Final 12 months and through the first half of 2022, speculators assumed the third-largest bitcoin deal with was a ‘mysterious whale,’ despite the fact that the pockets had proven robust traits of being a cryptocurrency change. The deal with often called “1P5ZED” has since been changed by one other deal with, after the pockets began to switch its total bitcoin steadiness in mid-July 2022. The bitcoin deal with “1LQoW” is now the third-largest pockets at present, and it’s very possible that the proprietor of the 1LQoW pockets is similar entity that managed the 1P5ZED pockets.

The Third Largest Bitcoin Pockets Modified to a New Deal with, a Pockets That’s Possible Managed by the Similar Proprietor

After bitcoin’s worth soared to new heights in November 2021, there was a big quantity of speculation regarding the third-largest bitcoin pockets often called “1P5ZED.” Rumors concerning the pockets plagued social media and a few individuals erroneously attributed the pockets to Microstrategy’s stash of BTC.

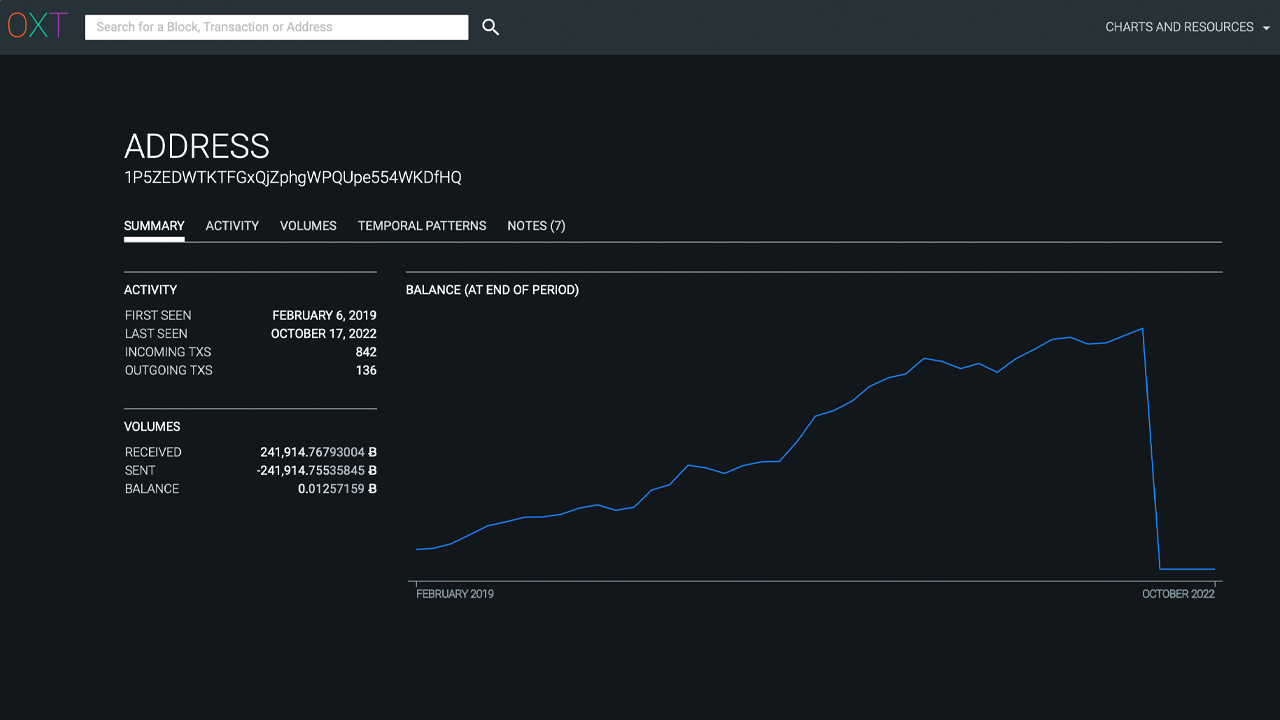

Then after the rumors have been debunked, blockchain observers noticed that 1P5ZED moved all of its bitcoins in mid-July. Blockchain data present that by the top of June 2022, the 1P5ZED deal with was all the way down to 0.01257 BTC. In 2021, when Bitcoin.com Information reported on 1P5ZED, a supply with “entry to blockchain analytics instruments (Chainalysis and Ciphertrace) as a part of their job operate” advised our newsdesk:

There’s an nearly 100% likelihood that each addresses in your article, each 1P5ZED and 1FzWLk, belong to Gemini.

The 1P5ZED pockets additionally had proven indicators of change spending patterns like cluster spending. Moreover, the block explorer oxt.me highlights two annotations, which assume that the “1P5ZED” bitcoin deal with might have been tied to the change Bittrex.

Nevertheless, following the mid-July and end-of-June removing of greater than 132,000 BTC, knowledge nonetheless signifies that the pockets continues to be possible related to the crypto change Gemini. Even when analysts can not determine the precise proprietor of 1P5ZED, onchain knowledge, clustering, and heuristics present that 1P5ZED merely modified arms (addresses), however the proprietor stays the identical.

Regardless of Hypothesis, Bitcoin’s Third Largest Pockets Is Not a ‘Thriller Whale’ or ‘New Market Participant’ — Onchain Information Factors to an American-Primarily based Crypto Change

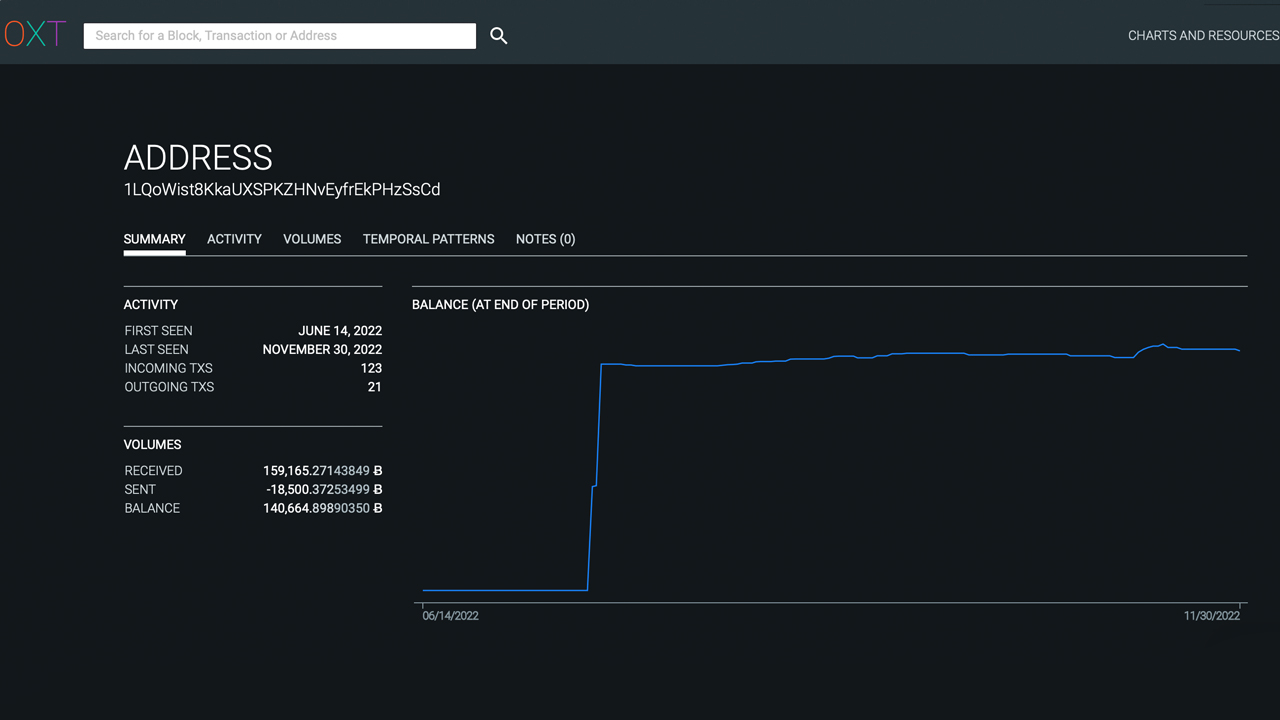

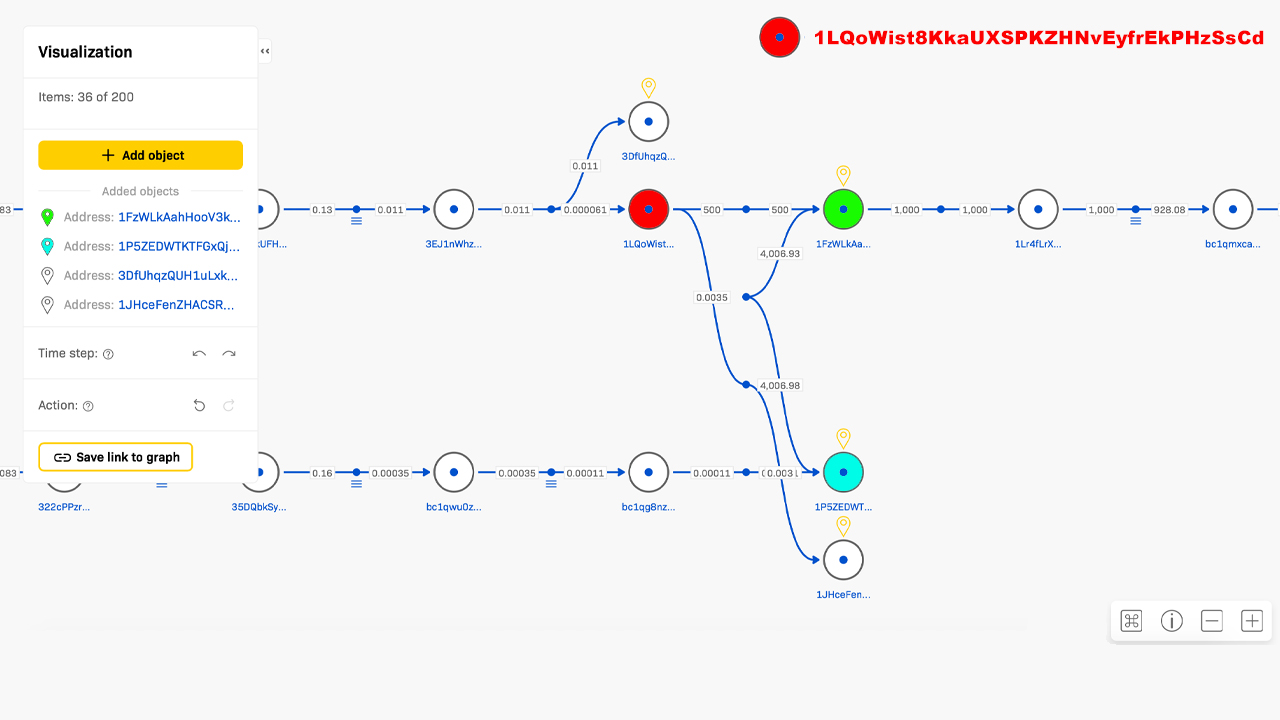

The third largest bitcoin pockets at present, “1LQoW” has a steadiness of greater than 140,000 BTC, and the pockets is related to 1P5ZED and “1FzWLk.” As we famous in our prior stories, 1FzWLk transacted with 1P5ZED on quite a few events and it transacted with 1LQoW as nicely. Evidently the now empty 1FzWLk pockets dispersed the funds to different addresses together with 1LQoW. Information additional reveals that 1FzWLk’s transactions have been typically related with recognized Gemini change wallets and the present third richest bitcoin pockets at present 1LQoW.

Per standard, social media posts and crypto publications identified 1LQoW as a brand new ‘thriller whale’ or new mega participant available in the market. OXT researcher Ergo BTC, tweeted concerning the deal with in July and August 2022. “1LQoW was first seen a couple of weeks in the past, receiving its first [transaction] in a batch withdrawal from Coinbase,” Ergo tweeted on July 19. “It’s 2 outgoing [transactions] are again to 1FzWL, which means that this deal with is at the very least linked and presumably co-owned by 1P5Zs/1FzWL/key rotation? In different phrases not ‘promoting.’” Speculating on whether or not or not it was Coinbase Custody, Ergo wrote:

Coinbase Custody: Professionals: By adjacency and first inflows into 1LQoW. Cons: The primary seen on 1FzWL doesn’t fairly align with the Coinbase Custody announcement.

Ergo additionally spoke concerning the bitcoin pockets 1LQoW on Aug. 2, 2022, when a whole lot of speculative reporting began to rise after the 1P5ZED myths prior. “Crypto tabloids and clickbaiters have gone from ‘1P5Z is dumping all his cash’ to ‘1LQoW is a brand new whale that purchased $1.64B out of nowhere. ’lmao,” Ergo tweeted. Onchain knowledge additionally confirms that 1LQoW just isn’t a brand new ‘mega whale’ or ‘market participant’ that simply all of the sudden took the third-largest bitcoin pockets reigns from 1P5ZED.

1LQoW is probably an American-based crypto custodian or change, and we are able to’t say for 100% sure that it’s a Gemini-associated BTC pockets. Cons embrace the truth that the pockets doesn’t match Gemini’s bitcoin reserve knowledge hosted on cryptoquant.com and different reserve knowledge websites like Glassnode. The stats from cryptoquant.com’s Gemini-associated bitcoin reserve knowledge reveals Gemini’s stash is round 136,923 BTC. The third-largest BTC deal with 1LQoW holds roughly 140,664 BTC (as of two:00 p.m. ET on Dec. 4, 2022). Coinglass.com knowledge reveals Gemini’s BTC reserves stash is estimated to be round 132,102 BTC at present, which can be a discrepancy.

What do you consider the connection between wallets 1P5ZED, 1FzWLk, and the present third-largest bitcoin pockets 1LQoW? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.