An evaluation of market cap and realized cap Bitcoin dominance (BTC.D) knowledge carried out by CryptoSlate means that customers are more and more utilizing stablecoins, as an alternative of BTC, as a security flight.

Most are acquainted with market cap, which is calculated by multiplying the circulating provide by the present token worth.

Realized cap can be a valuation metric however differs from the market cap by substituting the present token worth with the value on the time the token final moved. This technique is claimed to present a extra correct measure of valuation because it considers and minimizes the impact of misplaced and irretrievable cash.

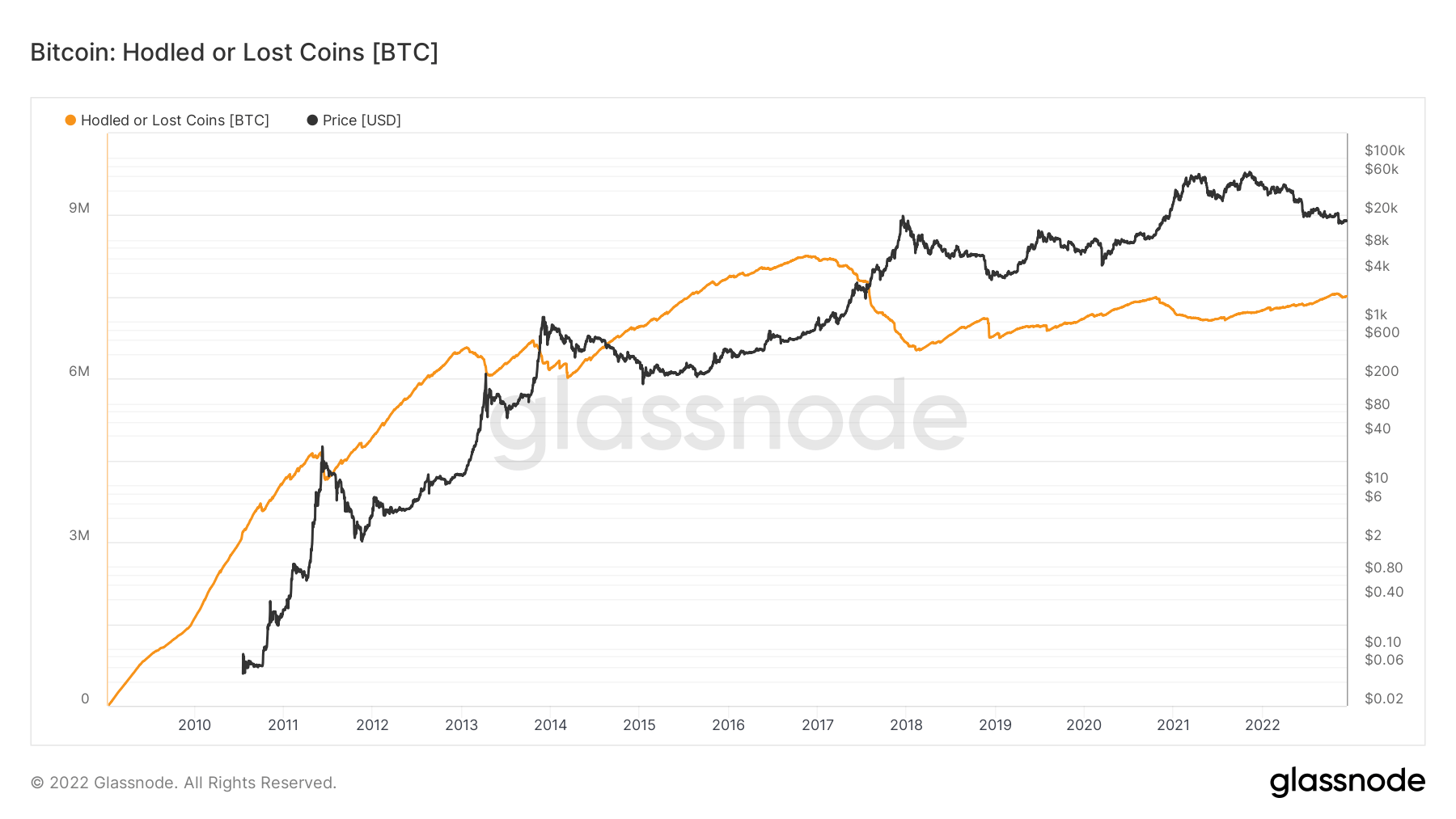

Glassnode estimated hodled or misplaced cash at the moment are available in at round 7 million tokens, representing a big proportion of the circulating provide.

If a token has by no means moved the realized worth of that token is zero, and if a token has not moved in a very long time its impression is recorded at a a lot cheaper price than the present worth. Due to this fact, lively tokens make up the majority of the realized cap valuation, giving a extra holistic and consultant determine versus market cap.

Nevertheless, realized cap doesn’t differentiate between tokens which are misplaced/irretrievable and people which are in deep storage. Due to this fact, whereas it does de-emphasize the impression of misplaced/irretrievable cash, it’s nonetheless not an ideal valuation measure.

Regardless of that, market cap is rather more extensively used than realized cap. For instance within the calculation of BTC.D.

Bitcoin market dominance

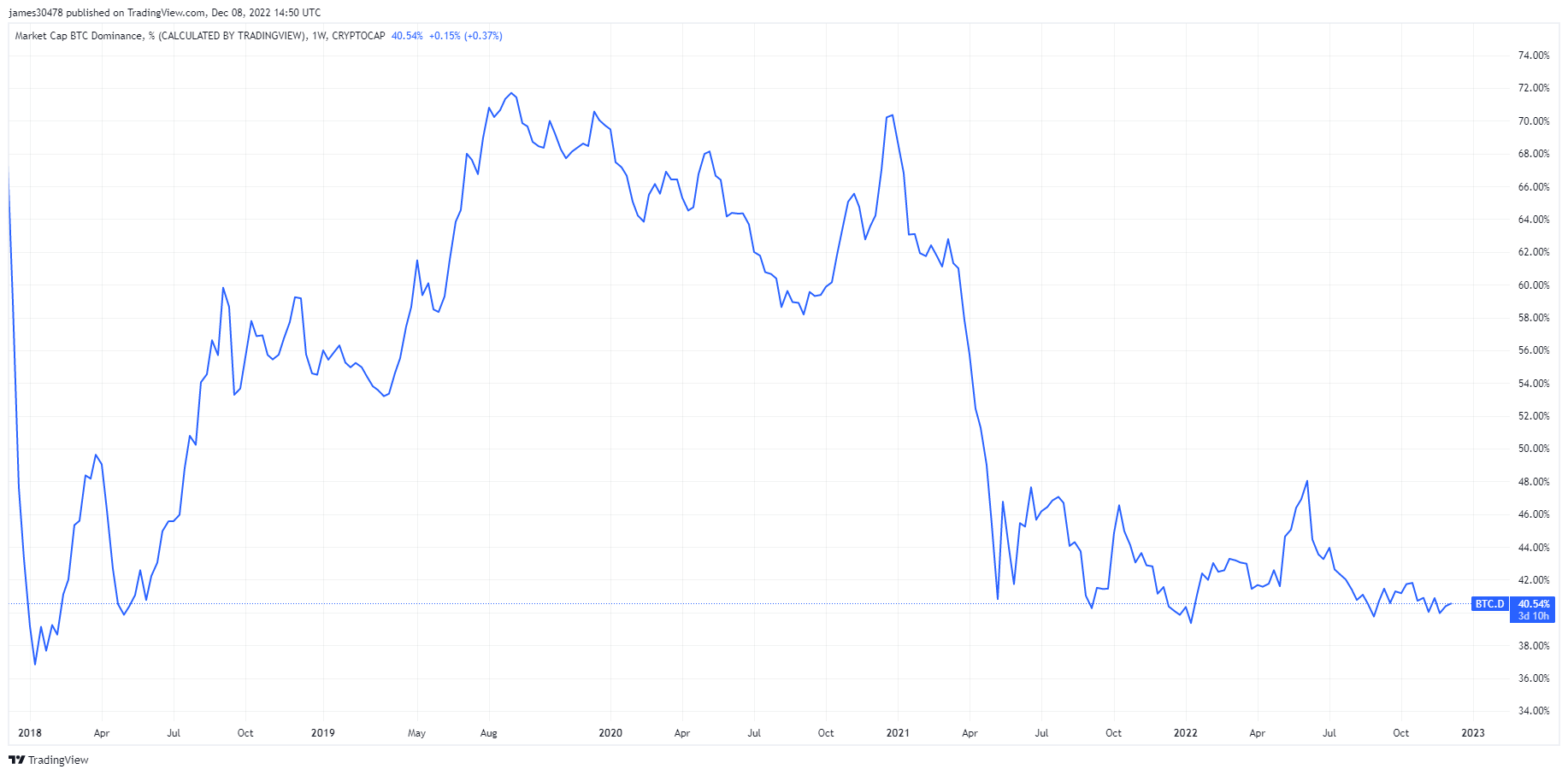

Crypto markets at the moment are over a yr for the reason that market prime. Throughout this time, BTC.D has been as little as 38.9%, peaking at 48.6% in June following the Terra implosion and subsequent flight to security.

BTC.D is calculated utilizing the overall crypto market cap divided by the Bitcoin market cap. At present, Bitcoin dominance is at 40.7%, hovering near cycle lows.

In previous bear markets, BTC.D has been a lot greater, with the earlier cycle bear seeing BTC.D hit as excessive as 73.9%.

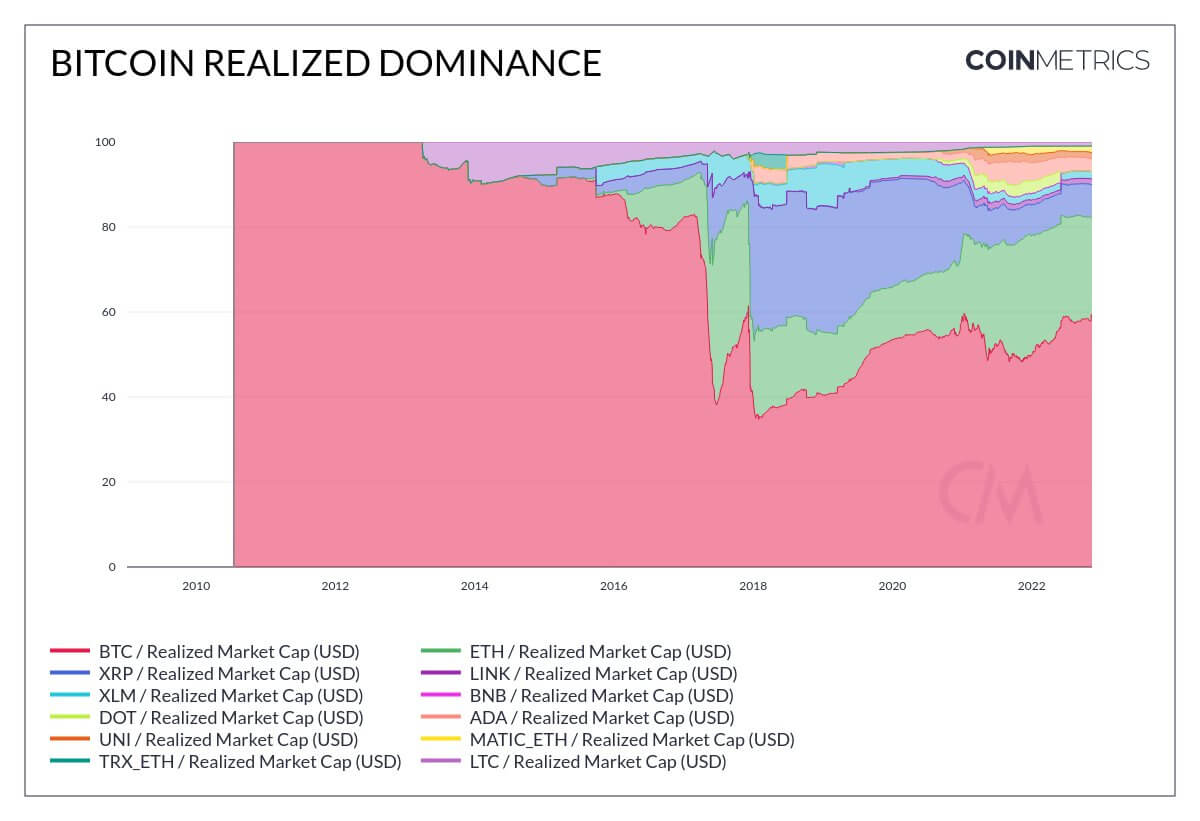

Utilizing realized cap, as an alternative of market cap, to calculate BTC.D provides a present determine of 60%, which is extra in keeping with expectations of the majority of customers biking into Bitcoin as a security play throughout a bear market.

Nevertheless, just like the market cap technique for calculating BTC.D, the realized cap technique additionally reveals dominance at a lot greater percentages (than 60%) throughout previous bear markets, corresponding to in 2015, when it was round 90%.

This begs questions on altering market dynamics in 2022 versus 2015.

The rise of stablecoins

Stablecoins are designed to remain at a set worth no matter cryptocurrency worth volatility. They supply a way to enter and exit positions whereas retaining capital within the cryptocurrency market.

BitUSD was the primary stablecoin to come back to market, launching in July 2014. Nevertheless it wasn’t till 2015, when Tether launched, that stablecoins started making their mark. Earlier than Tether turned in style, traders tended to cycle into Bitcoin throughout bear markets. However since round 2017, this has not been the case.

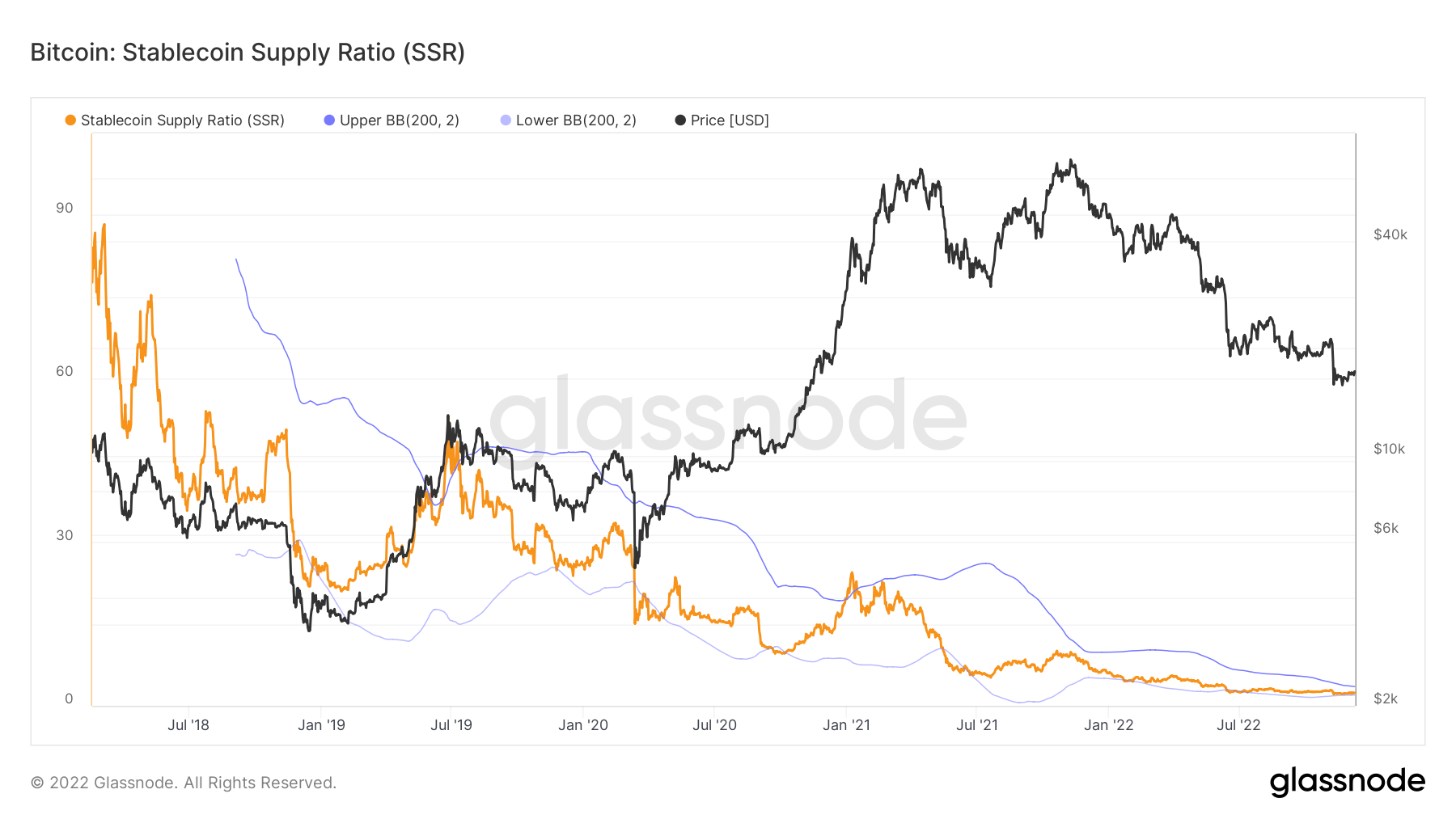

The chart under reveals the Bitcoin: Stablecoin Provide Ratio (SSR) on a macro downtrend since 2018, giving a present ratio of roughly 2. This metric illustrates the proportion of Bitcoin provide in opposition to stablecoin provide, denominated in BTC.

When SSR is low, this means the present stablecoin provide has excessive shopping for potential. In different phrases, a low SSR equates to a excessive proportion of sidelined stablecoins.

When taken along side the development of falling BTC.D, it suggests stablecoins have gotten the go-to selection for security flight.