain in mild of current occasions.

Particularly, each dYdX and ApeX Professional have added safeguards with the combination of StarkWare’s Layer 2 scalability engine StarkEx, permitting the customers of each DEXs to entry compelled requests to retrieve their funds even when the DEXs should not in service. Moreover, STARK proofs are utilized in each dYdX and ApeX Professional to facilitate the correct verification of transactions, whereas GMX depends on the protection provisions of Arbitrum and Avalanche.

DEXs are identified for his or her privacy-preserving measures, which is why GMX and ApeX Professional, in true decentralized style, are absolutely non-KYC. dYdX, however, has, on a earlier event, carried out KYC to assert rewards for a specific marketing campaign.

One other notable issue can be the provisions for governance and group discussions — on dYdX and GMX, pages to host votes and discussions are available. At current, nevertheless, ApeX Professional continues to be working in direction of creating their community-dedicated house for people to hold out actions corresponding to voting and placing up solutions.

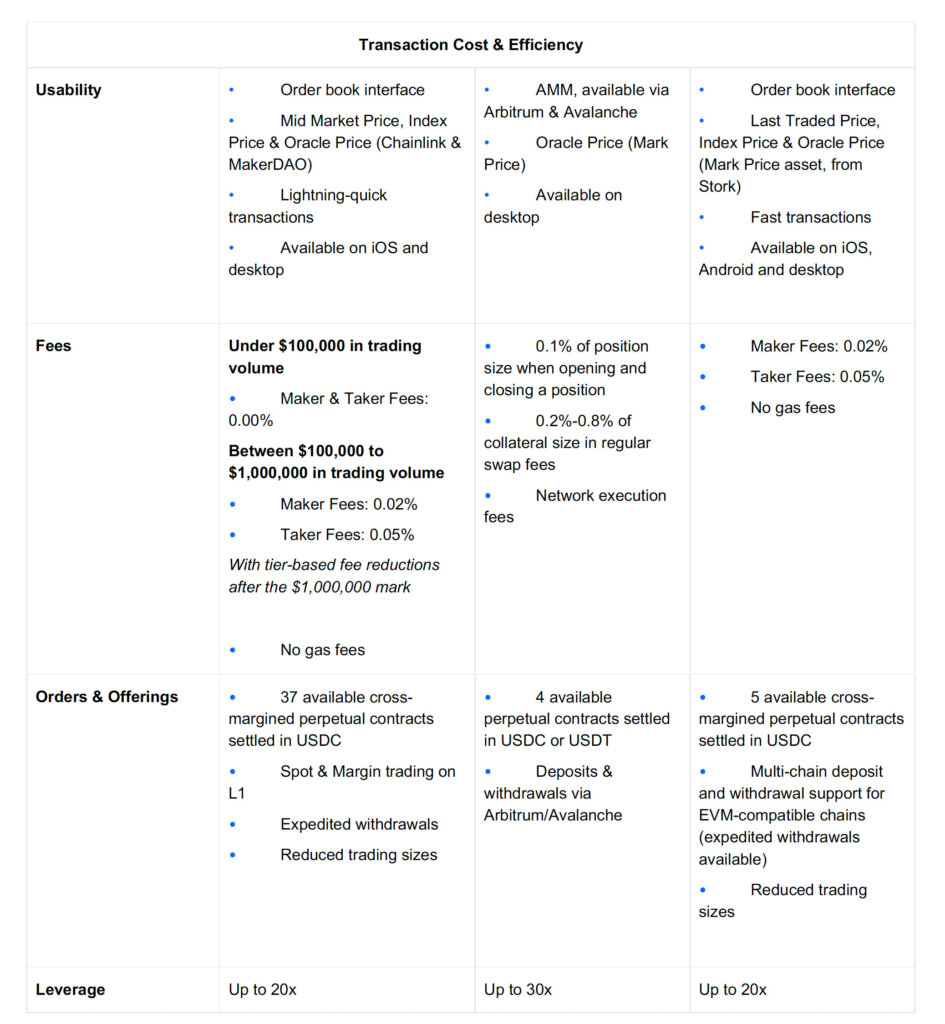

(2) Transaction Value & Effectivity

ApeX Professional has determined to go together with the orderbook interface that’s discovered mostly in CEXs, and like dYdX, this buying and selling mannequin works as a result of it removes the barrier to entry for conventional and aspiring crypto merchants to step into DeFi. It additionally makes use of three value sorts which assist to forestall market manipulation. Nevertheless, it might be as much as a dealer’s desire to see Mid-Market Value (dYdX) or Final Traded Value (ApeX Professional) for extra correct trades.

With StarkWare’s integration, it’s no shock that ApeX Professional amped up on transaction speeds to course of roughly ten trades and 1,000 order placements each second at no fuel charges, along with the low maker and taker charges. dYdX’s tiered charges are extremely complete and cater to completely different dealer’s completely different buying and selling sizes; with none fuel charges, it’s unsurprising that derivatives DEX merchants have regarded primarily at dYdX.

These tiered charges are additionally acquainted to derivatives merchants on CEXs. GMX, however, does cost community execution charges, which signifies that fuel charges paid by the dealer for his or her commerce could range in accordance with market components.

ApeX Professional doesn’t have tiered charges simply but however contemplating that it simply launched in November, differential charges are prone to drop quickly with an upcoming VIP program, the place the staked quantity of APEX will decide the low cost utilized to maker-taker charges.

For merchants on the lookout for selections in buying and selling pairs, dYdX stays the DEX with the best variety of perpetual contracts whereas additionally offering entry to identify and margin buying and selling on the similar time on Layer 1 Ethereum. ApeX Professional and GMX don’t provide as many perpetual contracts as dYdX. Nonetheless, with new buying and selling pairs being launched continuously, it’s solely a matter of time earlier than merchants get entry to multitudes of property and pairs on the remaining DEXs.

What could be notable for all is ApeX Professional’s help for multi-chain deposits and withdrawals on EVM-compatible chains; that is actually a plus level for merchants who have interaction in dynamic trades throughout a number of platforms, chains and asset classes in crypto.

(3) Tokens & Rewards

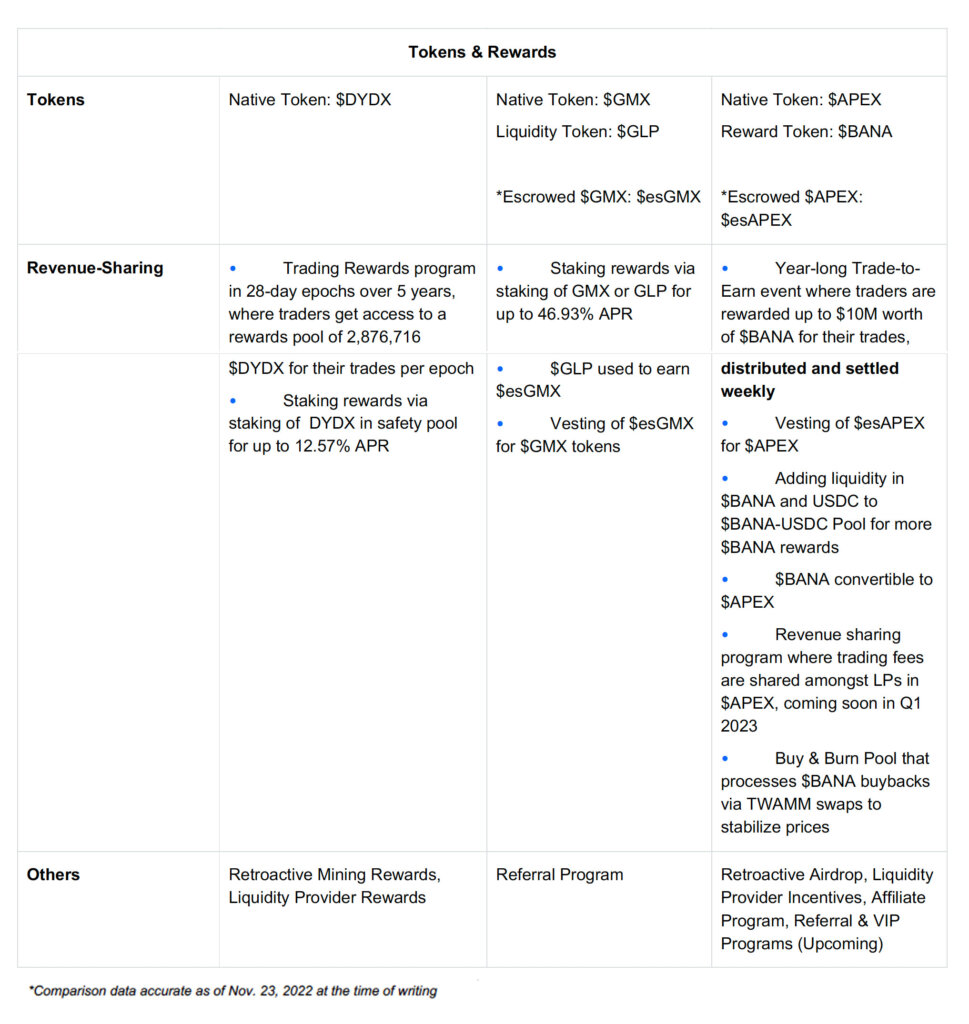

Of all components, that is in all probability the one that almost all merchants are thinking about — how every DEX helps to a number of rewards and earnings whereas guaranteeing that these rewards stay helpful to the person dealer over time.

With dYdX and GMX, the success and recognition of buying and selling occasions to earn rewards and staking incentives are obvious. It’s paramount for DEXs to allow entry to revenue-sharing applications for his or her group members and token holders, which generally contain the distribution of buying and selling charges accrued over a single interval. Rewards and incentives are sometimes distributed within the platform’s native tokens.

dYdX’s choices are simple, with a Buying and selling Rewards program that distributes 2,876,716 $DYDX to merchants based mostly on their buying and selling quantity in 28-day epochs. On prime of that, customers may stake $DYDX in a pool to obtain further staking rewards. This dual-earning observe stays successful amongst merchants. GMX, however, has taken group rewards ahead by using escrowed tokens in its staking program to stabilize additional and maintain the worth of the reward tokens that their merchants obtain.

ApeX Professional follows in GMX’s footsteps by enriching its token ecosystem with escrowed and liquidity tokens, which permits for extra dynamism in maximizing token worth and sustaining long-term token use instances for the group than utilizing a single token for all DEX initiatives.

With a complete provide of 1,000,000,000 $APEX, 25,000,000 $APEX has been minted to create $BANA. With ApeX Professional’s year-long Commerce-to-Earn occasion and weekly reward distributions in $BANA, merchants get to swap rewards for tangible incentives in USDC, and in addition redeem $APEX tokens after the occasion ends. Merchants may add liquidity to a $BANA-USDC Pool in change for LP Tokens, which they’ll then change for extra $BANA.

Furthermore, ApeX Professional maintains the soundness of $BANA’s worth with a Purchase & Burn Pool, guaranteeing that its customers’ holdings of both token are maximized at any time. $190,000 value of $BANA shall be distributed weekly for a 12 months — a fast and straightforward settlement that each dealer can actually recognize.

Conclusion

Improvements in DEX structure within the nascent DeFi business abound as DEXs discover their footing in a world dominated by CEXs. It’s excellent news for merchants as a result of they’ll select DEXs based mostly on the provisions that swimsuit them most or draw their most popular advantages throughout numerous platforms. With the expansion, it has seen inside its first week of mainnet launch and an ecosystem that mixes the most effective of options on present DEXs, ApeX Professional is one to be careful for in 2023.

Ending with a quote as regular.

“Blockchain-based tasks ought to return to their roots – decentralization. Decentralization is right here to remain and it’s the future.”

– Anndy Lian

Visitor submit by Anndy Lian from Mongolian Productiveness Group

Anndy Lian is a enterprise strategist with over 15 years of expertise in Asia. Anndy has labored in numerous industries for native, worldwide, and publicly traded corporations. His current foray into the blockchain scene has seen him handle a few of Asia’s most outstanding blockchain corporations. He believes that blockchain will rework conventional finance. He’s presently Chairman of BigONE Change and Chief Digital Advisor on the Mongolian Productiveness Organisation.

Study extra →