As rumors about Argo’s attainable chapter proceed to unfold, extra details about what prompted the corporate’s troubles are unraveling.

The U.S.-based Bitcoin mining firm has seen its shares plummet within the second half of the yr because it struggled to maintain a constructive money move. In October, Argo didn’t safe a $27 million strategic funding that was supposed to enhance its liquidity place.

On the time, the corporate stated it was persevering with to search for an answer to its money drawback, however famous that it may fail to resolve its points. Initially of December, Argo by chance revealed a petition for chapter.

A screenshot of a particular announcement for Argo’s stakeholders was reportedly leaked, exhibiting that the corporate is perhaps making ready to file for chapter.

In line with a current report, Argo’s failure to safe a fixed-price PPA earlier this yr may very well be what prompted its issues.

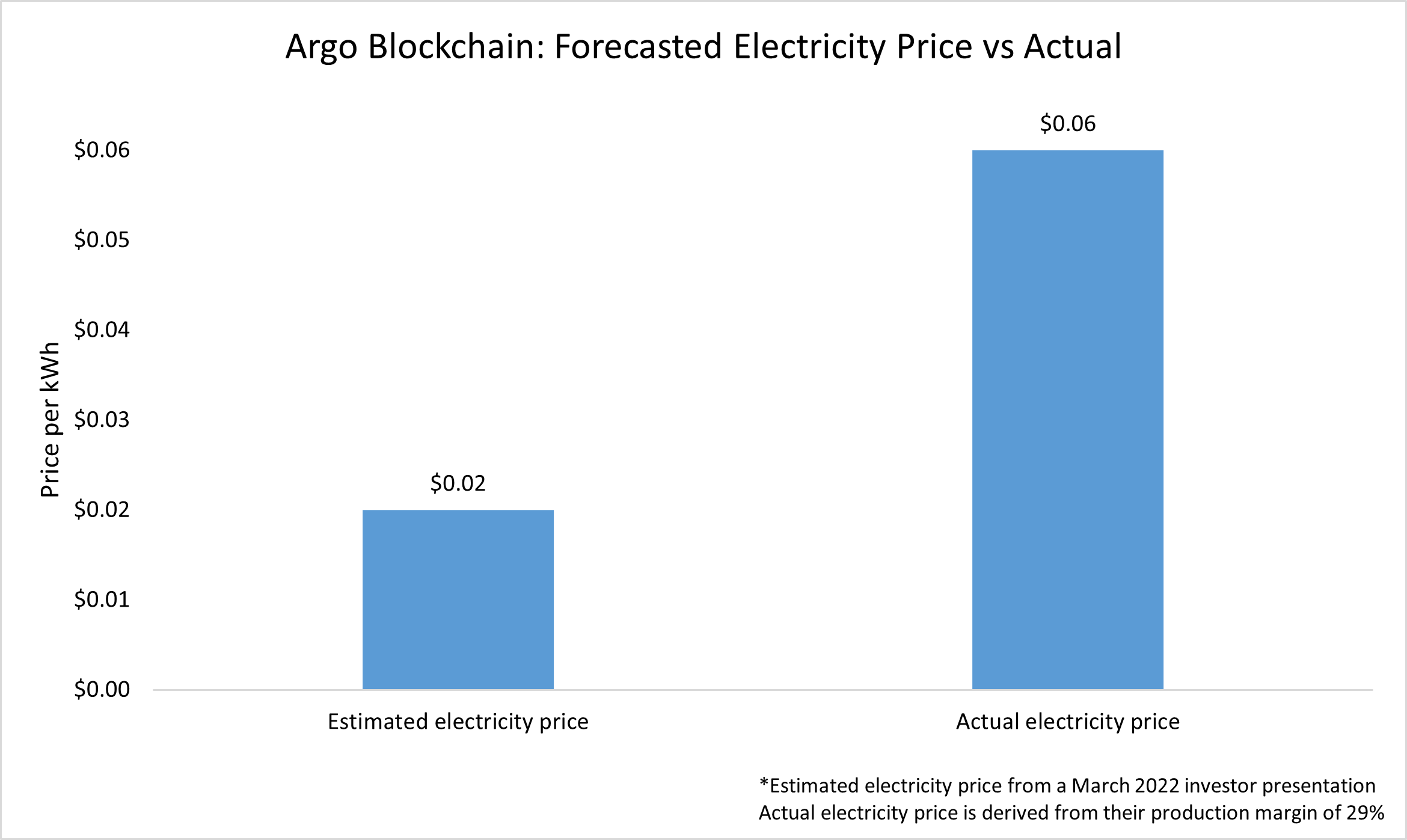

Jaran Mellerud, a analysis analyst with the Hashrate Index, famous that Argo said they’d entry to electrical energy priced at $0.02 per kWh. The quantity was reportedly shared in a March 2022 investor presentation.

That is from Argo’s investor presentation from March 2022. Their said electrical energy value of $0.02 per kWh grew to $0.06 per kWh. pic.twitter.com/dcObBxAj1n

— Jaran Mellerud (@JMellerud) December 12, 2022

Nevertheless, analyzing Argo’s November manufacturing report confirmed that the electrical energy value the corporate pays is definitely $0.06 per kWh. The precise electrical energy is derived from Argo’s reported manufacturing margin of 29%.

The threefold improve in electrical energy value led to a considerably greater improve in manufacturing value. In line with the report, Argo’s electrical energy value of mining 1 BTC is round $12,400. If the corporate paid $0.02 per kWh because it said in its investor pitch, the price of mining 1 BTC can be round $4,000.

Growing the electrical energy value from $0.02 to $0.06 per kWh leads to an enormous improve in manufacturing value.

Argo’s electrical energy value of mining 1 BTC is $12.4k. It might solely be $4k in the event that they paid $0.02 per kWh. pic.twitter.com/Vm4vhHs1eH

— Jaran Mellerud (@JMellerud) December 12, 2022

The vast majority of Argo’s mining operation is positioned in Texas. The Electrical Reliability Council of Texas (ERCOT), the group working Texas’s electrical grid, has seen its electrical energy value skyrocket because the starting of the summer season. This meant that the $0.02 per kWh value Argo touted to traders was short-lived.

Bitcoin miners are recognized to safe fixed-price energy buy agreements (PPAs), a contract between power consumers and sellers that ensures a set value for each kilowatt of power. These contracts present Bitcoin miners with much-needed value stability as they take away one of many largest variables from their manufacturing prices.

It now appears that Argo didn’t safe a fixed-price PPA when increasing to Texas and skilled huge losses when the value of electrical energy started rising.