Dec 2022, CoinGecko and Footprint Analytics Joint Report

There may be an underlying assumption that your entire NFT market is fraudulent in nature and solely consists of wash merchants. Sadly, we regularly see media headlines pushing this narrative. In any case, why would folks spend thousands and thousands of {dollars} on a JPEG?

There may be an underlying assumption that your entire NFT market is fraudulent in nature and solely consists of wash merchants. Sadly, we regularly see media headlines pushing this narrative. In any case, why would folks spend thousands and thousands of {dollars} on a JPEG?

Wash buying and selling is the act of a dealer shopping for and promoting the identical asset repeatedly to govern the buying and selling volumes and the value of an asset. Events concerned might encompass a single entity or a collusion of entities. It’s unlawful in conventional capital markets to scrub commerce, because the intent is commonly to mislead different patrons/sellers that the asset is value much more than it’s and that there’s an artificially liquid marketplace for the asset.

Crypto, particularly NFTs, doesn’t have strict rules, and wash buying and selling can generally be rampant. Along with the explanations acknowledged above for wash buying and selling, two different causes are distinctive to NFTs: tax loss harvesting and incomes token rewards.

Wash Buying and selling For Worth/Liquidity Manipulation

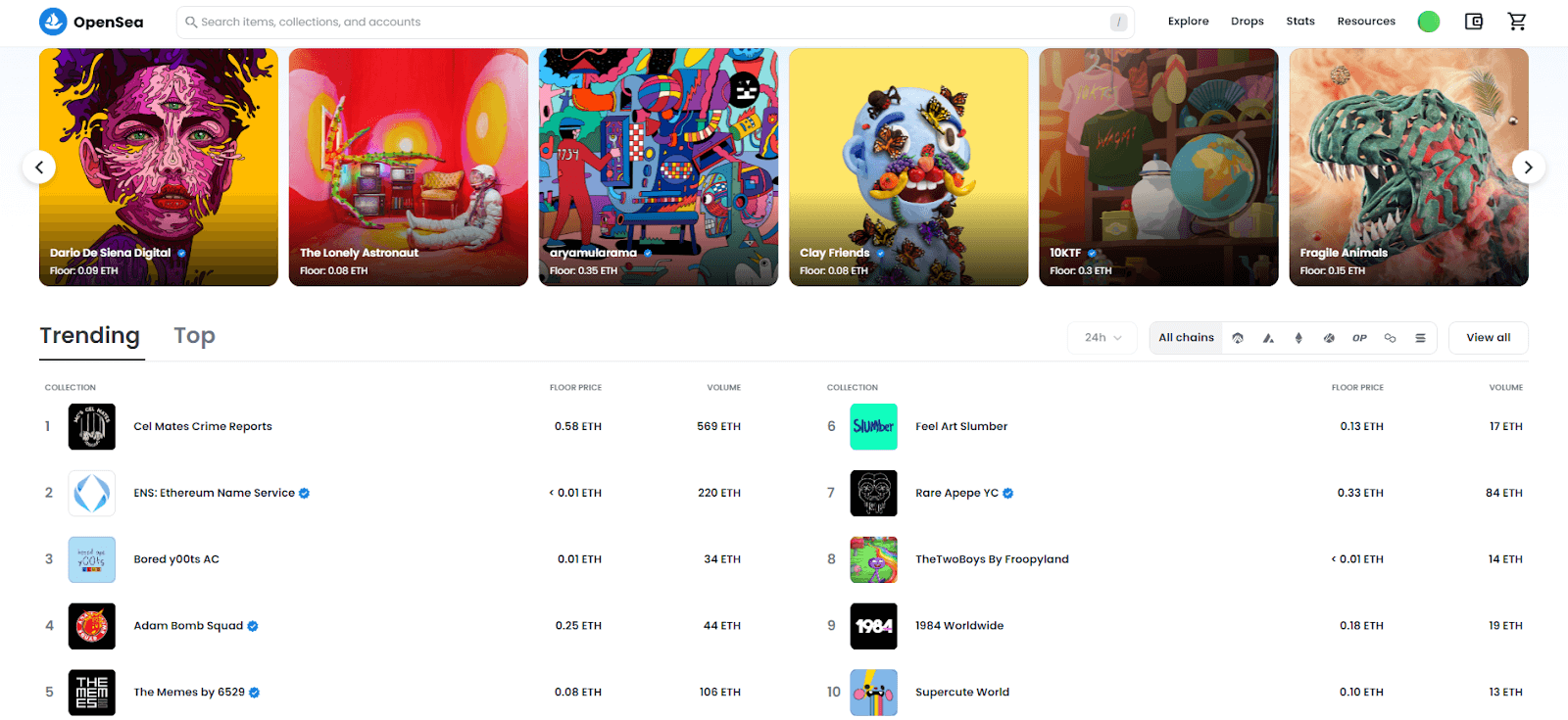

Consideration is every little thing for NFTs. In an area the place collections reside and die by the hour, founders will do no matter they’ll to draw eyeballs and create momentum. The best strategy to garner consideration is by showing on the entrance web page of NFT marketplaces. OpenSea, LooksRare, Magic Eden, and so on., all have a touchdown web page that showcases trending collections.

Whereas not one of the marketplaces are express about how their trending algorithms function, it’s clear that buying and selling volumes are a big issue for inclusion on the Trending Collections checklist. This incentivizes NFT assortment founders to scrub commerce to pump their buying and selling quantity numbers, thereby growing the possibility of their collections being listed on Trending. Sadly, Wash buying and selling additionally offers a misunderstanding of liquidity, producing false confidence that there’s demand and hype surrounding their NFTs. Inevitably, this will likely entice unsuspecting patrons into shopping for their NFTs at an inflated worth.

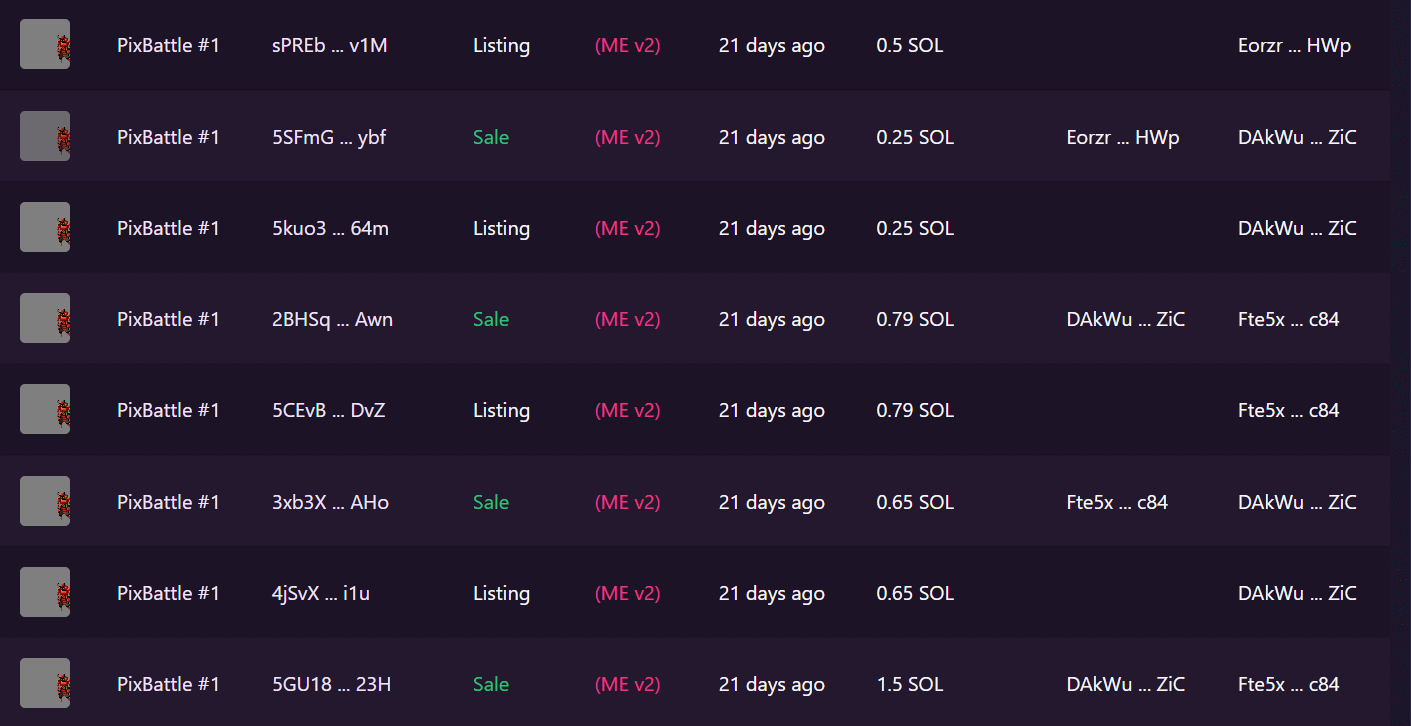

One instance that now we have recognized is PixBattle #1, a gaming venture who stylized itself as the primary pixel recreation on Solana.

The screenshot above exhibits {that a} single NFT was repeatedly traded between two addresses over a day. There is no such thing as a purpose for this to happen aside from to falsify buying and selling quantity and curiosity. The dealer additionally didn’t hassle to attempt too exhausting to cover their tracks by repeatedly utilizing the identical two addresses. Furthermore, utilizing the NFT with the #1 ID (thereby indicating it was minted first) raises the probability that the dealer was in all probability a founding father of the gathering who knew firsthand when it could be launched.

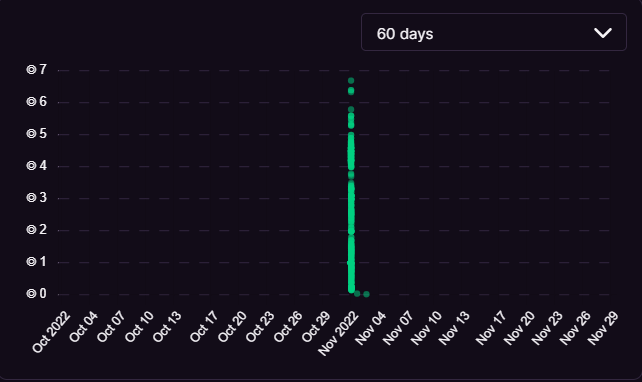

If we take a look at the chart on Magic Eden, we are able to see some unwitting suspects shopping for the highest earlier than liquidity dried up in a single day and the gathering went to 0.

Figuring out Wash Trades

Whereas it’s near unimaginable to establish all collections that perform wash buying and selling because it entails filtering an intensive knowledge set primarily based on qualitative elements, these are some widespread indicators to look out for:

- Assortment trades at a persistent worth stage (i.e., no outlier buys for ‘rares’).

- Assortment has excessive buying and selling quantity / is trending however has low visibility / poor social media metrics (e.g., low Twitter follower rely)

- An NFT was purchased greater than a traditional quantity of occasions in a day (at Footprint Analytics, we estimate this to be greater than 3+)

- An NFT was purchased repeatedly by the identical purchaser tackle over a brief interval, say 120 minutes.

Wash Buying and selling For Harvesting Tax Losses

Another excuse for wash buying and selling is for tax loss harvesting. Sure jurisdictions, such because the US and Europe, deal with NFTs as capital belongings and impose some type of capital positive aspects tax. Which means merchants pay tax on positive aspects however can sometimes offset funding losses within the remaining tax calculation. Nevertheless, this solely applies when the investor has realized their positive aspects and losses, i.e., they should promote their belongings. Below these circumstances, patrons who purchased the highest however are actually down badly could also be incentivized to promote their NFTs at a loss to offset positive aspects they could have made in different capital belongings. Technically, tax-loss harvesting is neither unusual neither is it an unlawful phenomenon. Nevertheless, due to the benefit with which NFTs may be wash traded, we imagine this warrants a point out.

It’s straightforward to promote an NFT to a different pockets that you just really management ‘at a loss’ on an NFT market. Setting the value at a nominal quantity (e.g., 1 USDC) permits the consumer to reap tax losses whereas possessing the supposed ‘disposed of’ asset. Sadly, the dearth of regulatory oversight over NFT marketplaces and the problem of proving tax fraud encourage this system.

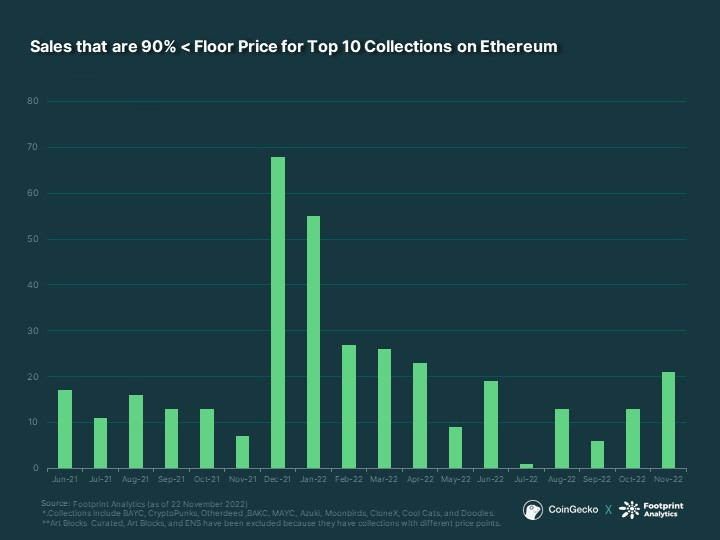

If we take a look at the Prime 10 Collections on Ethereum, we are able to see that there are actors within the house who do reap the benefits of this. We now have filtered the transactions primarily based on gross sales under 90% of the ground worth on the time.

Trying on the gross sales sample, the very best month-to-month gross sales occurred in December 2021, adopted by January 2022. Coincidentally, that is the shut of the tax reporting interval for a lot of jurisdictions. It’s in all probability protected to imagine that the majority (if not all) of those transactions concerned some intent to reap tax losses throughout this era as asset holders put together to file their tax returns.

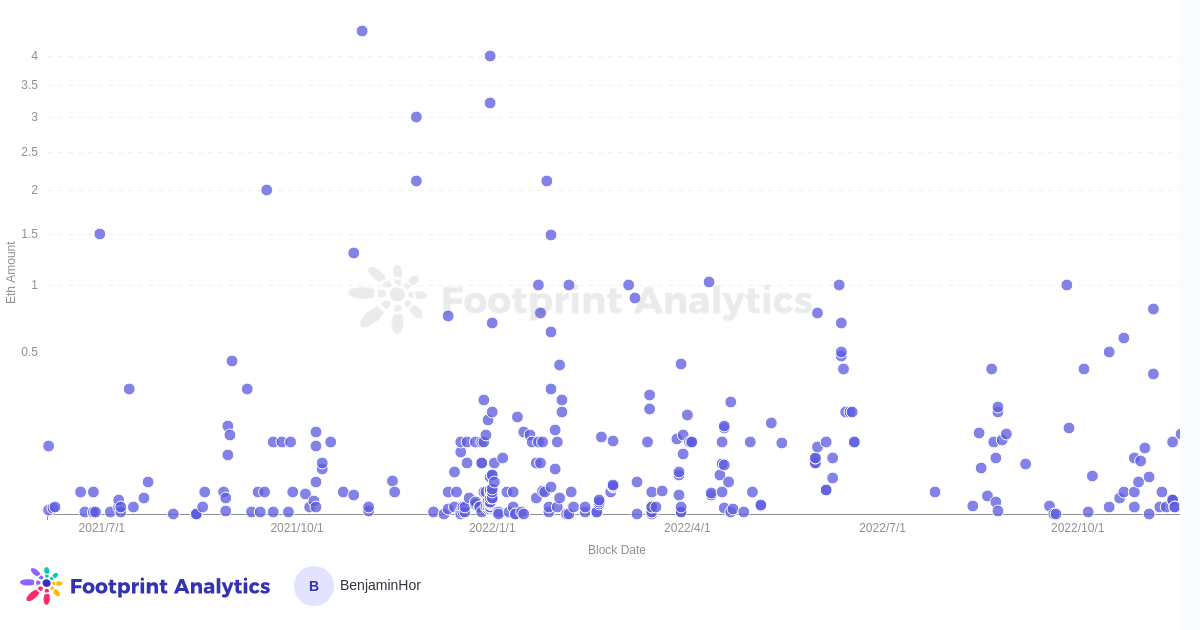

Inside the Prime 10 ETH Collections, the highest three favourite collections for harvesting tax losses are MAYC (117), Cool Cats (74), and CloneX (61). Moreover, wash merchants beneath this class appear to promote at meager costs, i.e., under 0.5 ETH and most near 0, making them apparent outliers for any on-chain observers.

However, it’s value mentioning that there could also be different causes for having these low-priced gross sales, equivalent to incorrect itemizing costs and promoting to somebody at a reduction.

Wash Buying and selling For Tokens

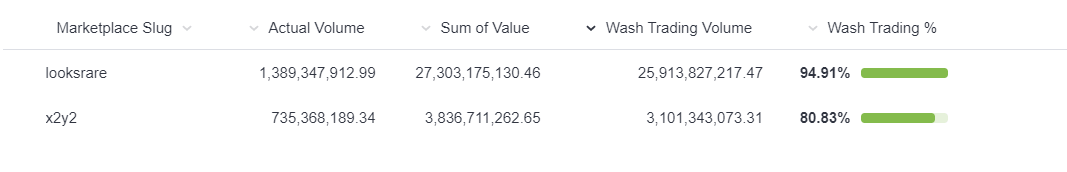

LooksRare and X2Y2 are probably the most well-known NFT marketplaces with their very own token. Presently, tokens are distributed to high-volume merchants on their respective platforms. Wash merchants reap the benefits of this system and maximize their rewards by producing appreciable buying and selling quantity each day by back-and-forth buying and selling between wallets they personal. To establish these kinds of transactions, now we have filtered transactions on each LooksRare and X2Y2 in response to the next system:

- Overpriced NFT trades (10x OpenSea Common Worth)

- Collections with 0% royalties (besides CryptoPunks and ENS)

- An NFT purchased greater than a traditional quantity of occasions in a day (at present filtered for greater than 3+)

- An NFT bought by the identical purchaser tackle in a brief interval (presently filtered for 120 minutes)

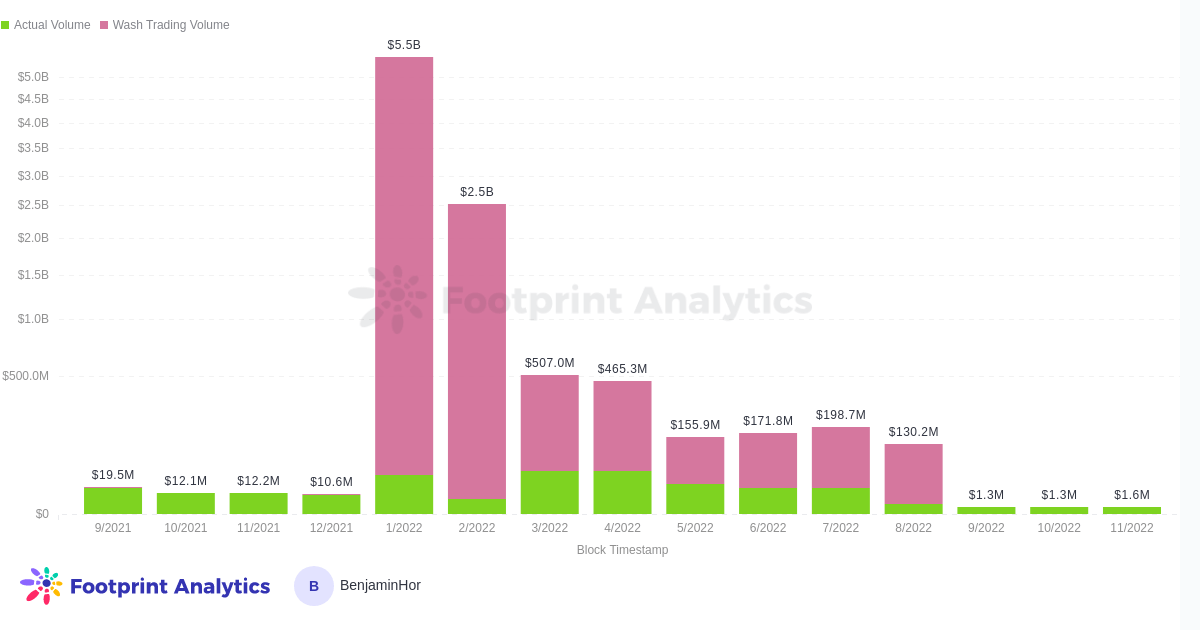

Making use of these filters, plainly greater than 80% of the buying and selling quantity for these two marketplaces are wash buying and selling transactions since launch:

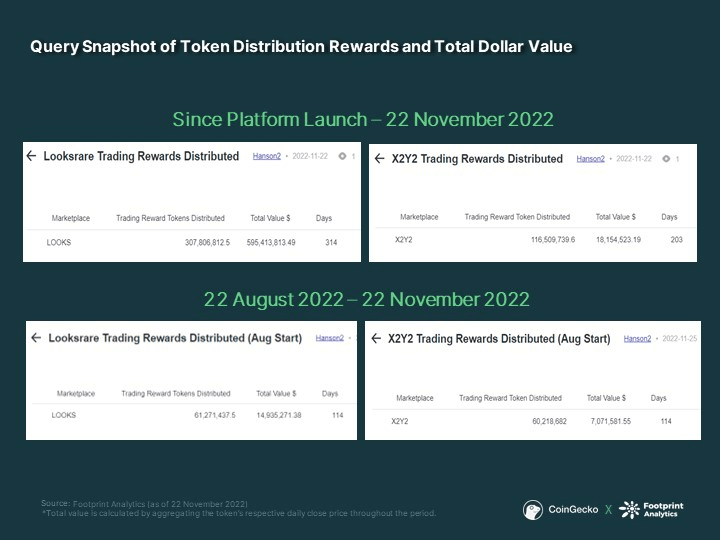

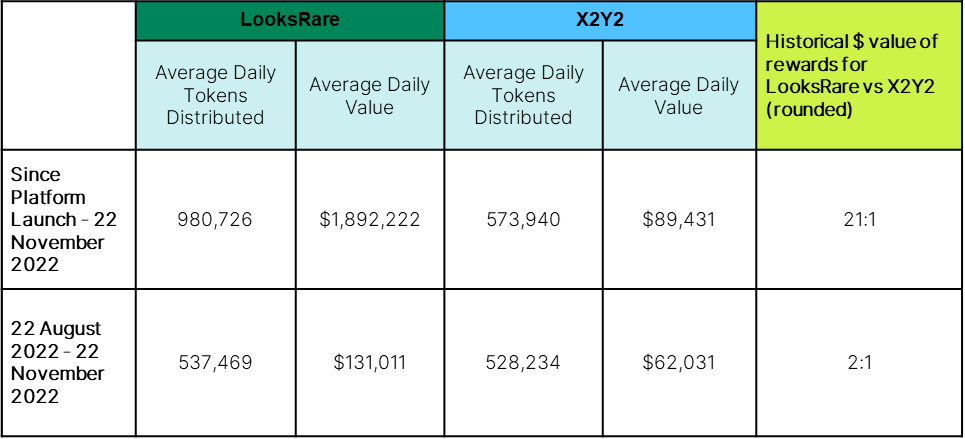

We imagine LooksRare has a better wash buying and selling quantity as a result of its rewards are extra profitable. Due to this fact, we’ve calculated the entire worth of distribution rewards measured in opposition to every token’s each day shut worth since launch. Beneath are the outcomes up until 22 November 2022.

If we take the historic common, for each greenback you earn on X2Y2 from buying and selling rewards, you’d have earned twenty-one extra on LooksRare. Nevertheless, this quantity is deceptive as LooksRare launched about three months earlier than X2Y2 when the market was nonetheless exuberant, and the costs of LOOKS (LooksRare’s token) have been a lot greater. After the preliminary hype died down and the bear market kicked in, the buying and selling rewards normalized to extra even ranges. Even so, LooksRare nonetheless affords twice as a lot greenback worth primarily based on the previous three months.

However, these are solely broad assumptions, because the rewards are extremely depending on the share of the platform’s respective each day buying and selling volumes. For instance, X2Y2 can have greater rewards for a specific day if the entire gross sales quantity is decrease (thus giving the vendor a better % of token rewards) or if the token’s worth is greater.

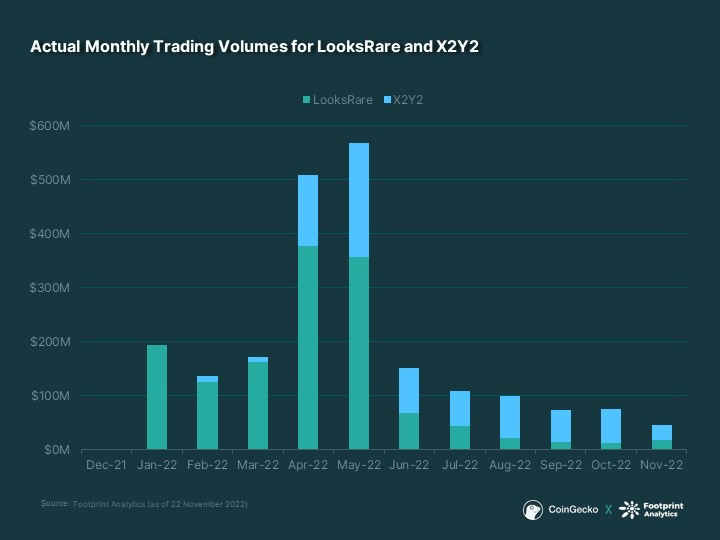

Funnily sufficient, though LooksRare distributes extra worth on common, X2Y2 has extra natural volumes. Furthermore, since June 2022, X2Y2 has constantly outperformed LooksRare in month-to-month buying and selling volumes (disregarding wash buying and selling volumes).

A possible rationalization is an look of being less expensive. X2Y2 costs a 0.5% market charge and affords non-obligatory royalties (although this characteristic has been retracted as of 18 November 2022), whereas LooksRare has a better buying and selling charge (2.0%). Nevertheless, even when we think about LooksRare’s greater buying and selling charge, it has at all times been cheaper to commerce on LooksRare after we offset token rewards. We will solely surmise that X2Y2’s advertising technique is more practical the place human psychology favors ‘reductions’ over ‘cashback.’ That is additionally regardless of LooksRare’s common staking rewards being greater for its token (53.61%) than X2Y2’s (38.81%) as of twenty-two November 2022.

Buying and selling Demographics and Patterns

Due to the prevalence of this wash buying and selling methodology, we thought it could be fascinating to dive somewhat deeper into the buying and selling patterns of LooksRare / X2Y2 wash merchants.

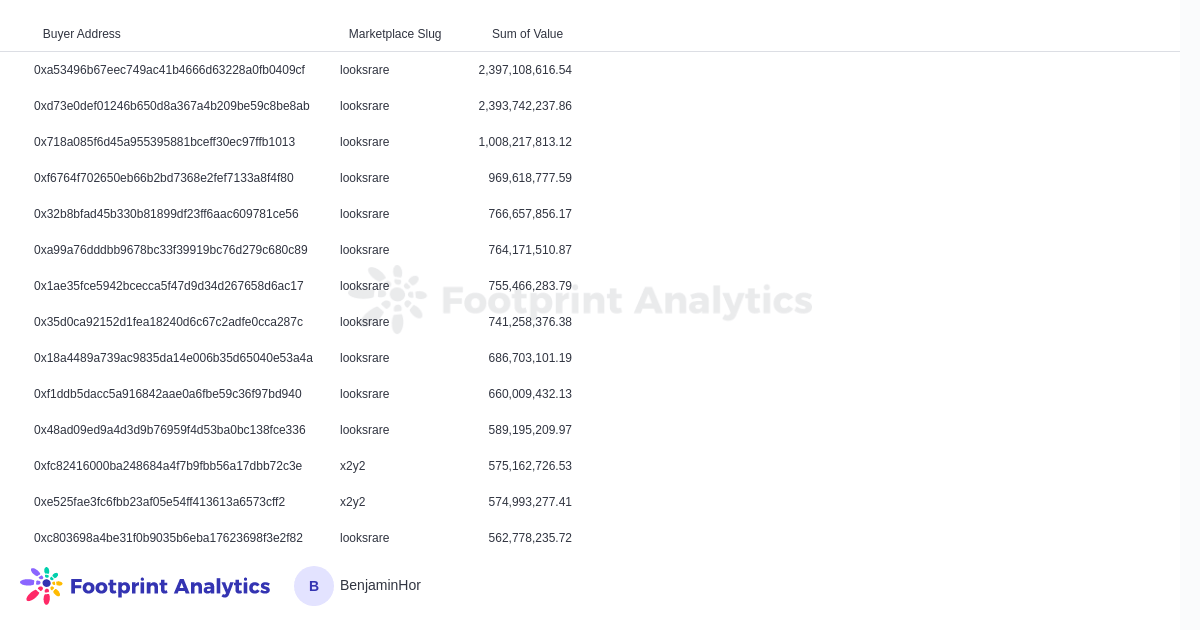

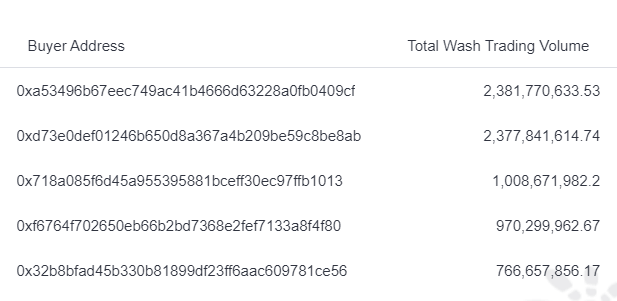

We now have recognized over 6442 addresses that wash commerce on LooksRare and X2Y2. The Prime 10 addresses are all from LooksRare, which aligns with the premise that there’s higher worth extraction from the token rewards.

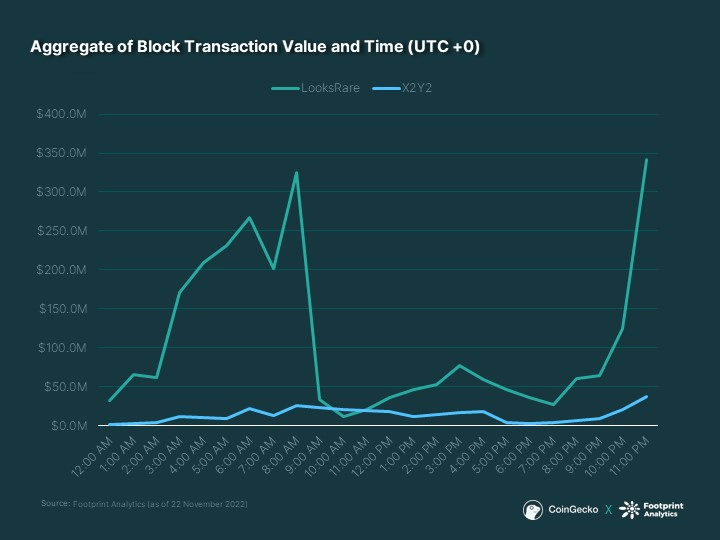

These merchants have two distinct buying and selling occasions, spiking at 8 AM-9 AM (UTC+0) and in the direction of the top of the day.

Ethereum makes use of a Unix timestamp, i.e., UTC. Due to this fact, buying and selling proper earlier than the day closes is sensible as a result of they’re in all probability making an attempt to extend their each day quantity share on {the marketplace}. Since buying and selling rewards are primarily based on % of {the marketplace}’s each day complete quantity, it’s higher to scrub commerce as late as doable to find out the quantity of firepower/effort wanted to command a sizeable share of rewards. As for the spike within the morning, we speculate that these merchants function in timezones which are near midnight for them, which coincides with late evenings for the US.

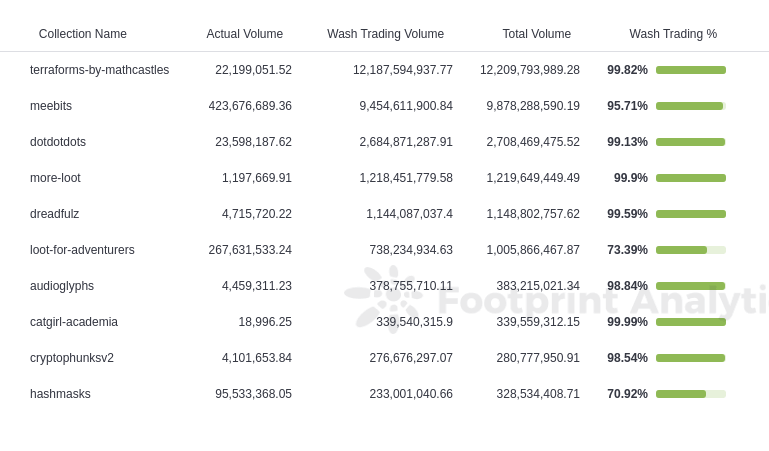

By way of the preferred assortment for wash buying and selling, Terraform by Mathcastles takes the highest spot. Over $12B have been wash traded, representing 99.82% of the gathering’s collective buying and selling volumes on LooksRare and X2Y2.

We’re not certain why that is the case. The one factor in widespread between all these collections is that they’ve zero royalties (besides Meebits), which suggests it prices much less to scrub commerce. We will solely assume {that a} whale or a pod of whales have designated it as their most well-liked wash buying and selling assortment. Certainly, if we take a look at the checklist of wash merchants for Terraform, the highest 2 wallets have traded near $4.8B alone.

Almost certainly, it is a single whale buying and selling between their wallets, contributing over 1/third of wash buying and selling volumes for the gathering alone.

Earlier than Terraform took over, it’s value noting that Meebits was the favourite for wash merchants after LooksRare launched till they carried out royalties in September 2022. Wash buying and selling volumes subsequently died in a single day.

Conclusion

With out correct regulatory oversight and enforcement, NFT wash buying and selling is an unavoidable phenomenon on NFT marketplaces. Historically, manipulating costs/volumes and fraudulently harvesting tax losses are unlawful, and that customary is prone to maintain for crypto. Wash buying and selling to farm token rewards, alternatively, is a brand new kind of exercise distinctive to crypto. Whereas the first victims in danger are the marketplaces themselves, unsuspecting customers may additionally be harmed throughout this exercise. Though there are moral considerations, crypto natives would argue that code is the regulation. If the NFT marketplaces haven’t imposed any limitations on reward distributions, why shouldn’t customers reap the benefits of this bug characteristic?

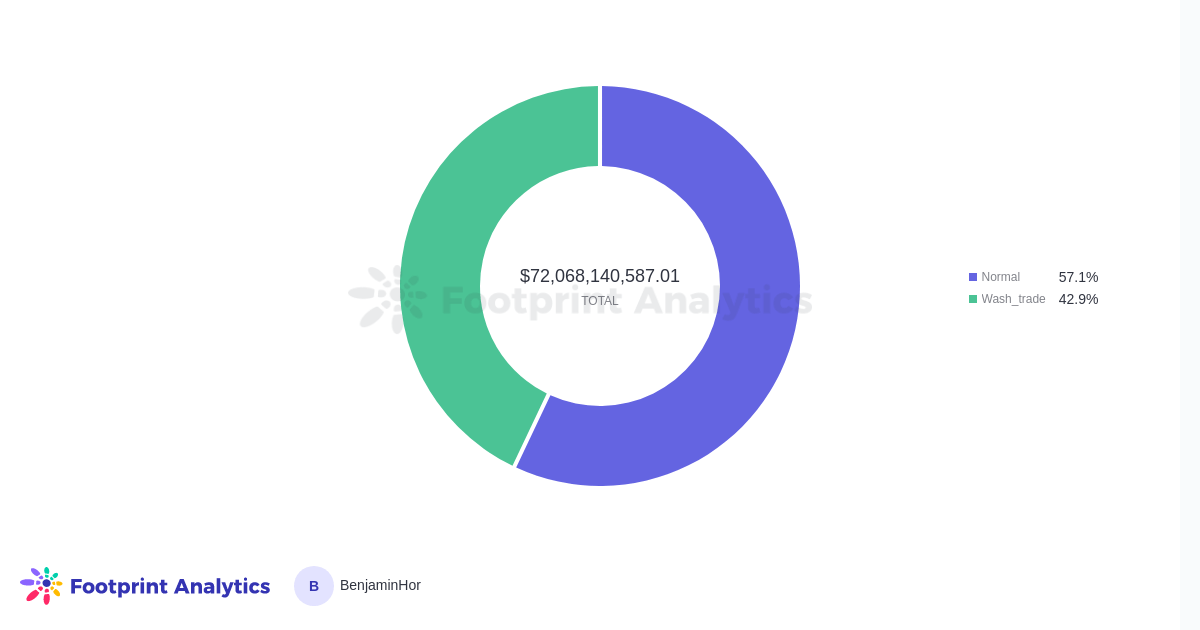

With all this in thoughts, it’s no surprise that everybody thinks NFTs are a rip-off. Nevertheless, if we take a look at the entire wash buying and selling volumes on ETH, the image is just not very fairly.

42.9% of all volumes are wash buying and selling volumes. The sensationalist interpretation is that just about half the market is a rip-off; nevertheless, a extra cheap inference is that platforms like LooksRare and X2Y2 have propped up the market with faux volumes. Additional, this doesn’t change the truth that there are real patrons. Certainly, if we measure the market utilizing a distinct metric, i.e. variety of transactions, a really completely different image emerges.

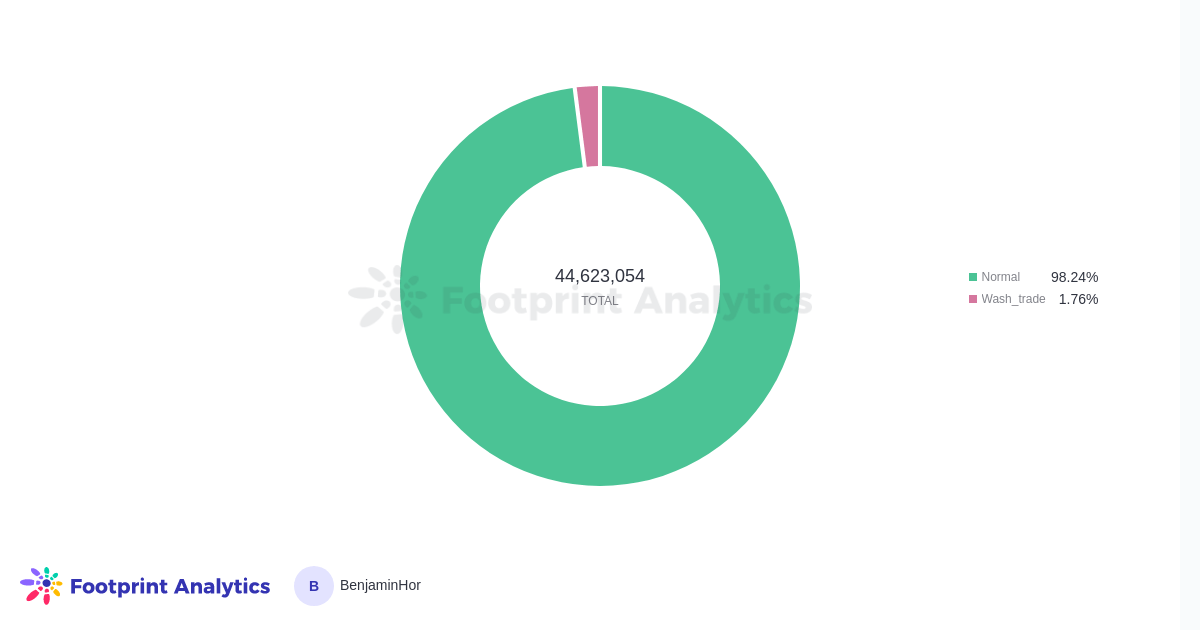

Over 98% of complete transactions have been recognized as real. In different phrases, it’s doable that folks identical to JPEGs. A examine on OpenSea NFTs by a gaggle of researchers additionally helps this thesis with a distinct methodology.

Quite than being a wash buying and selling haven, the picture and repute of the NFT trade are closely distorted by whales and savvy degens. In fact, there are limitations to this technique, and we can not account for each wash buying and selling transaction on the market. Nonetheless, we imagine that it is a extra correct illustration of the NFT market.

However this doesn’t imply we must always take issues without any consideration. Blockchain know-how makes each transaction clear, making it simpler to establish wash buying and selling and, thus, defend ourselves.

The primary line of protection is training. NFT merchants ought to study to establish wash buying and selling patterns earlier than aping into lesser-known collections. Even then, among the hottest collections, e.g., Meebits, might not be resistant to this exercise. Nevertheless, we are able to additionally count on wash merchants to develop into more and more refined and canopy their tracks. Efforts to enhance on-chain evaluation and use platforms like Footprint Analytics would assist customers minimize by the noise however assist customers make higher buying and selling selections.

Marketplaces also needs to play a extra lively function in discouraging wash buying and selling, because it harms precise customers and themselves if somebody is actively farming their native tokens.

This text was written in collaboration with Footprint Analytics. Footprint Analytics is constructing blockchain’s most complete knowledge evaluation infrastructure with instruments and API to assist builders, analysts, and traders get unequalled GameFi, DeFi, and NFT insights.

The engine indexes clear and abstracts knowledge from 20+ chains and counting—letting customers construct charts and dashboards with out code utilizing a drag-and-drop interface in addition to with SQL.