Reflexity Analysis cofounder Will Clemente tweeted on Dec. 5 that stablecoins had been one of many few crypto use instances which have discovered product market match regardless of the present market situation.

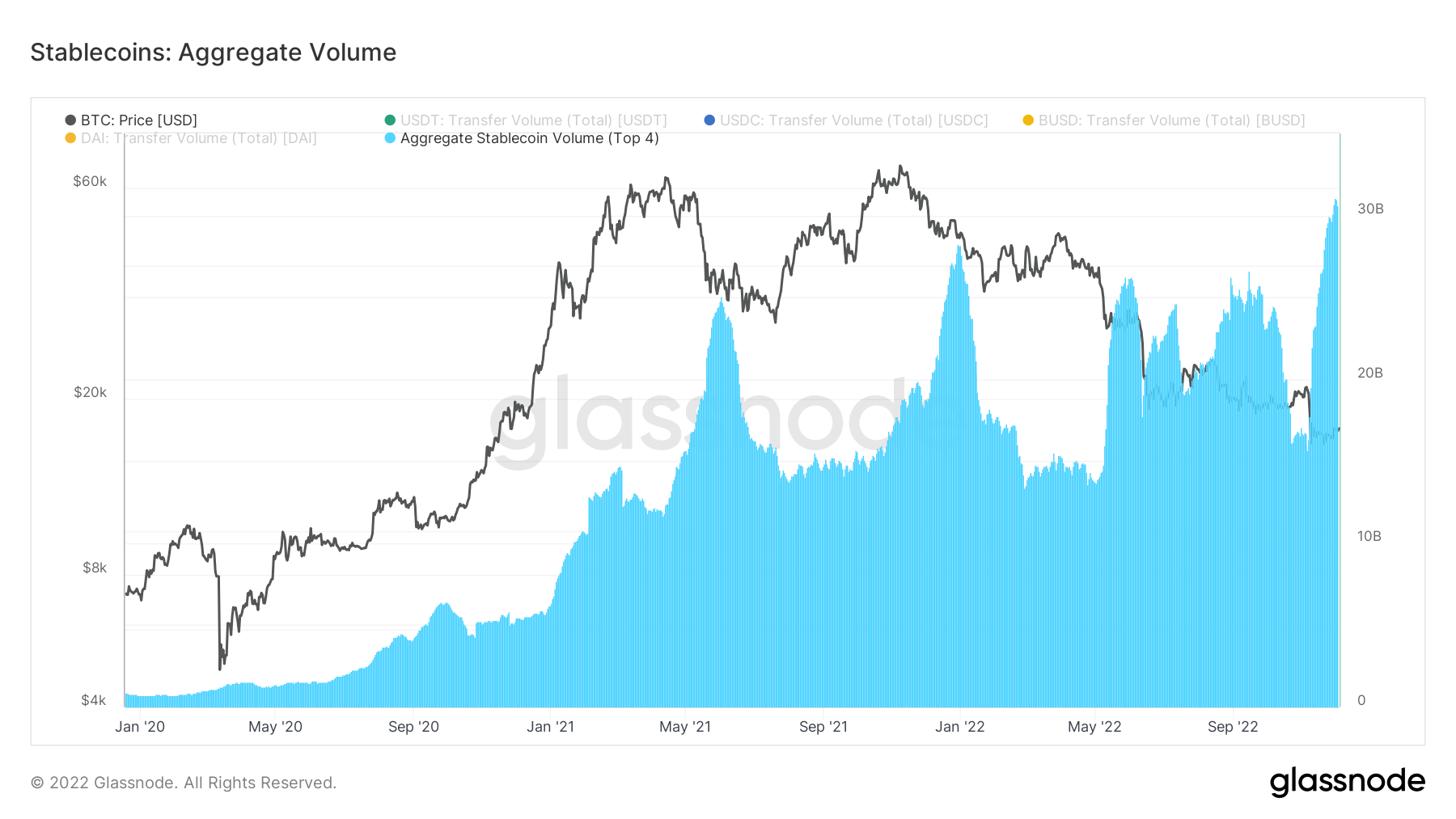

Stablecoin mixture quantity reaches ATH

Citing Glassnode knowledge, Clemente mentioned stablecoin’s progress was evident in a number of areas. This included the mixture quantity reaching an all-time excessive regardless of the crypto winter.

The Glassnode chart under exhibits that the mixture quantity for the highest 4 stablecoins surpassed $30 billion just lately.

In line with the chart, stablecoin’s mixture quantity throughout the previous yr first spiked above $20 billion through the Terra LUNA collapse round Might and June.

Whereas it spiked above the mark round September too, it dropped under $20 billion in October. Nevertheless, the current FTX implosion has seen it surge above $30 billion.

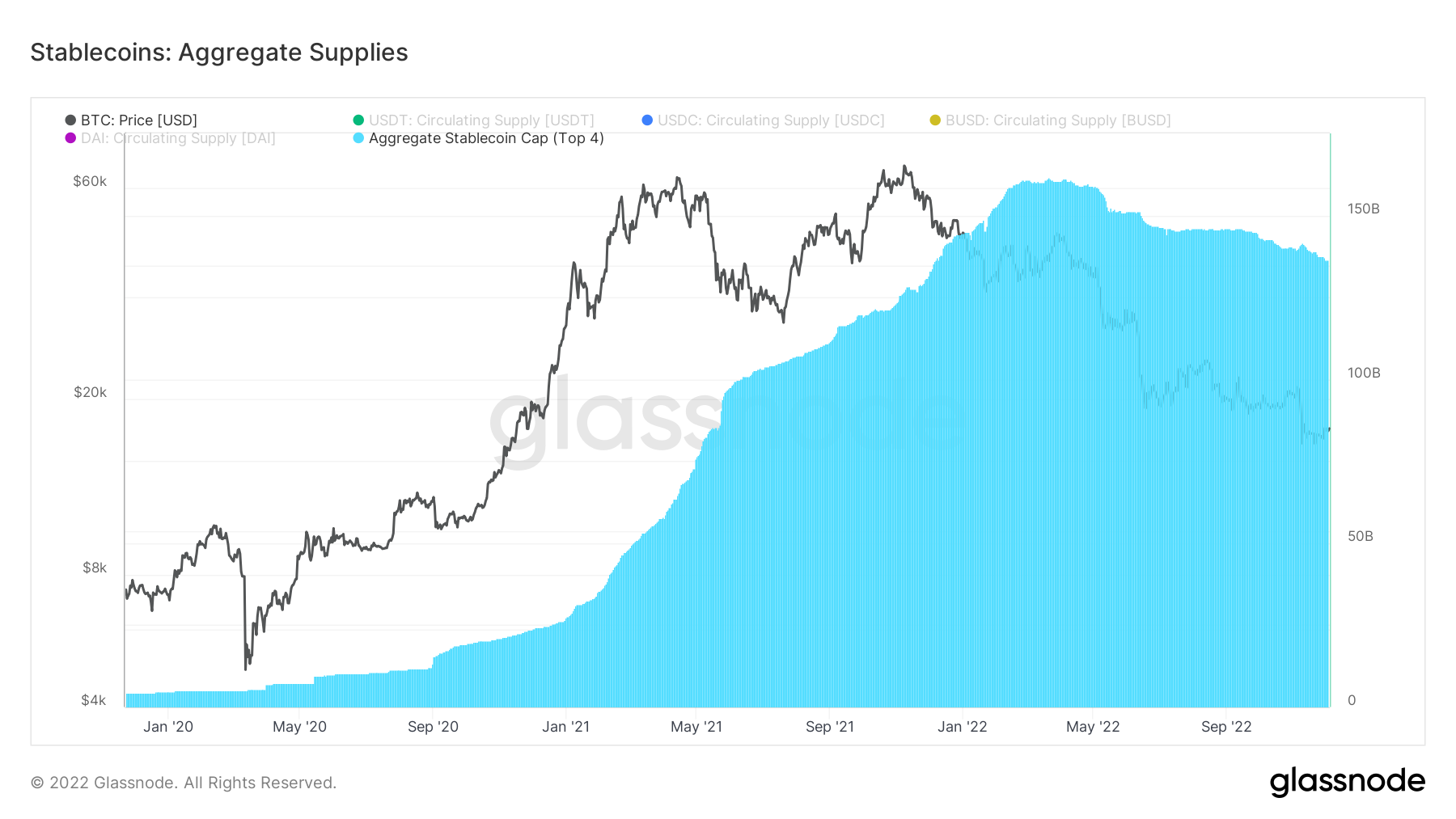

Stablecoin mixture provide on the up

The mixture provide for stablecoin can also be near an all-time excessive, based on Glassnode knowledge.

The mixture provide reached an all-time excessive of over $150 billion earlier within the yr earlier than the Terra-related market crash. Whereas the decline has steadily declined since then, the provision continues to be above $100 billion.

For context, the provision for Binance-backed BUSD grew from $18 billion initially of the yr to over $22 billion. USD Coin (USDC) provide additionally crossed the $50 billion mark earlier within the yr earlier than dropping to its present ranges.

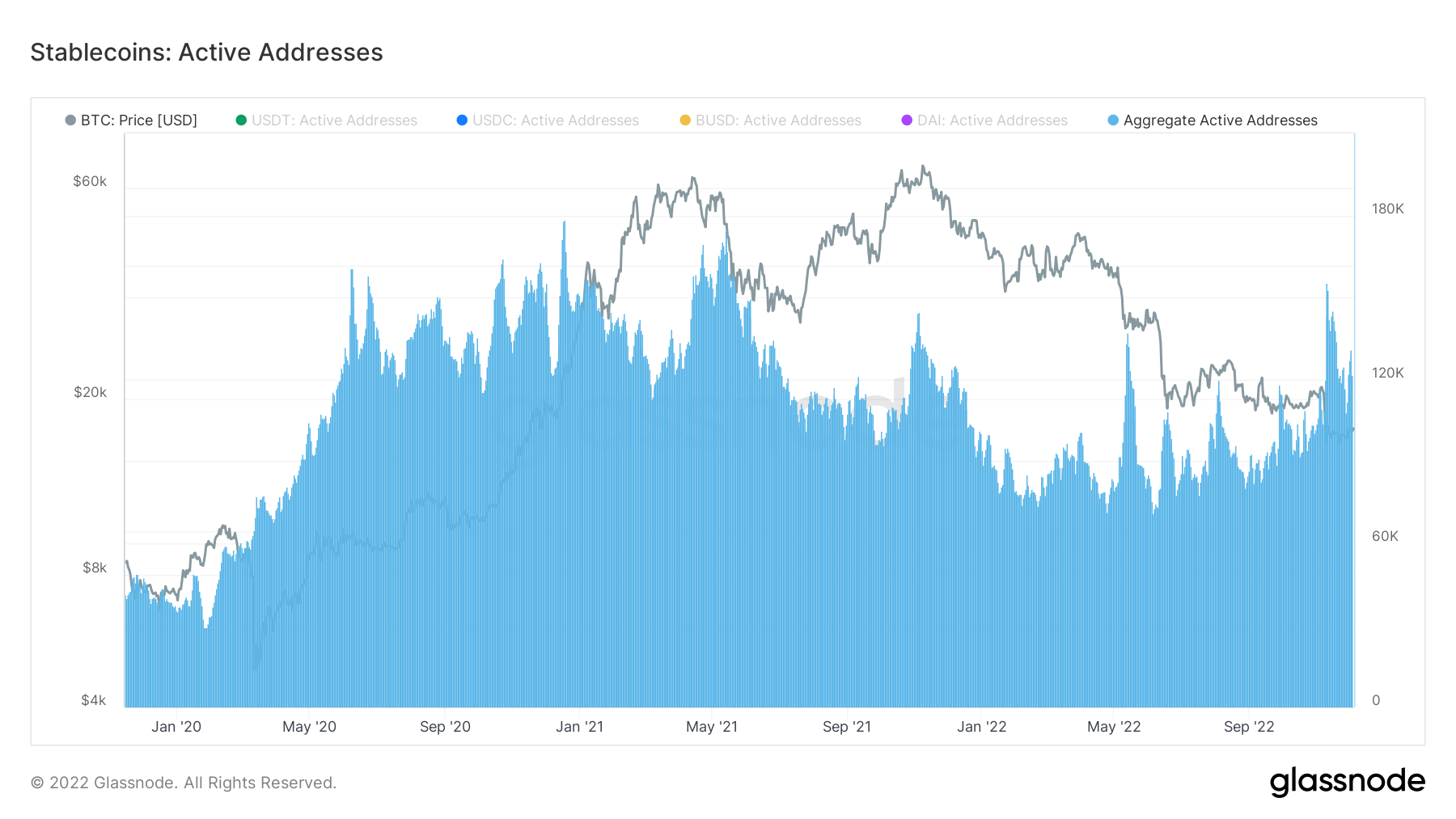

Stablecoin lively addresses rise

In the meantime, the variety of stablecoin lively addresses has returned to its 2021 peak. In Might 2021, there have been over 150,000 mixture lively addresses.

Nevertheless, the variety of lively returned to that stage through the second half of 2022 because the crypto traders handled the fallout of Terra’s crash and FTX’s implosion.

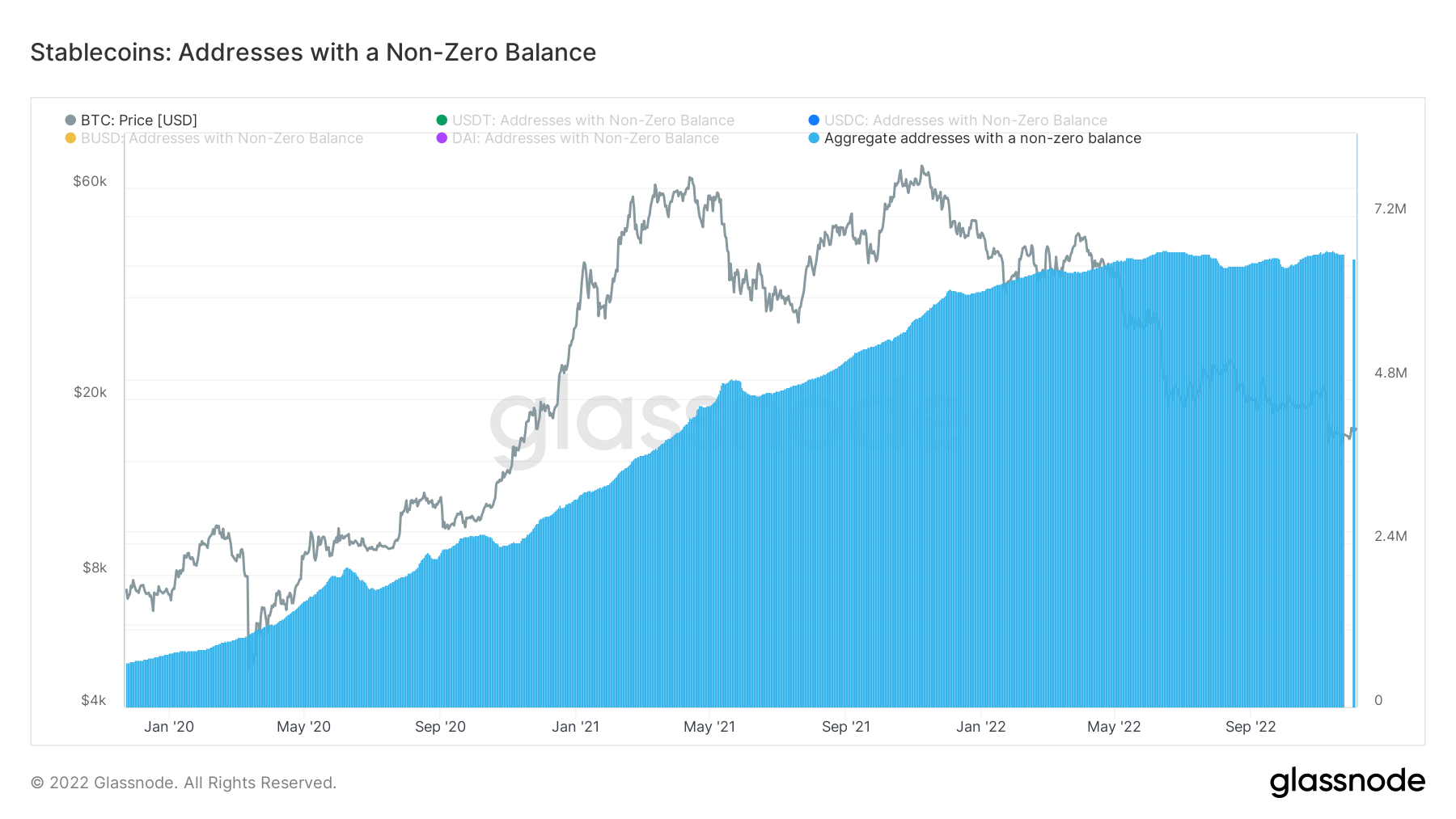

In the meantime, the variety of addresses with a non-zero steadiness can also be at its peak presently at over 6 million.

Clemente believes all of this was due to stablecoin use instances, which included “capital effectivity in crypto, giving entry to USD to these with out banking, amongst different causes.