- Senator Lummis has launched a invoice to incorporate crypto in mortgage approvals.

- The invoice targets younger consumers and aligns with FHFA’s current crypto directive.

- Critics cite crypto’s volatility as a mortgage default danger.

US Senator Cynthia Lummis of Wyoming has proposed laws that, if handed, would require housing finance companies to think about digital belongings in evaluating mortgage mortgage functions.

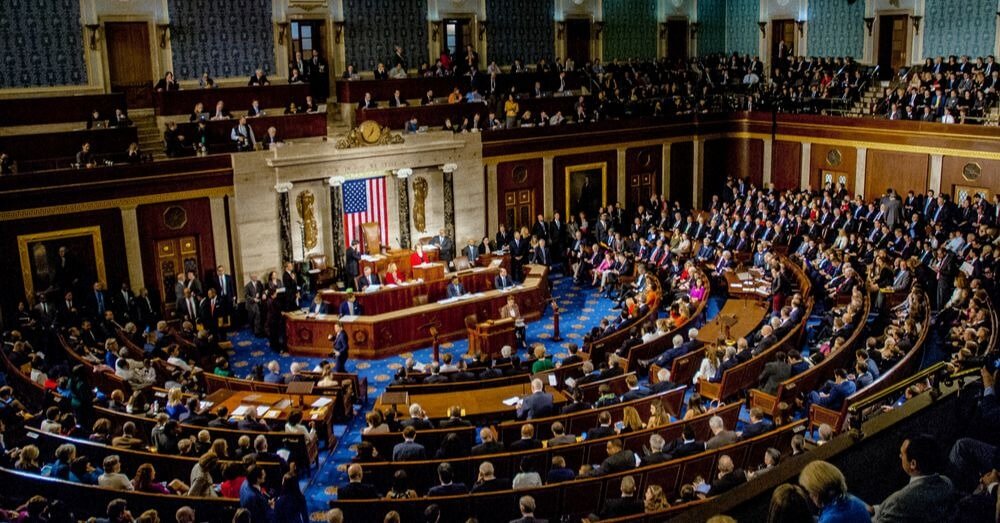

The invoice has sparked debate on Capitol Hill, with supporters viewing it as a step towards monetary modernisation and critics warning of potential dangers.

Invoice tied to current Federal Housing directive

The proposed laws, generally known as the twenty first Century Mortgage Act, goals to codify a current order issued by the Federal Housing Finance Company (FHFA).

That order directed Fannie Mae and Freddie Mac, two key mortgage purchasers within the US, to think about cryptocurrencies as a part of asset evaluations for single-family mortgage loans.

Senator Lummis introduced the invoice shortly after the FHFA directive, stating that congressional motion was wanted to make sure the order turns into everlasting legislation.

In response to the senator, the invoice displays a contemporary strategy to wealth-building, particularly for youthful People who usually tend to personal digital belongings than conventional property or financial savings.

Focusing on the youthful era of consumers

Citing US Census Bureau knowledge, Lummis famous that homeownership amongst People underneath 35 stood at simply 36% within the first quarter of 2025.

For a lot of on this demographic, crypto represents a good portion of their internet price.

Subsequently, the invoice seeks to deal with a rising want to think about all types of private wealth — not simply fiat or conventional belongings — throughout the mortgage approval course of.

The invoice would enable debtors to retain their cryptocurrency holdings with out being pressured to liquidate them into US {dollars} for mortgage consideration.

This strategy, Lummis argues, retains tempo with how wealth is evolving and acknowledges the monetary actuality of recent younger adults.

Pushback from Democratic lawmakers

Regardless of its potential to increase monetary inclusion, the invoice has confronted early resistance.

A number of Senate Democrats have expressed concern over the FHFA order, and by extension, the proposed laws.

In a letter despatched to FHFA Director William Pulte on July 24, they urged the company to totally consider the dangers and advantages of integrating crypto into mortgage evaluations.

In response to the letter, a borrower who depends on risky digital belongings might wrestle to transform these holdings into money throughout a downturn.

That, in flip, might elevate the danger of mortgage default, which might influence not solely the person borrower but additionally the broader monetary system.

Broader crypto laws on the horizon

The twenty first Century Mortgage Act is only one of a number of crypto-related payments making their approach via Congress.

Senator Lummis can be spearheading a separate effort to ascertain a complete framework for digital asset markets.

In the meantime, the Senate is reviewing one other invoice that might ban the Federal Reserve from launching a central financial institution digital foreign money (CBDC), following its approval within the Home earlier this month.

On the Home facet, an identical invoice has already been launched by Consultant Nancy Mace.

Generally known as the American House owner Crypto Modernisation Act, Mace’s invoice would mandate mortgage lenders to think about the worth of digital belongings held in brokerage accounts linked to crypto exchanges throughout the credit score analysis course of.